Crypto Gets Its “Netscape Moment”

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

It’s Now.

by Alex King, CEO, Cestrian Capital Research, Inc.

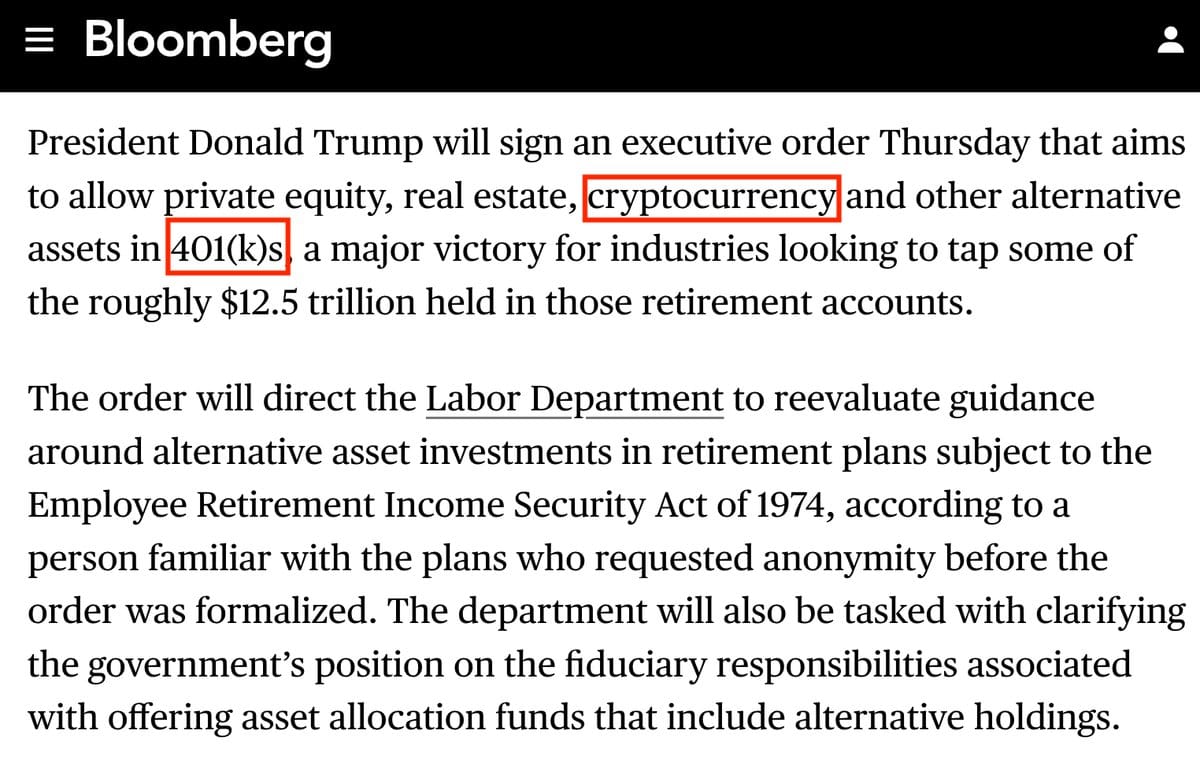

Right around now the Administration is ushering in a new era in investment regulation. Specifically, it is laying the groundwork for 401(k) plans to be able to invest in a wider range of assets than has hitherto been the case. If that sounds like a nothingburger, I assure you it is not. The driver here is the asset management industry, which has long eyed 401(k) plans as a potential source of funds for a long list of currently verboten assets, from private credit to real estate to crypto.

The background of course is the GENIUS Act, which enshrines (i) stablecoins backed by the U.S. dollar and (ii) tokenization of currently illiquid assets in a manner such that the tokens can be recorded and traded in a blockchain-based environment.

Taken together, these two changes are huge, huge structural wins for the asset management industry. The 401(k) access means a tsunami of capital becomes available - only available - people still have to choose what to invest their retirement into - and the tokenization means a lowering of regulation vs. the common stock environment. It is, I would say, unclear at present whether a token is or is not a security, but I think it is very clear that the asset management industry would prefer it to be just a little bit less onerous than a security. Asset management profits will rise in lockstep with any reduction in regulatory oversight.

The market is responding in kind. Bitcoin and Ether are both thinking about making new highs - that’s nearer for BTC than ETH - and the Ether Treasury Companies (BitMiner, SharpLink Gaming etc) are either breaking out (BMNR) or consolidating ahead of a likely breakout (SBET). The SPAC, $DYNX, that is slated to merge with The Ether Machine, is also seeing rising interest in its stock and warrants.

Let’s look at how much progress is being made, and how one might deploy capital in pursuit of this trend.