Apple Q4 FY9/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Happiness Is A Warm iPhone

Apple stock should have collapsed years ago, as everyone knows, since it is nothing more than AT&T or Standard Oil for the modern age. Drip-feed minimally improved devices to the public, half of whom are reliant on said devices to operate within their social and family circle (who knew blue messages would define status?). Whack up the prices of storage even though your cost of storage keeps plummeting. Survive multiple attempts to topple the App Store fees and keep sucking those fees out of the happy customer.

I’ve had to check twice that this wasn’t an April 1st story.

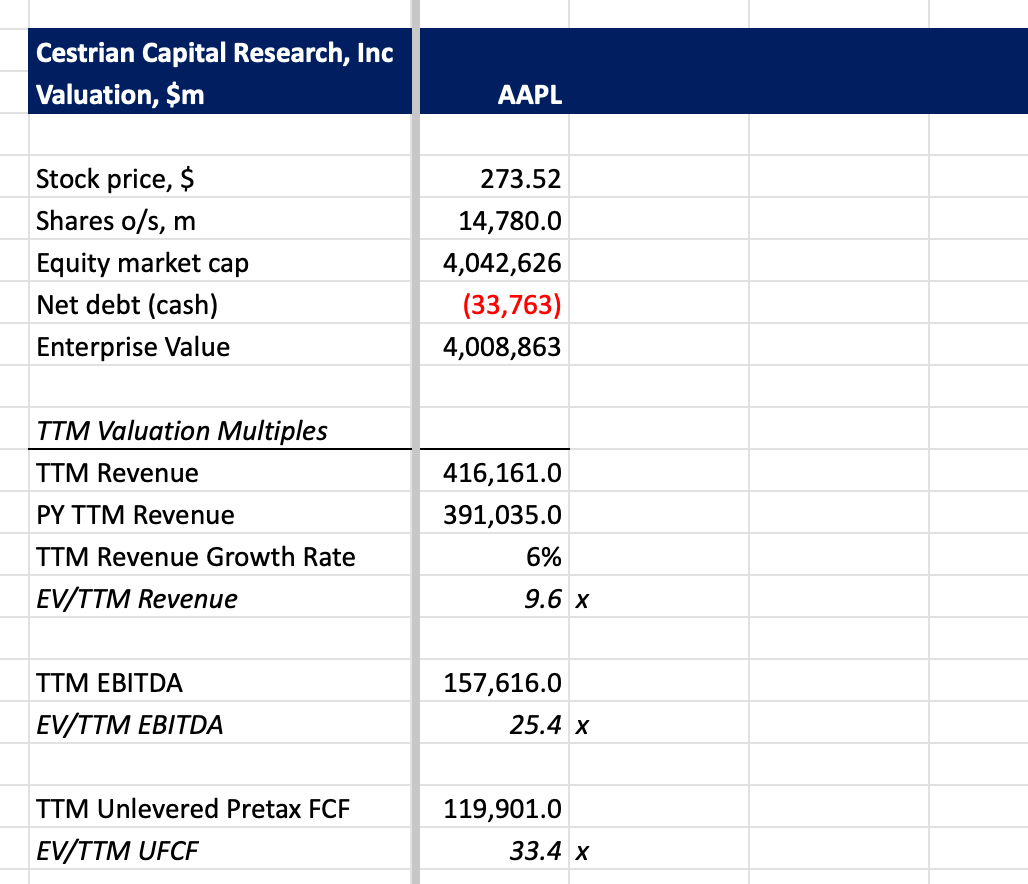

$AAPL is, in my view, now expensive at 33x TTM unlevered pretax FCF in exchange for 6.4% TTM revenue growth. Obviously the balance sheet is rock solid ($34bn of net cash) and sometimes the stock acts as safe harbor on a day to day basis when volatility hits but … it’s not really a source of downside protection when trouble really comes to town.

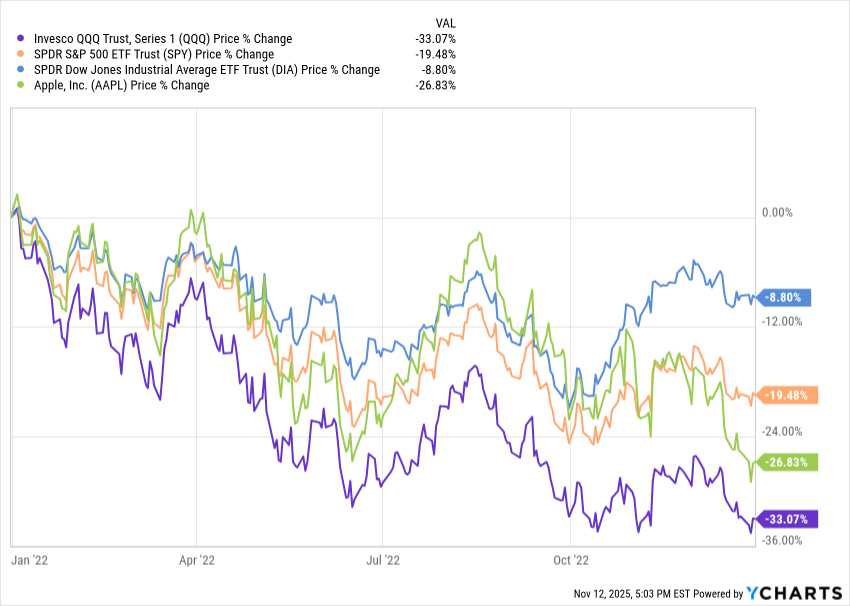

In the 2022 bear market you’d have been better off in the Dow or even just the S&P.

I think that as $AAPL approaches $300 it likely becomes a profit-taking opportunity for many.

We rate the stock at Hold, for now, but if I owned it I would have my finger hovering over the SELLSELLSELL button for when the market turned down for real.

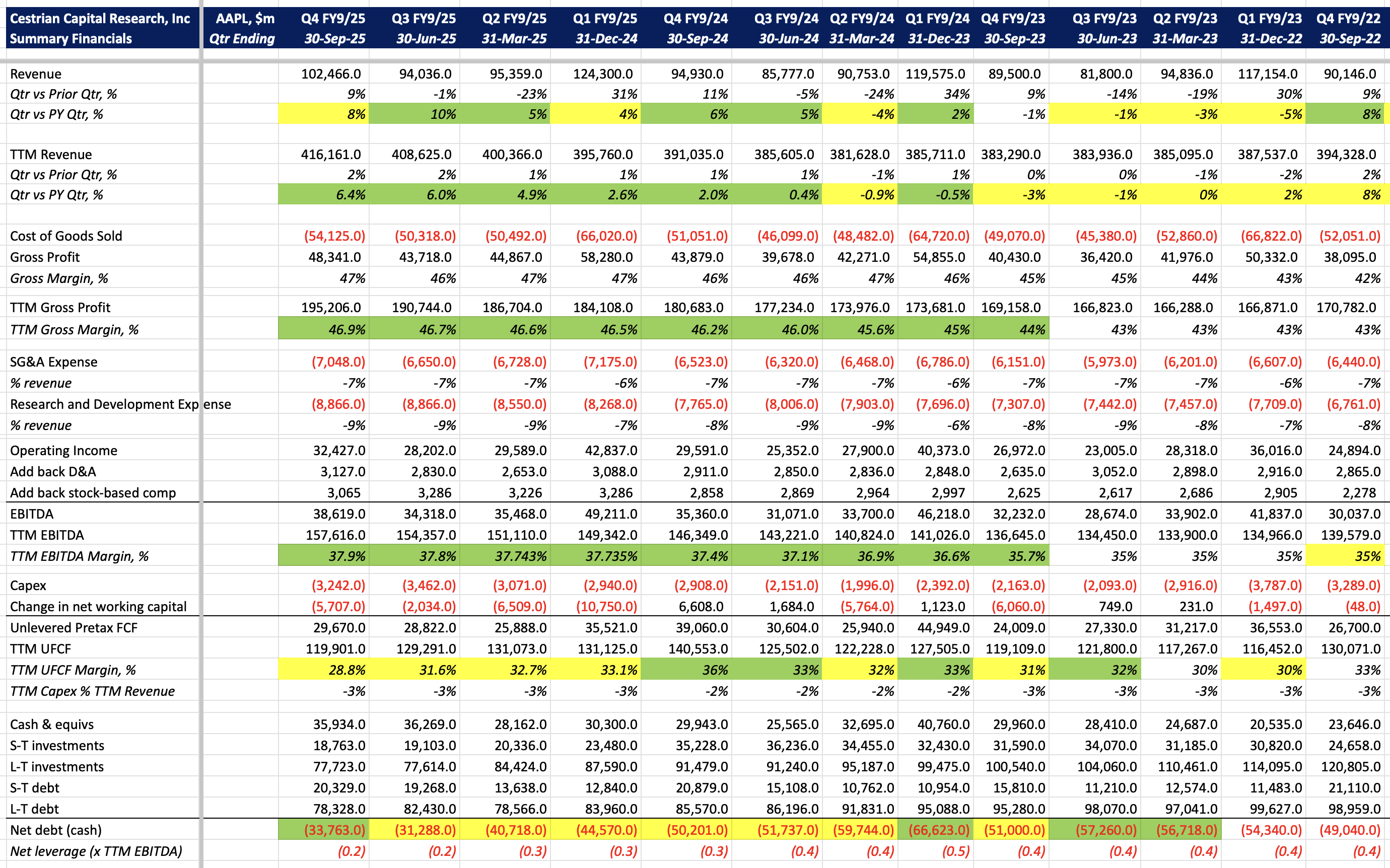

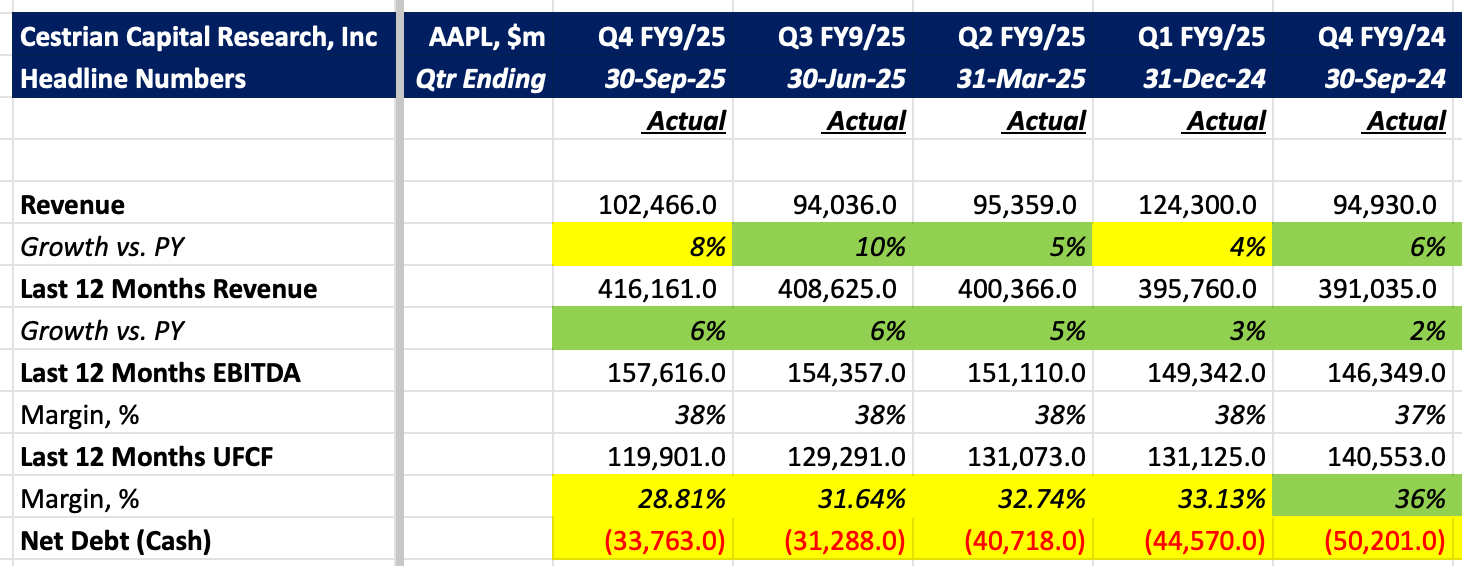

Here’s the numbers by the way - headlines first then the full monty at the end of this note. The rate of decline of the cash pile - because it’s used to pay for buybacks - is partly why the company’s idea of product innovation is a sock with a strap on it.

Valuation is, as I say, a little punchy these days.

Alex King, CEO, Cestrian Capital Research, Inc - 12 Nov 2025.

APPENDIX: Full Fundamentals