AMD Q4 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

It’s Not About The Numbers

by Alex King, CEO, Cestrian Capital Research, Inc

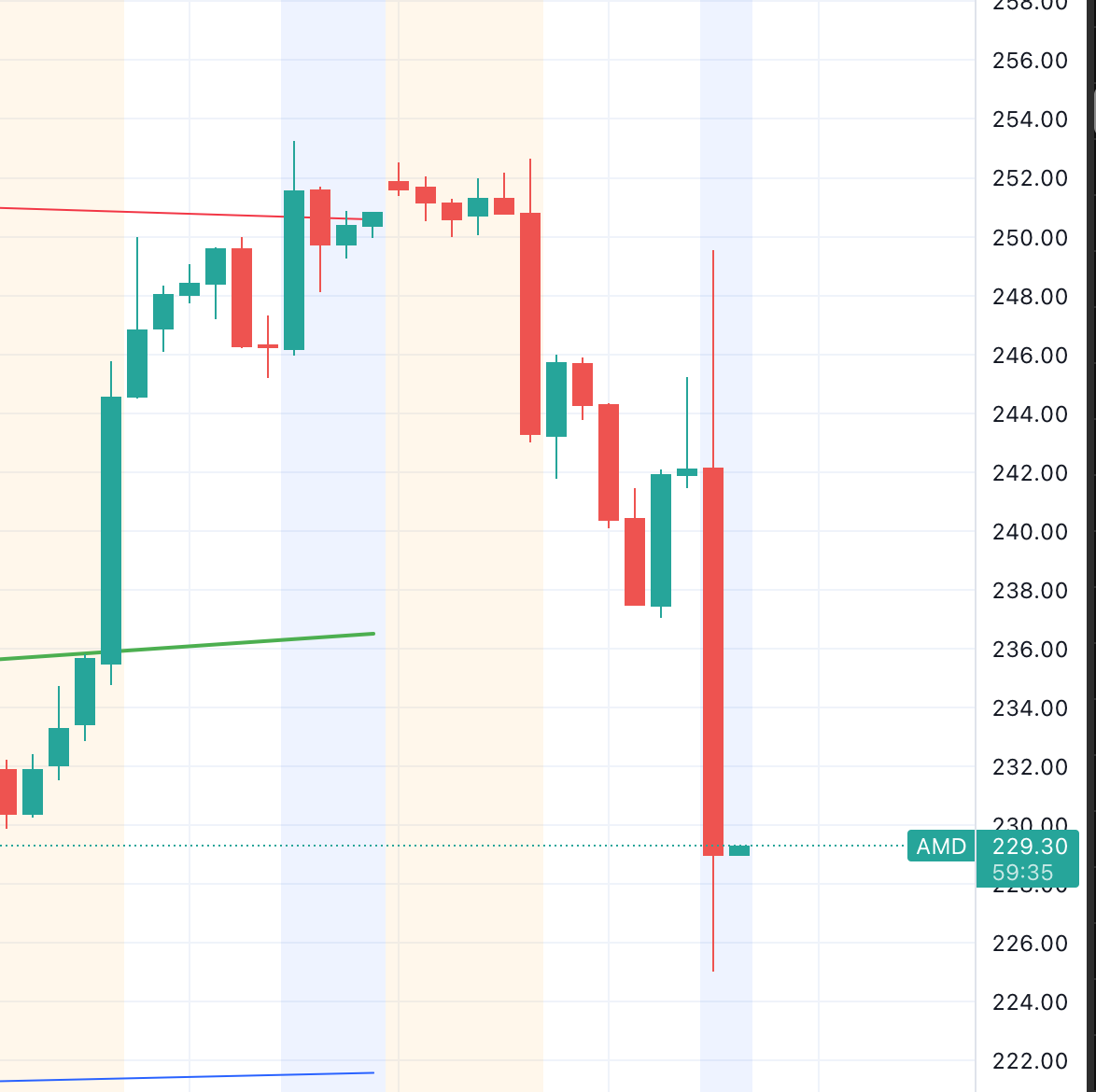

AMD stock is down a little in post-market trading. Here’s the hourly chart.

The green line is the 21-day EMA and the lower blue line is the 50-day EMA. Put simply, to remain bullish on AMD my own view is that I want to see it over the 50-day at all times and I want to see no more than one daily close below the 21-day EMA.

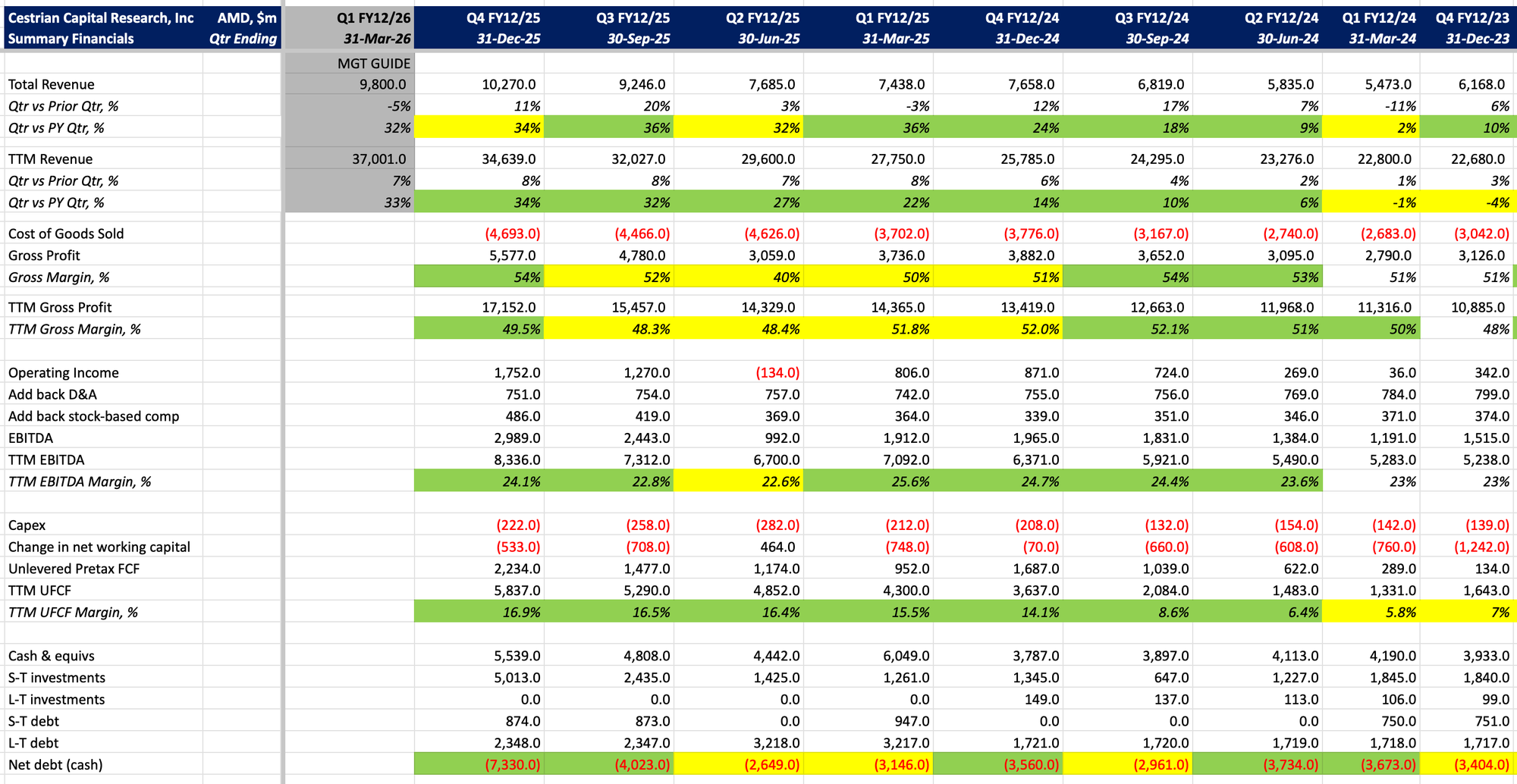

It was a very good quarter - revenue beat the company’s guide, margins were up and cash balances were up a lot.

The issue of course is that semiconductor stocks are up, way up. I don’t see the telltale high vol x price bars of distribution yet, but I think it may be coming.

So what does that mean for AMD?