Don’t Sleep On Energy - Exxon Mobil Q3 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Who’s On Next?

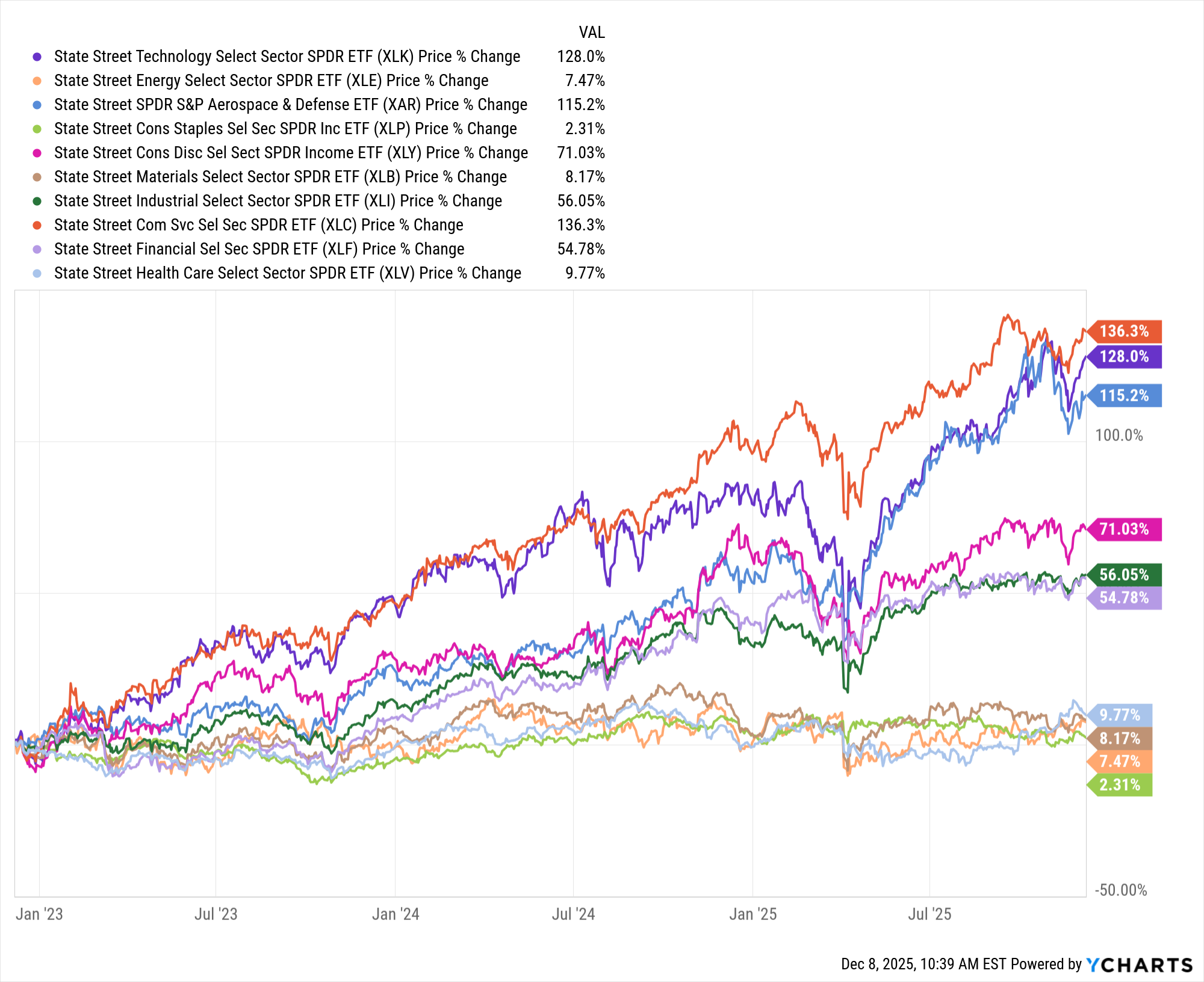

In the last three years, energy as a sector has languished vs. the S&P500. Here’s a chart of the major sector ETFs over that period.

Energy ($XLE) is near the bottom of the pile, with only consumer staples ($XLP) coming in lower on a price basis.

Measuring on a total return (incl. re-invested dividends) basis make the picture slightly more rosy, but only just.

If you simply bought $SPY and held it for three years, you would now be up some 80%, inclusive of re-invested dividends. $XLE? Just 20% over that time.

Now that alone sets the scene for a potential bullish run for ExxonMobil stock. It looms large in $XLE (it’s about 23% of the ETF), has been largely ignored since its popularity in the early days of the Russian invasion of Ukraine, and the market is at a point where some rotation out of the tech leaders would not be at all surprising.

Here’s how the $XOM chart looks.