CrowdStrike (CRWD) Q2 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Out of the Dog House

by Hermit Warrior, a.k.a Richard Iacuelli

Welcome to the new sleeker, easier to read format for our earnings reviews which we'll be using for selected names. The aim is to make the important points 'pop out', with an easier read - and we're dragging ourselves firmly into the AI-augmented (not replacement) age with a new 'AI Insights' section. All feedback - good, bad, or just meh - is always welcome!

House View

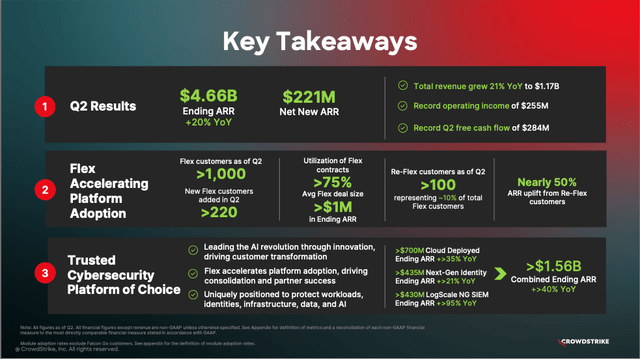

A solid set of Q2 results from CrowdStrike ($CRWD), marking acceleration across revenue growth, net new annual recurring revenue (ARR) and remaining performance obligations (RPO), as well as improving cost metrics and unlevered free cashflow margins (UFCM), all giving a sense that the 'Blue Screen of Death' (BSOD) outage seen a little over a year ago is firmly in the past, with CrowdStrike rehabilitated and well and truly out of the dog house.

Here are the headlines.

Analyst Insights -

Growth:

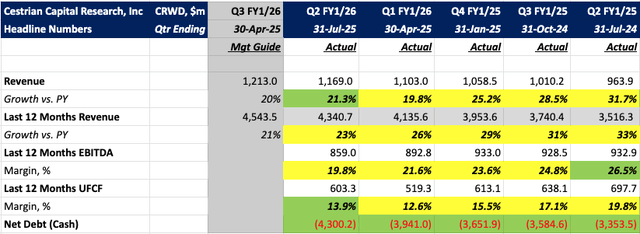

- 21% revenue growth year on year came in above the 19% guide - and marked the first acceleration in five quarters (since Q1/25).

- ARR grew 20% yoy and set a Q2 record; new platform ARR (Cloud Security, Next Gen Identity and Security Information and Event Management - SIEM) grew over 40%, reaching more than $1.56B.

- Remaining Performance Obligations also accelerated, up 47% year on year, the highest rate since Q3/25.

- Management is guiding for Q3 revenue growth of 20% at the midpoint which means that - and I think it's safe to assume they will beat this - revenue growth may at least stabilize at 21% or potentially accelerate further.

- Management sees Total Addressable Market size more than doubling by 2029, from $116B to $250B which should underpin continued strong revenue growth.