CrowdStrike (CRWD) Q3 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Better by Increments

by Hermit Warrior, a.k.a Richard Iacuelli

Welcome to the new sleeker, easier to read format for our earnings reviews which we'll be using for selected names. The aim is to make the important points 'pop out', with an easier read - and we're dragging ourselves firmly into the AI-augmented (not replacement) age with a new 'AI Insights' section. All feedback - good, bad, or just meh - is always welcome!

House View

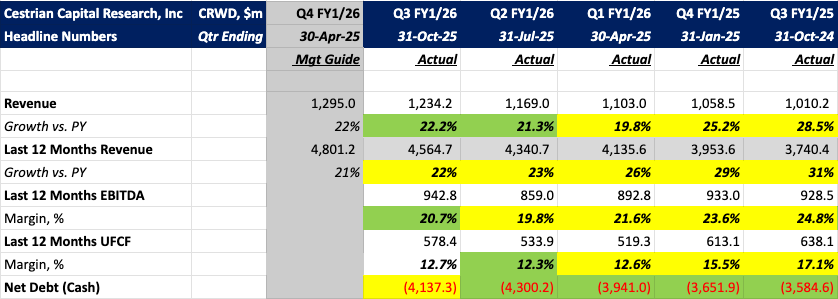

Q3 marked another solid set of results for CrowdStrike ($CRWD) - and the second consecutive quarter it delivered accelerating revenue growth, improved gross and EBITDA margins, and higher unlevered free cashflow (UFCF). It also gave a sense of an organization playing the long game, positioning itself as the essential partner to others, and squeezing out incremental improvements to fundamentals, all while anticipating a burst of AI-fueled growth as talk of agentic AI, wider 'attack surfaces' and outsized TAMs (Total Addressable Market) turns from talk into real revenue. Meanwhile, identity and endpoint security are taking center stage as CRWD joins peers in filling gaps in their portfolio through bolt-on acquisitions in order to protect against new ways organizations' information and infrastructure are threatened in the age of artificial intelligence.

Here are the headlines:

Analyst Insights -

Growth:

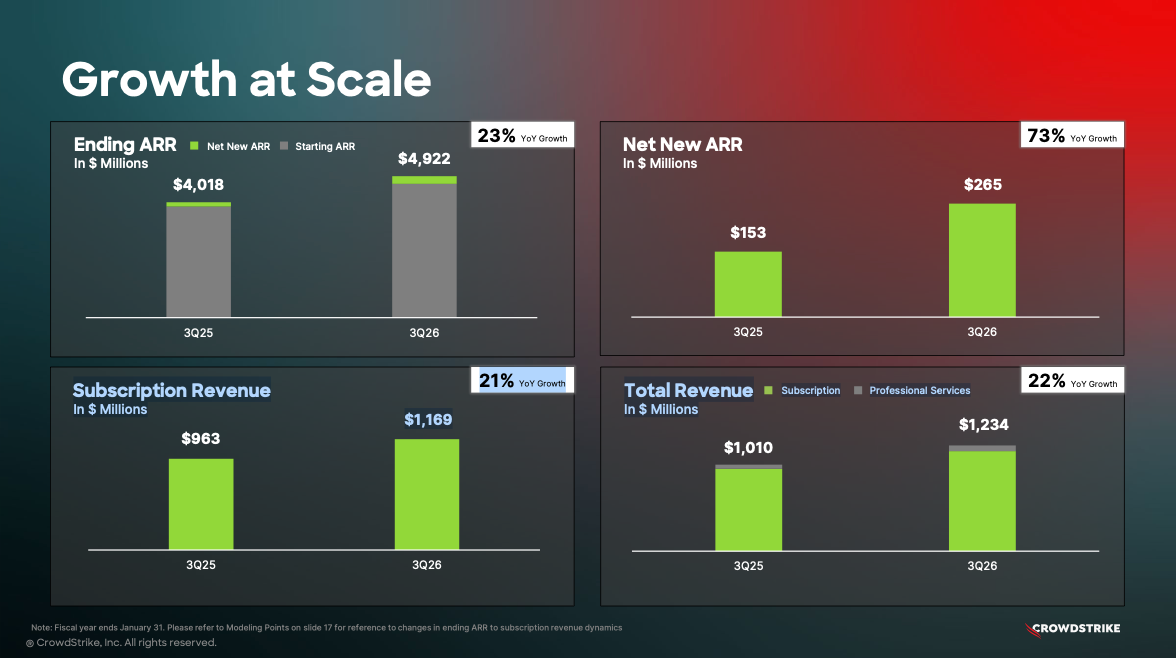

- Q3 revenue of $1.23B beat the $1.21B guide of 20% growth, although actual revenue growth of 22.2% was a little under 1% higher than in Q2 (21.3%). By comparison, Palo Alto ($PANW) grew revenues 16% in their most recent quarterly report, while Zscaler ($ZS) grew 26%.

- The guide for Q4 is for 22% revenue growth - ostensibly flat, however we can likely infer a further slight acceleration in the next quarter given healthy net new ARR and RPO growth (see below).