AMD Q3 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Low On Hoopla, Big On Results

By Alex King, CEO, Cestrian Capital Research, Inc.

Is Jensen Huang a better engineer, or manager-of-engineers, than his cousin Lisa Su? Maybe, maybe not, hard to say. Is he a better dreamweaver? Able to lead markets uphill and down dale with an unflinching gaze on the bright and sunny uplands? Most certainly. And this, as much as any technical specifications, is what explains the difference between NVDA’s meteoric rise and AMD’s more steady-Eddie performance.

The AMD earnings today featured no fried chicken, no signing of shirts, and no theater at the White House. But it did feature rock solid numbers and, on a bright red day that is just dying to punish more stocks, AMD is fairly unchanged after printing earnings, down just 1.3% in post-market trading at the time of writing.

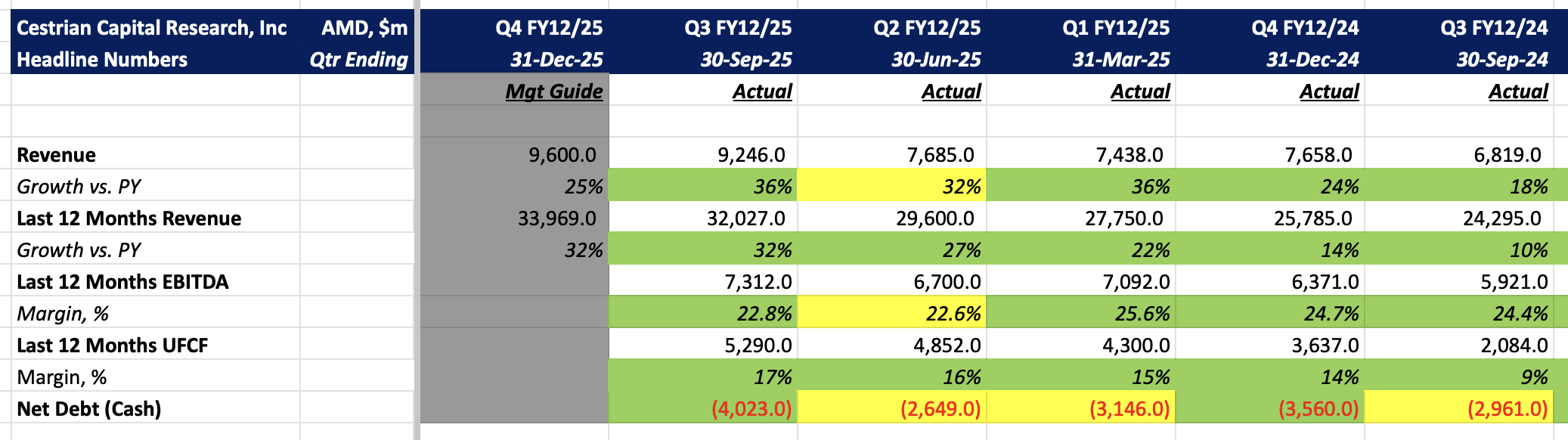

Here’s the summary numbers.

- Revenue growth accelerated to +36% YoY in the quarter, +32% YoY on a TTM basis.

- TTM EBITDA margins ticked up to 23%, TTM unlevered pretax FCF margins to 17%.

- The balance sheet strengthened, now with $4bn of net cash.

Full numbers, valuation, stock chart and rating below.