An Introduction To Rubrik, Inc

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Rubrik ($RBRK) – Securing the AI Data Layer

Alex King, CEO, Cestrian Capital Research, Inc (+ Google Gemini) - 31 December 2025

Preamble - AI Rising

As I’ve mentioned, we will be using still more AI-generated work in 2026; we’re in the early days of adding to our analyst resource using digital agents in addition to more wetware. Before those agents are rolled out (right now they are about as useful as a recalcitrant nepo-baby intern - they are refusing to deal with Google Sheets and claiming Excel finance-bro purity for instance, oh and also really want to use ChatGPT rather than the superior Google Gemini models - what’s the Google beef???) you’ll see some content generated by LLMs in response to careful and specific prompting and refining by the hoomans over here at Cestrian Towers. None of what we publish in our written notes will be autonomous for the time being - everything will be human-in-the-loop. Not least because LLMs tend to sound like wide-eyed 2nd year analysts who still believe that things companies tell them are true.

Why bother? Because in this way we will start to expand and deepen and speeed up our coverage esp. of single-stock names and international markets. We will, in short, weave a lot more cloth with the machines than we could ever do with just the artisans. Industrial Revolution 2.0, no doubt about it.

Below is an introductory note on Rubrik, a cybersecurity play that is relatively new to public markets. It doesn’t feature our usual in-depth financial analysis quarter by quarter, TTM by TTM. We’ll include that in the next earnings report on the stock. But by using The Machine we can level-set our background knowledge and understanding of the company ahead of that first earnings analysis.

So here goes. What follows is cyborg text ie. it’s machine and human all blended into one.

(1) History of the Company

Rubrik was founded in 2014 by CEO Bipul Sinha and a team of engineers from Google, Facebook, and Oracle. The company’s original mission was to disrupt the backup and recovery market with a "converged" appliance that simplified data management. Backup being a mature market, this didn’t get so far, and the company’s defining strategy switch occurred around 2021, moving from simple backup toward security. In 2024, the company went public, positioning itself as the security layer for corporate LLMs in order, no doubt, to take advantage of enhanced valuations for anyone convincing enough to make this claim.

(2) Products and Services

Rubrik operates a high-margin SaaS model through its Rubrik Security Cloud:

- Data Threat Analytics: Uses AI to detect anomalous data behavior, identifying ransomware encryption in real-time.

- Data Security Posture (DSPM): Helps companies find "sensitive" data (PII) hidden in their cloud silos before it is leaked.

- Cyber Recovery: Orchestrates the clean restoration of massive datasets after a breach.

- Agent Cloud: A 2025 initiative that monitors and governs how AI agents interact with corporate data, aiming to prevent "AI hallucinations" or unauthorized data exfiltration.

(3) Customer Base

Rubrik targets the Fortune 500 and large public sector entities. Notable customers include the U.S. Department of Defense, The Home Depot, and Barclays. The company is increasingly focused in regulated industries (Healthcare and Finance) where data compliance is high priority. As of late 2025, the company claims over 2,200 customers spending more than $100k annually in subscription ARR.

(4) Financial Analysis (8-Year Annual Table)

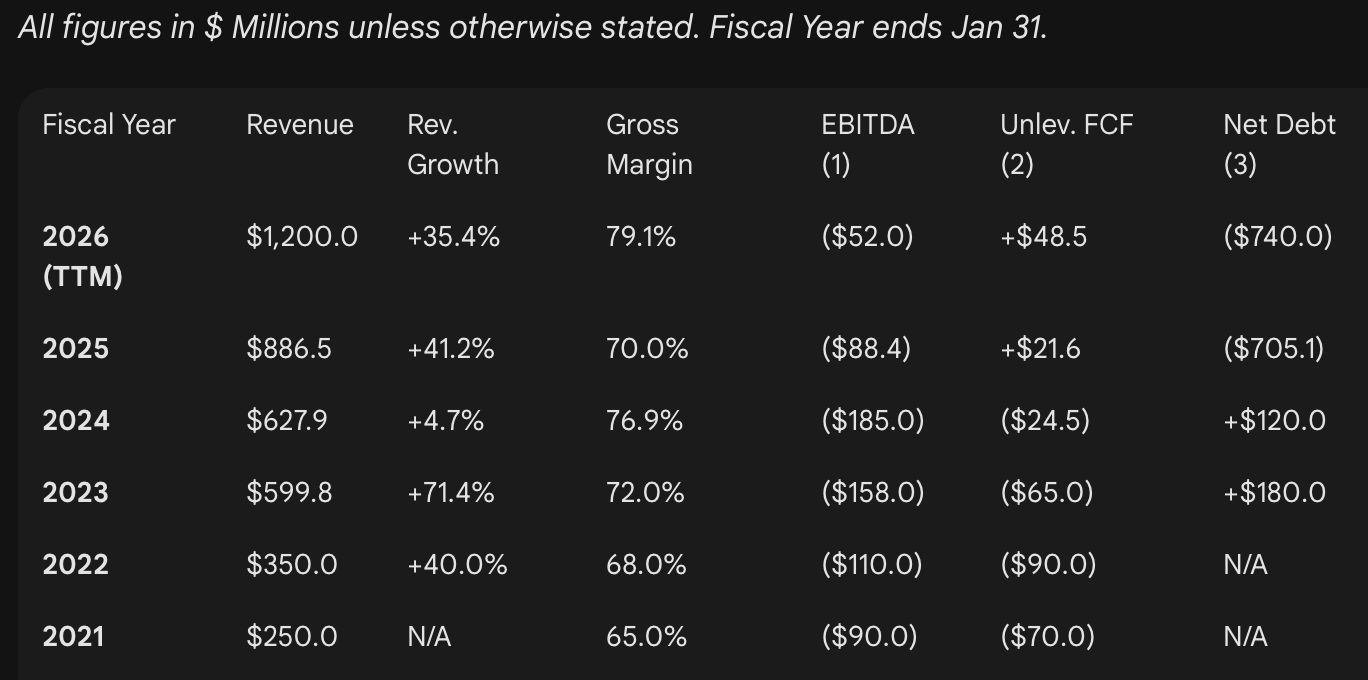

All figures in $ Millions unless otherwise stated. Fiscal Year ends Jan 31.

Definitions as per standard Cestrian analysis ie. (1) EBITDA: Operating Income + D&A + Stock-Based Compensation (SBC). (Note: FY25 EBITDA is heavily adjusted for IPO-related SBC spikes). (2) Unlevered Pretax FCF: EBITDA - Capex - Change in Working Capital. (3) Net Debt: (LT + ST Debt) - (Cash + Equivalents + Investments). Negative values indicate a "Net Cash" position.

(5) Valuation (TTM Basis)

As of Dec 30, 2025:

- Recent Share Price: $78.01

- Shares Outstanding: ~192.0 Million

- Market Cap: ~$14.98 Billion

- Net Debt: ($740.0 Million) - Net Cash

- Enterprise Value (EV): ~$14.24 Billion

| Metric | TTM Value | EV / Multiple |

| TTM Revenue | $1.20 Billion | 11.9x |

| TTM EBITDA | ($52 Million) | N/A |

| TTM Unlev. FCF | $48.5 Million | 293x |

We can call that punchy as in, 293x unlevered pretax FCF is a lot.

(6) Stock Price Movement & AI Analyst Comment

The price action of $RBRK since its April 2024 IPO has followed a classic "Innovation Cycle" pattern.

- Post-IPO Flush: The stock initially struggled under the weight of high stock-based compensation (SBC), falling into the $40s in mid-2024.

- The 2025 Breakout: Driven by the AI data-security narrative and a pivot to positive Free Cash Flow, the stock surged to a 52-week high of $103.

- Analysis: At 11.9x Revenue, $RBRK is currently valued at a premium to legacy backup peers (Commvault) but at a significant discount to pure-play cybersecurity leaders like CrowdStrike (typically 15x-20x Rev).

- Technical Context: The stock is currently retracing from its $103 peak and is searching for support near the $75 level.

(7) Stock Chart And Rating

You can open a full page version of this chart, here. There looks to be accumulation between $65-$77 so anyone buying a position in this range might think about a stop below that $65 and a Wave 3 target as shown. If the bull market continues, I would expect this name to do well. We rate at Hold.

Cestrian Capital Research, Inc - 31 December 2026