Blowout! - Micron Q1 FY8/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis on this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Cyclical Or Secular?

by Alex King, CEO, Cestrian Capital Research, Inc

The answer to that question determines where you think Micron stock goes from here. Earnings and guidance were epic-blowout-fantastic, no other way to describe this print. If you think Micron is now at peak earnings as a cyclical stock you should value it with a very low earnings multiple. If you think earnings can keep growing - that the company is on a secular growth path due to the AI buildout - then you can happily slap on a big earnings multiple, project way out into the future and conclude that MU is cheap.

First, the numbers.

Financial Fundamentals

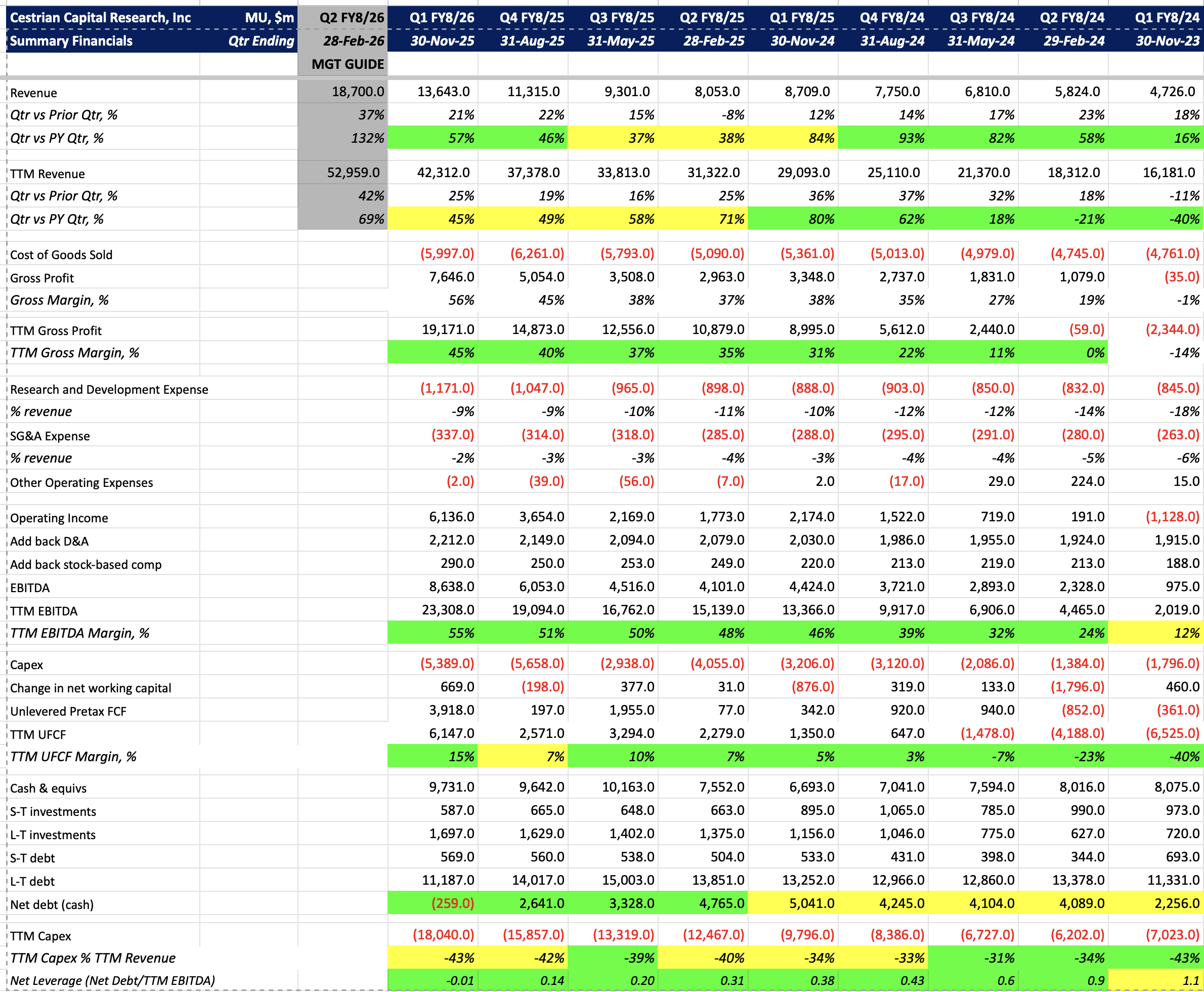

If you like numbers, read the table below and weep.

If you hate numbers (1) why? and (2) these are the important ones:

- Revenue growth accelerated to +57% YoY this quarter, not quite enough to drag the rate of TTM revenue growth back up, but that will be a different story in fiscal Q2 (ending Feb) because ...

- … the guide is for 132% growth!! - which would take TTM revenue growth to +69%, on a revenue base of $53bn pa. Outside of Nvidia earlier in its growth cycle I don’t recall seeing a business this big growing that fast.

- You can ignore EBITDA at Micron because it builds its own fabrication plants, like Intel, so its capex bill is big.

- Focus instead on unlevered pretax free cashflow margins, which sit at +15% right now. That’s very good for such a capital intensive business.

- The company has net cash on its balance sheet for the first time since early 2023. (That’s good of course).

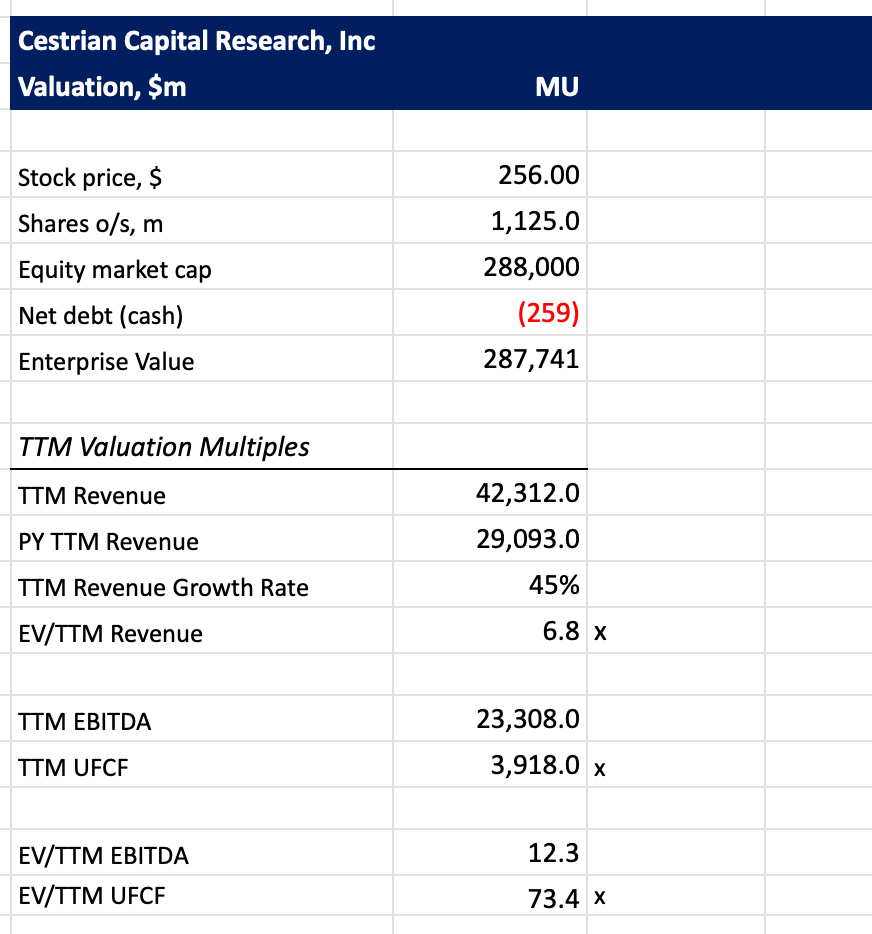

Valuation

It doesn’t matter. The earnings trajectory matters. If this is a cyclical high in earnings then this is a seller’s valuation b/c it has muted multiples. If growth is going to keep going then this is a buyer’s valuation.

Stock Chart

The short-term chart is what matters here. If Micron can close at a new all-time high today, tomorrow or Monday (it’s Q4 options expiry tomorrow so craziness will haunt Wall Street all day) then this thing can rocket higher. If the prior ATH is hard-rejected then the AI narrative is probably done for awhile.

You can open a full page version of this chart, here.

Rating And Risk Management

We rate Micron at Hold BUT if it starts dropping it can drop a lot, so have some risk management in mind. The 50-day moving average at $225 is a pretty good line in the sand (here).

Cestrian Capital Research, Inc - 18 December 2025