Chevron Q2 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

It’s Not About The Numbers

It really isn’t. The question of whether to own energy stocks is more about institutional rotation of capital into and out of the sector than it is anything to do with the financial performance of the companies themselves.

Let’s cut to the chase.

I think energy is likely on the up in the next 12-18 months, as profits are taken in tech and free-money gains sought elsewhere. If I am right, expect to see good news stories about oil & gas companies in a few months, after bigs have had time to accumulate.

As always the best way to judge this is using a stock chart. Here’s how I personally see $CVX right now.

First, the larger degree. The stock continues to trend sideways in what I believe to be an accumulation zone, between $140-172/share. As such, we currently rate CVX at ‘Accumulate’.

And zooming in? Shorter term I think we may see a little more downside, perhaps holding over the 200-day moving average at $150 (currently $154). If the stock tries a few dives down below the 200-day I would tend to assume this is a headfake to cause rules-based traders to sell their stock (many will do so below the 200-day for any stock). 3-4 daily closes below the 200-day and I would probably turn neutral on the name. Here’s a shorter term chart.

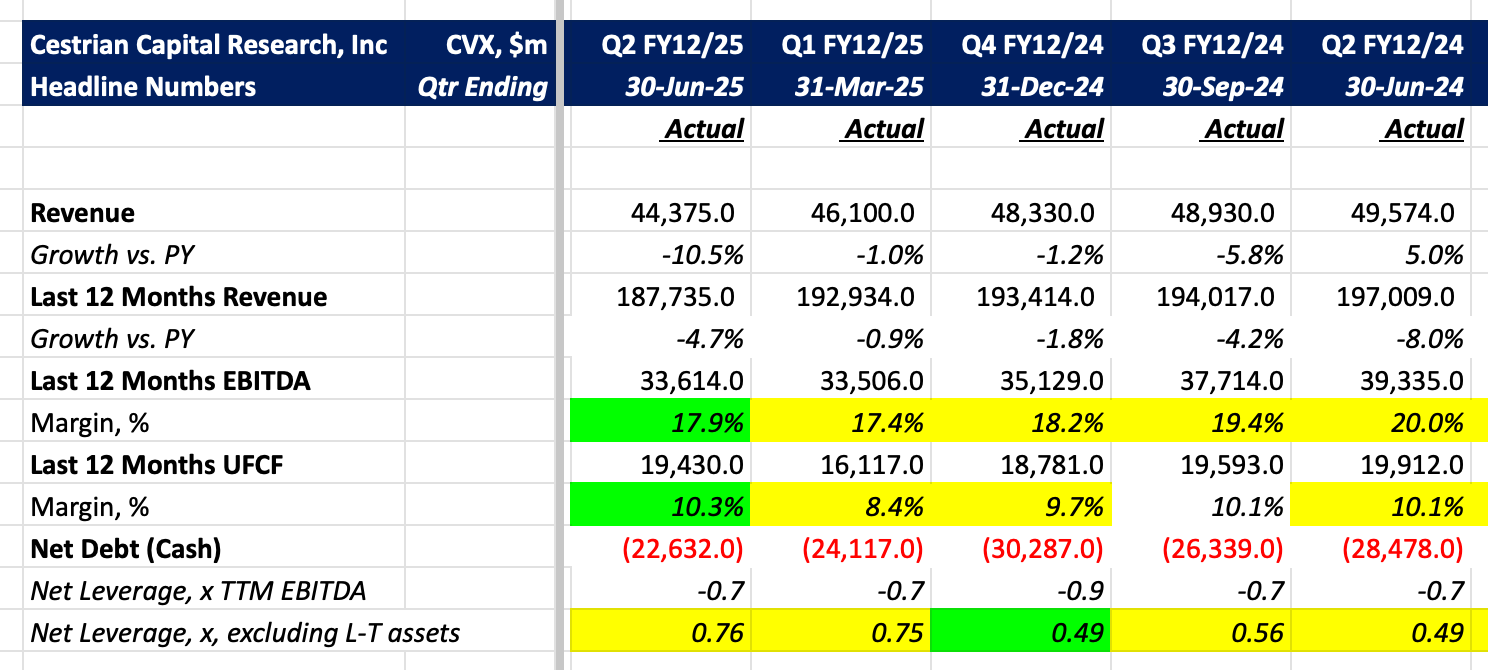

Oh yes. Numbers. Here they are. First in headline form. The headlines are that cashflow and cashflow margins are ticking up and that the balance sheet is holding steady.

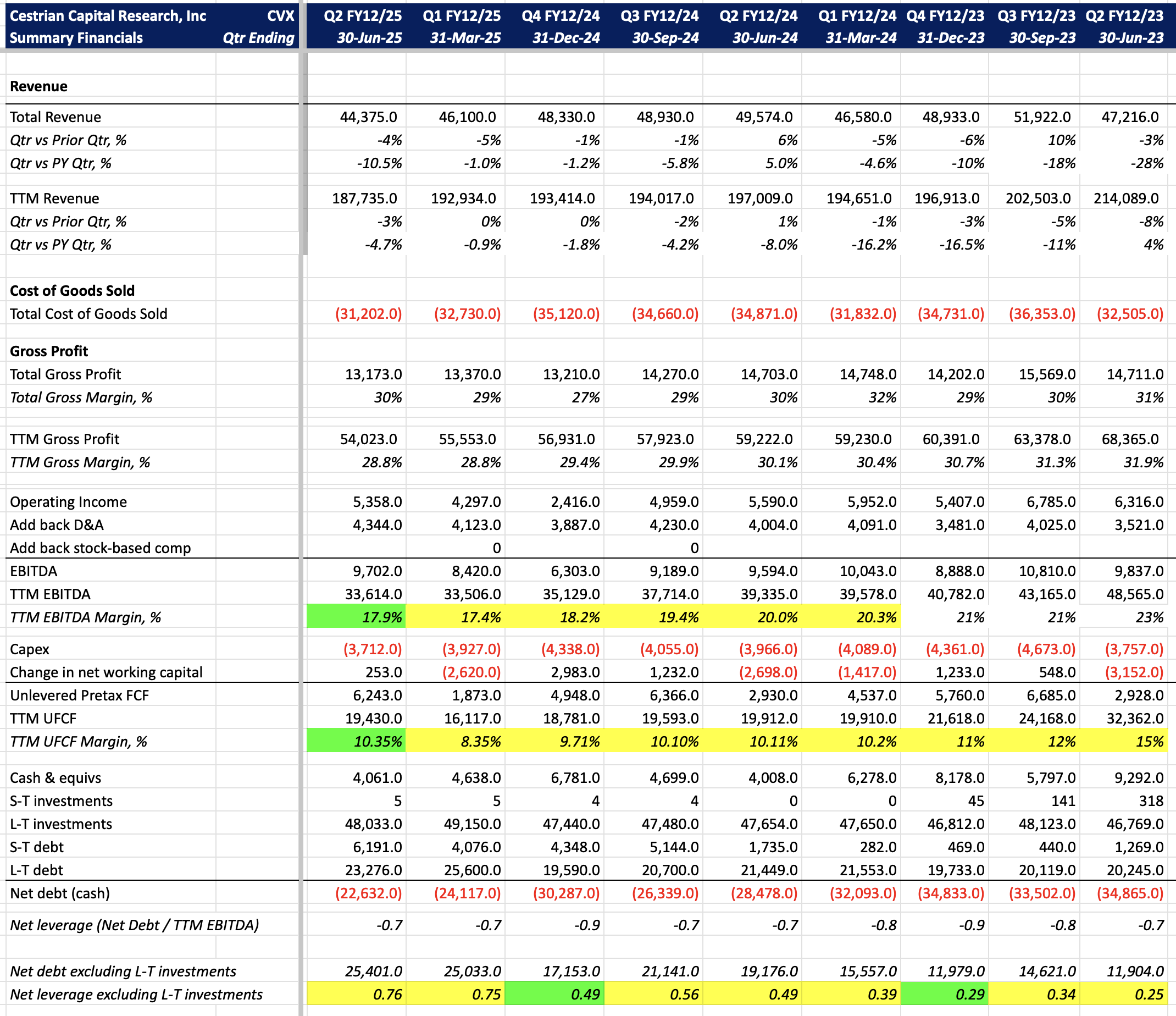

And now more detail:

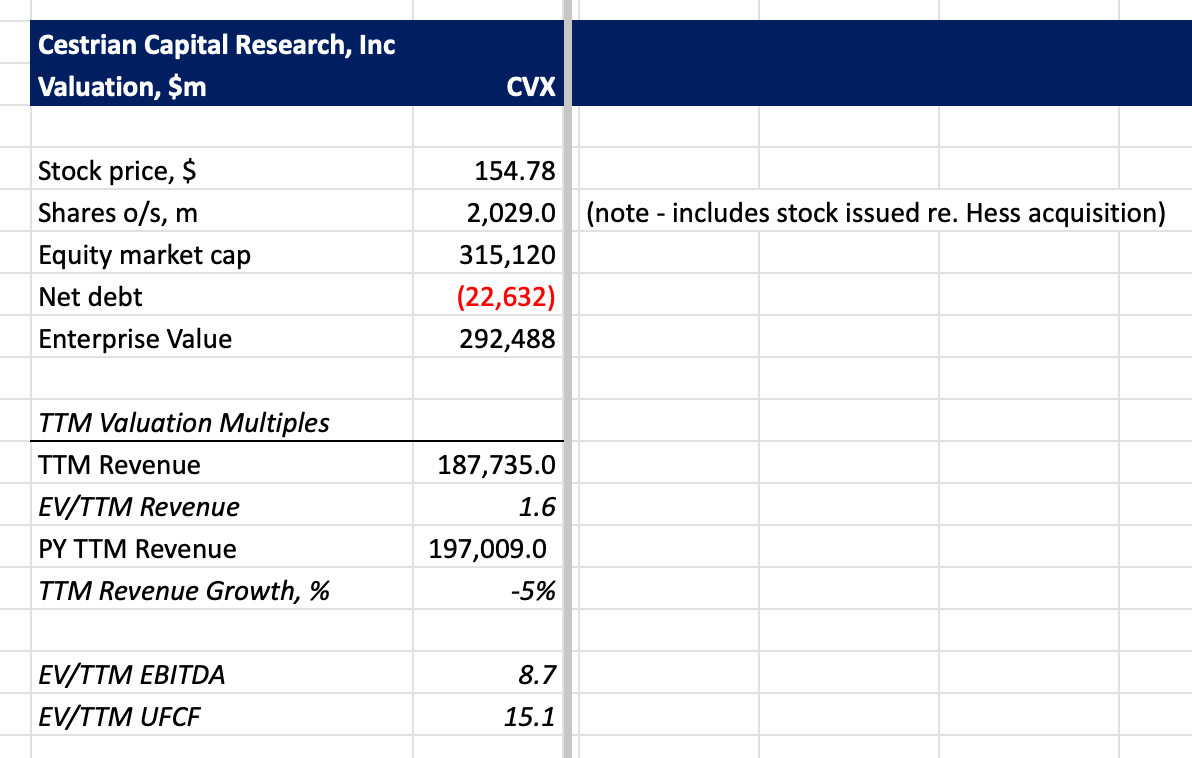

Valuation? Here you go.

Alex King, Cestrian Capital Research, Inc - 1 October 2025.

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts hold long position(s) in $CVX.