Cloudflare Q3 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Feeding the Machine

By Hermit Warrior, a.k.a. Richard Iacuelli

Welcome to the new sleeker, easier to read format for our earnings reviews which we'll be using for selected names. The aim is to make the important points 'pop out', with an easier read - and we're dragging ourselves firmly into the AI-augmented (not replacement) age with a new 'AI Insights' section. All feedback - good, bad, or just meh - is always welcome!

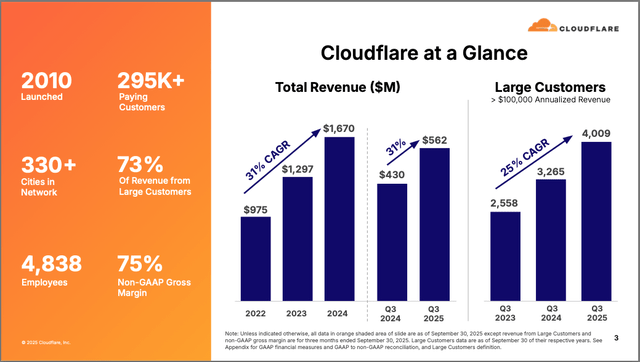

House View

Another very strong print for CloudFlare ($NET) marked by a second consecutive quarter of revenue acceleration and underpinned by disciplined expense management, a continued focus on growing large enterprise customers and rapid expansion of their network capacity. With the strongest growth in RPO since 2022 bringing the prospect of another revenue beat in Q4, added to strong demand for its network-embedded services, and a pace of customer acquisition that added 30,000 paying customer this quarter alone, there's a distinct sense that CloudFlare is successfully 'feeding the machine' of sustained future growth.

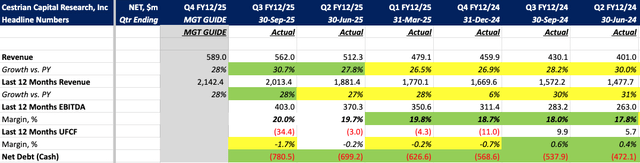

Here are the headlines.

Analyst Insights -

Growth:

- Q3 revenue growth of 30.7% handily beat the 26% guide, and accelerated from the 27.8% growth seen in Q2 - the second consecutive quarter of revenue acceleration.

- The Q4 guide is for 28% growth however, given 43% yoy growth in Remaining Performance Obligations (RPO) - a leading indicator of future revenue growth - I think it's safe to say they will beat this, and potentially match if not exceed the 31% growth achieved in Q3.