Big Money Crypto: Market Update

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Take A Step Back

by Alex King, CEO, Cestrian Capital Research, Inc

Bitcoin, Ether, Solana and all the stocks in their respective complexes are taking a beating today. I don’t think this is a new bear market; I think it’s a shakeout of weak hands, by which I mean over-levered long hands.

Let's start today’s note by looking at where the three cryptocurrencies stand vs. the dollar, and then let’s update on a number of important moves in:

- BitMine Immersion ($BMNR)

- Sharplink Gaming ($SBET)

- EthZilla ($ETHZ)

Bitcoin

Bitcoin is hitting its head on the ceiling at $122k; not coincidentally that is the 1.618 Fibonacci extension of the prior Wave 1 placed at the Wave 2 low on this timeframe. (Here time = 0 is the Covid crisis lows). Now, because we’re in such a bullish market I’ve market the potential Wave 3 top at the 2.0 extension - that’s around $145-146k - and then laid out a Wave 4 correction before a final Wave 5 higher. This pattern makes perfect sense within the overall Elliot Wave / Fibonacci system but that, of course, is just pattern recognition and projection, it’s not anything that is certain to happen. If you’re long Bitcoin (and I am, via $IBIT) then you have to be aware that what is marked as a W3 high on this chart could turn out to be a Wave 5 high - and if so that would mean a very sharp correction thereafter.

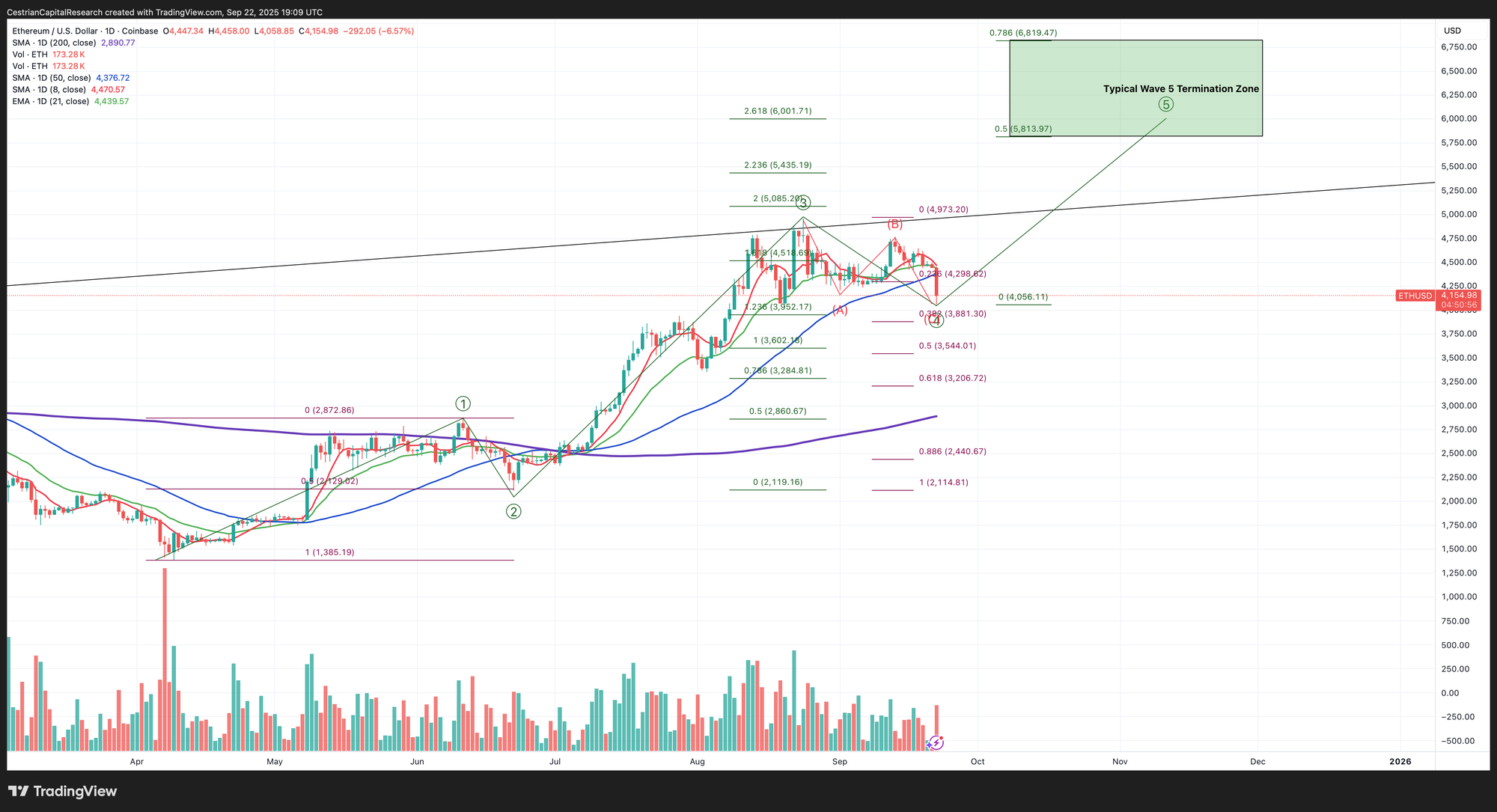

Ether

Last week it looked like Ether had started a Wave 5 up - that was a headfake. Today’s selling put in a new low and whilst it can keep dropping this looks like an a-b-c into a Wave 4 low. Intraday, the low has held as shown. I’ve adjusted the Wave 5 target (down a little) to reflect today’s price action.

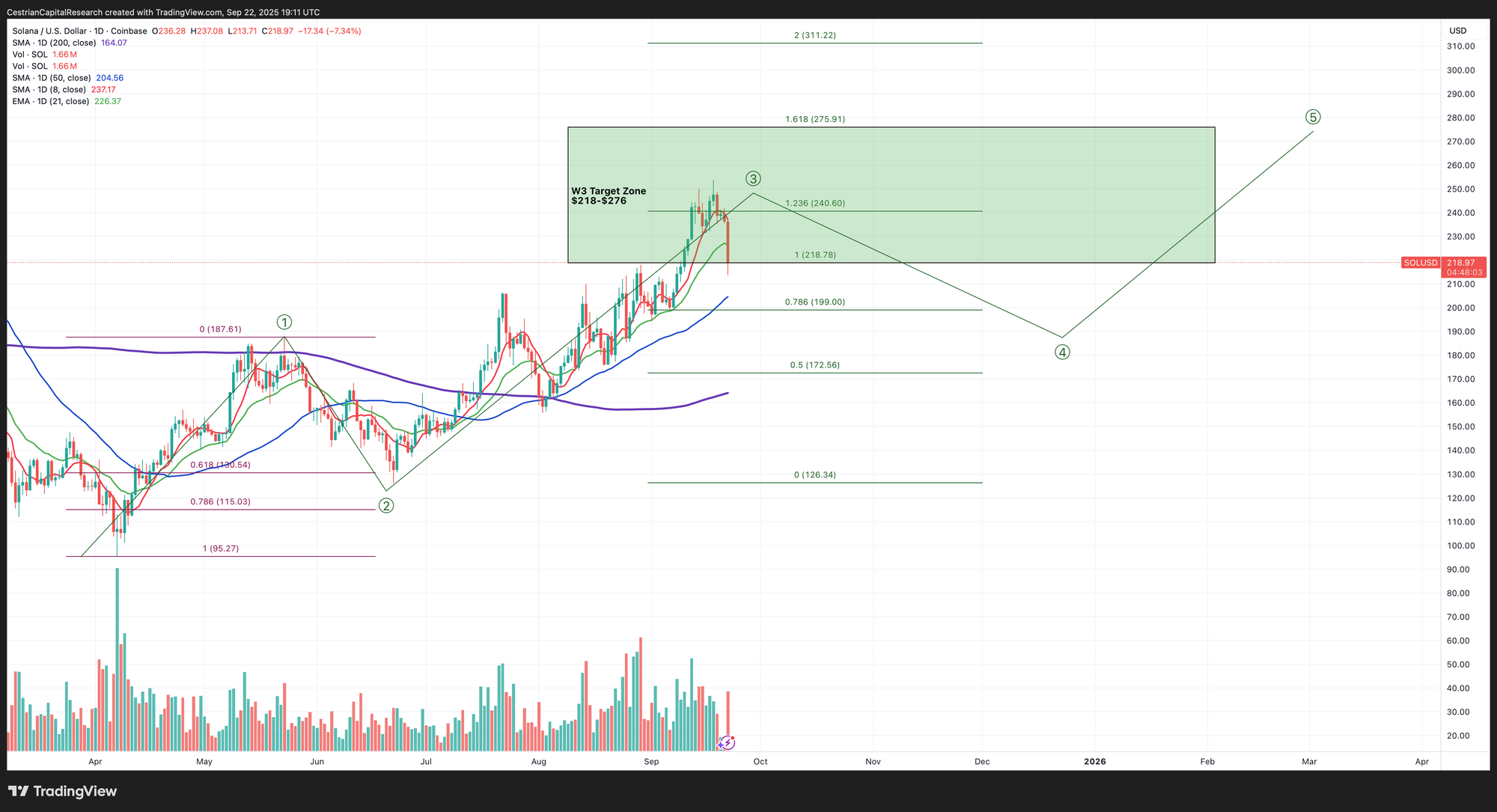

Solana

Solana hit the middle of our Wave 3 target zone and found resistance there.

To be honest I would be surprised if that turned out to be a Wave 3 high. In this bullish a market I would expect SOL to hit the 1.618 extension - that’s around $275 - before a material Wave 4 down. For now let’s see if it can hold over the 50-day moving average (that’s the blue line shown - currently at around $205).

So - overall - I think we are still in a bull market in the three primary crypto names. And in that context let’s take a look at some of the stocks in the crypto complex.

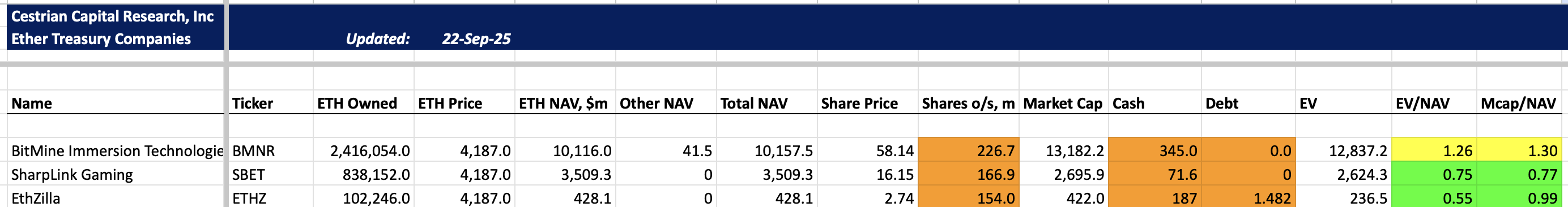

Ether Treasury Companies - BMNR, SBET, ETHZ

Let’s check in on where these companies are trading vs. NAV. I will say these numbers are directionally correct but not dot-accurate, not least because obtaining a daily read of the no. of shares outstanding is very difficult.

Broadly though we can say $BMNR is trading above NAV, and the others are below NAV.

Let's get into it.