Autodesk Q3 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

A Glimpse Of The Future?

Autodesk ( $ADSK ) is one of a number of stocks that act as useful “canaries” at times of economic change. Autodesk software is, as you know, used to design things. And things are designed in advance of being constructed. And to construct things you need capital expenditure. In weakening economies, capital expenditure falls and ADSK sales fall as a result. In strengthening economies, capital expenditures rise and ADSK sales rise too. Capital expenditure cycles being what they are, purchases of ADSK licenses and/or subscriptions tend to run just a little bit ahead of the capex spend itself, and for this reason one can use ADSK financials and its stock as just a little glimpse into the future.

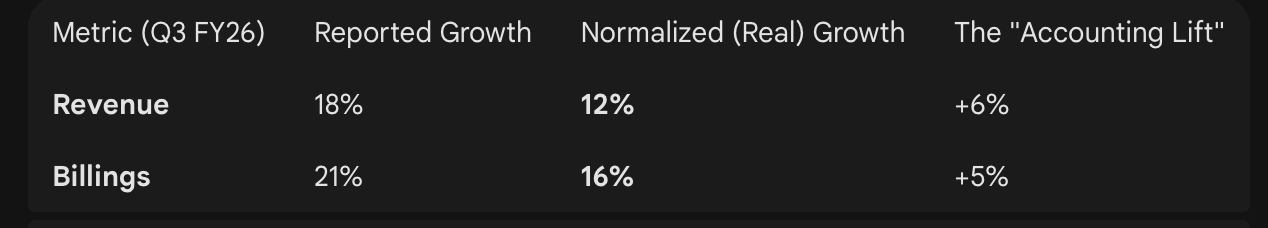

In Q3 (ending 31 October 2025), Autodesk’s recognized revenue growth looked good, but the the company is guiding to a slowdown. Further, the recognized numbers include a change in sales model wherein revenues are biasing over from reseller to direct-sale, which flatters growth a little. Google Gemini estimated the benefit as follows:

Finally, the company announced a 1,000 head reduction in force, amounting to approx. 7% of total staff.

Taken together, the softening guide, one-time accounting benefit in the recognized growth rates and headcount cuts all point to a weakening customer environment. Autodesk isn’t a monopoly in what it does, but it has very large market share in its key segments and its customers are conservative; I don’t think one can explain away the weakening environment by saying it is loss of share - I think we have to say it is indicative of a capex slowdown.