DataDog $DDOG x The Death Of Software - NO PAYWALL

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Save Yourselves!!

by Alex King, CEO, Cestrian Capital Research, Inc

As everyone knows, software is going to 0, because ClawdBot.

Also because Anthropic. Rumor has it that if you even say the word “Claude” to your average software developer, they come out in hives and develop a stammer.

If you think this negativity is all hype and mindgames, you’re wrong. Here’s employee number 10 at Meta Platforms, who wrote much of the social graph that sits beneath the Facebook product today.

Now I have been a technology investor for a very long time, and I know a tectonic shift when I see one. And make no mistake, AI is now very firmly in the tectonic shift category. It’s more of a change than was client-server to cloud, the last big change in software, which is about 20-25 years old now.

I think this shift will actually send some application software companies to Legacyville, population, them; anything which simply automates linear business processes and enshrines them in software workflow is at risk. One, because there are likely going to be less heads in the enterprise, ergo less seat licenses sold; and two because contrary to the doth-protest-too-much rejoinders of legacy software folks, it’s not that hard for AI to now map those processes and code them, at much lower cost than today’s vertical-market and horizontal-process applications. Moves, adds and changes, otherwise known as “yay, free money” since maybe 1980 to everyone from Oracle on down, will henceforth carry a much lower marginal cost to the software provider and that saving will be passed on to the customer. Finally, the legacy model of enterprise software which for some 50 years now has entailed (i) consultant visits customer, makes flow chart of relevant processes, (ii) devs code up those processes as best they can, (iii) business changes those aspects of its processes which could not be coded correctly, to match what could be coded - all that - that’s all over soon. If AlphaFold can predict viable proteins not currently found in nature or in synthesis, then I am pretty sure that Anthropic and co. can create new business processes that are more efficient than those that humans have come up with so far. And then automate them.

So, Software Is Really Dead Then?

I think software in a decade will be unrecognizable from software today. That means it is a very risky time to invest in the sector, because it is almost impossible to know which vendors will make it and which will fall by the wayside. So either don’t bother - that’s a perfectly reasonable take, there are many other places where capital can thrive - or if you feel that the negativity is now overwhelming, perhaps there are some bright spots to be had that are being ignored by the market.

My own view is: application software is too hot to handle right now. Anything dependent on large numbers of seat licenses, of automating human processes, that’s at risk. Salesforce and SAP and Workday could all moon tomorrow, I don’t know, but I think there’s a lot of risk there and I myself prefer not to put my own capital in those types of names.

There are two categories in software that, as categories, will most certainly survive in my view, and they are (i) systems monitoring and (ii) security. Because even if no humans interact with the datacenter or its physical or logical contents, you still need systems monitoring and you still need security. Probably in different forms. If we think forward 10-20 years it’s not difficult to imagine a datacenter where all logical actions are carried out by software agents (ie. bots, Clawds, etc) and almost all physical actions (swap out faulty network connections, replace failed power supplies, etc) by hardware agents (ie. robots). Today, in incubators and basements and garages across the world, 1-2 person teams are building software companies that can monitor and manage tomorrow’s datacenter with nary a human in sight. But also today, large enterprise customers won’t buy mission critical software from two pimply guys still in high school. They will continue to buy it from folks like DataDog ( $DDOG ), DynaTrace ( $DT ), CrowdStrike ( $CRWD ), ZScaler ( $ZS ), Cloudflare ( $NET ) and others though. And these are the names where I personally would go looking for overly negative situations to buy.

* WITH A STOP-LOSS *

Read that again.

* WITH A STOP-LOSS *

I can tell you from 2022 that when I thought the selling was nearly done in software, it wasn’t done. It kept going. It worked out for me in the end, but it ate up more stomach lining than was necessary. So once again if you are going to play with software stocks right now? Do it ...

* WITH A STOP LOSS *

OK. Let’s take a look at DataDog, one of two leading systems monitoring companies in the US right now.

DDOG Financial Fundamentals

Put simply, DataDog is having to spend significantly more money in order to accelerate revenue growth a little bit. TTM unlevered pretax cashflow margins dropped from 22% in December 2024 to 19% in September 2025. TTM revenue growth ticked up from 26.1% to 26.7% in that same period. So life is hard going at DDOG right now. They aren’t fighting for survival, far from it, but every day will be a slog. No fun.

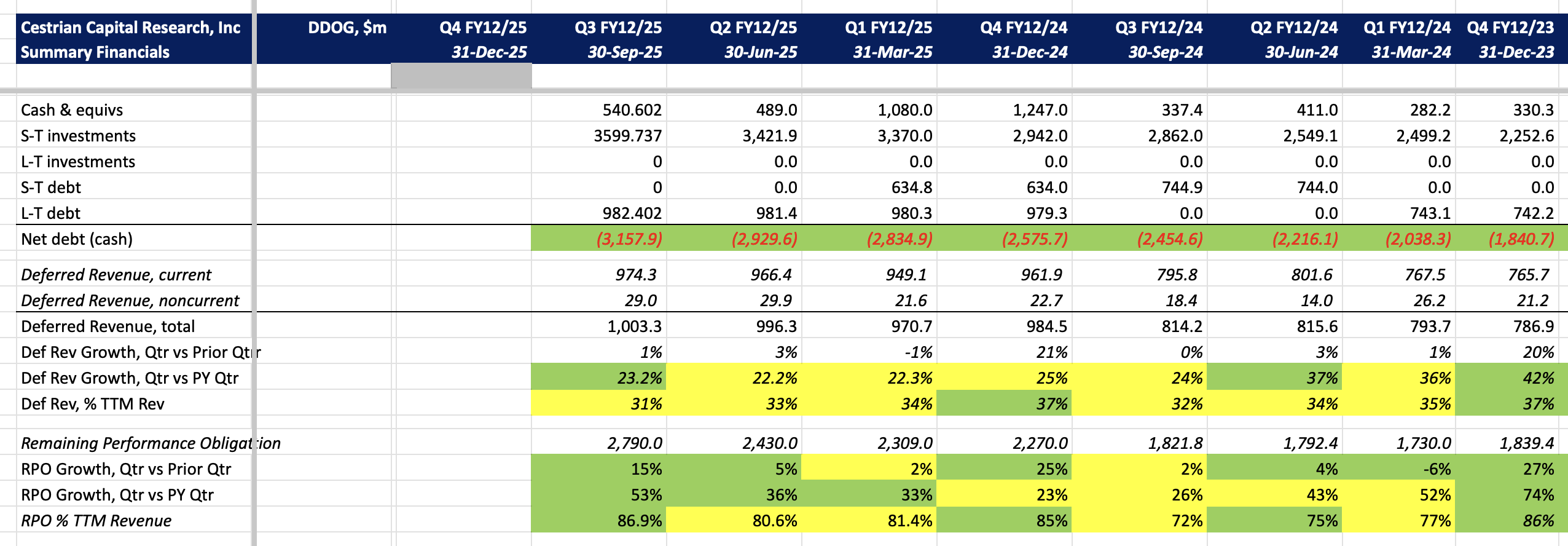

And looking forwards? Well, remaining performance obligations, aka. the order book, is at record levels and is growing at in excess of 50% p.a. Deferred revenue (the pre-paid part of the order book) is also over $1bn for the first time. The balance sheet has over $3bn in net cash on hand. That’s all good. But that deferred revenue is also growing more slowly than recognized revenue, and since there is much less certainty about the final value and timing of revenue that arises from RPO (that’s the nature of the beast, it’s not a specific issue at $DDOG ) , it’s hard to take too much comfort from that 50% RPO growth when you see deferred revenue growing at less than half that rate.

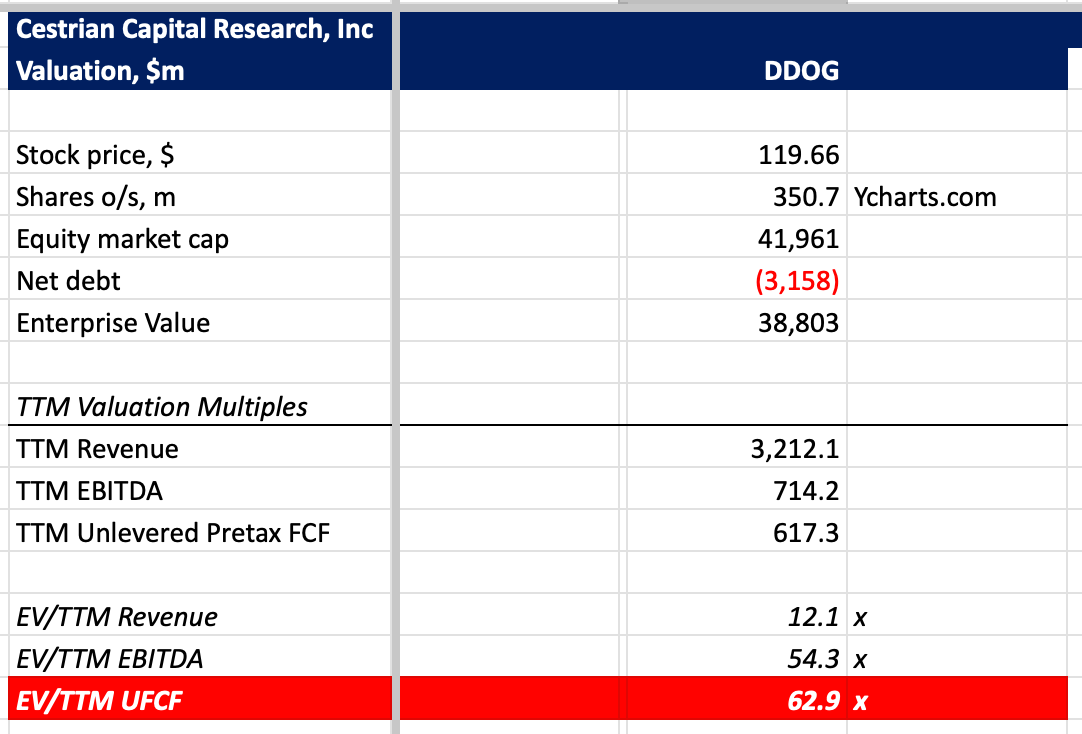

The valuation is very high still in my opinion. Now that does not necessarily matter, most of the time it doesn’t, but you can’t say “well I should load the boat on this one because it’s cheap”. It is not at all cheap.

DDOG Valuation

63x TTM unlevered pretax free cashflow. Zoinks.

As you can see, it’s easy to just say - too hard, I shall avoid software altogether for a while until it’s clearer how it’s going to play out.

DDOG Stock Chart

If you are interested in buying this deeply unfashionable sector though, I would do so using stock charts and, did I mention, stop-loss orders. Here’s the charts for $DDOG as I see it.

First, here’s how the stock could keep falling to around $95. This is a pretty simple chart but sometimes simple is best. If it’s going to drop from $120 to $95 then it’s probably best left to do this by itself. You can always go looking around at that level if it happens, or put in a stink bid right now in that zone.

Secondly, here’s how it could be approaching support right now and offer a good time to buy. (With a stop loss).

The stock is right around the corner.618 Fibonacci retracement of the move up from the Liberation Day lows to the ATH. Technically that may see support firm up, if not here then a little lower at the .786 ($110 ish). And technically - yes I know, but remember bullish moves always look crazy when sentiment is this bad - it could move back up and over ATHs ($200+) on this basis.

DDOG Rating

We rate the stock at Accumulate, subject to it holding over $110. Below $110 I think take I would take a small loss and come back another day.

Cestrian Capital Research, Inc - 4 February 2026

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, $DDOG.