Airbnb ($ABNB) – Q3 FY2025 Earnings Review

Summary

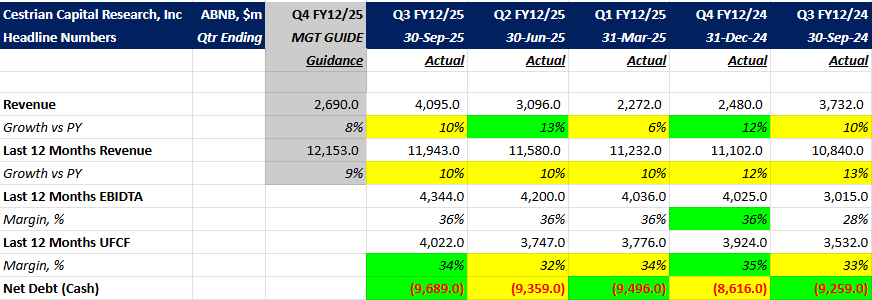

- Airbnb ($ABNB) delivered a steady Q3 FY12/25, with revenue growth holding at ~10% year-over-year, while profitability and cash generation remained strong.

- Free cash flow was $1.3 billion for the quarter (31% margin), with TTM free cash flow ~$4.0 billion (34% margin).

- Strong balance sheet with $9.7 billion in cash.

- Airbnb’s TTM revenue growth looks like it has stabilized for now. The key question: does it reaccelerate from here, or is this just a pause before further slowing?

Read on for detailed analysis of the fundamentals, valuation, and technicals.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Beginning of a New Airbnb – How Long Will it Take?

by Abhishek Singh (Abhisingh_86)

Over the last few quarters, we have been discussing Airbnb’s focus on four key areas: improving the core rental product, pushing deeper into expansion markets, launching offerings beyond stays, and integrating AI. While improving and maintaining the core service is key for the company’s durability, the next bump in revenue will likely come from international expansion and expansion beyond rentals into services/experiences. These initiatives will take time to play out and do what they’re meant to do — translate into incremental revenue.

One may choose to view Airbnb’s Q3 FY2025 results as those of a company in transition.

ABNB’s business is subject to seasonality; hence it is more useful to look at slow-burn numbers such as TTM revenue growth rather than quarterly revenue growth, which is more prone to fluctuations. The TTM revenue growth rate decline appears to have stabilized over the last three quarters, while EBITDA and cash flow margins have more or less held steady.

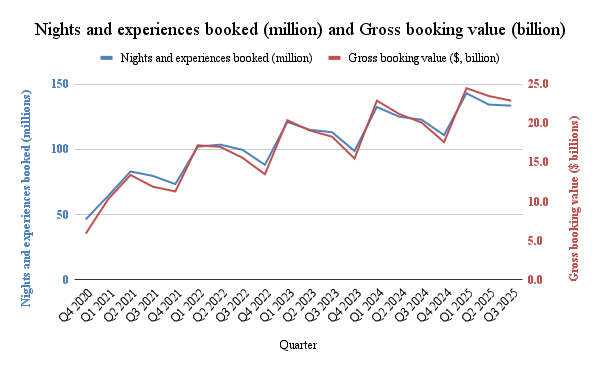

Non-GAAP measures such as Nights and experiences booked (million) and Gross booking value (billion) continue to inch upwards.