Embracing AI

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Human Assist.

by Alex King, CEO, Cestrian Capital Research, Inc.

The thing I love most about public securities markets is the infinite-game nature of the beast. In choosing to invest and/or trade, you are in essence committing yourself to the greatest and most difficult MMORPG of them all. And whoever you are, tomorrow someone bigger, stronger, better financed, smarter, more knowledgeable than you can join the game. Fortunately, it’s a game in which there are endless sub-games and many ways to win. Sheer power can prove a hindrance; classical training can lead to damaging rigidity; oftentimes creativity and drive are enough to succeed. The longer you spend in public securities markets, the more you learn about how money flows the way it does, why things are priced the way they are, and how emotions interact with reason. And because the game keeps changing its rules - specifically the players of the game change the rules of the game all the time - it is impossible in my opinion to be bored by public markets. If you are intellectually curious and competitive, it is a wonderful place to spend your working day. And night. And non-working days. And non-working nights. “Non-working” lol. This game is immersive.

Because competition is extreme and the prizes on offer are spectacular, this game attracts continuous technical improvement; it tends to attract some of the best and brightest minds both as game players and as builders of the tools used to play. And right now it is attracting many forms of AI.

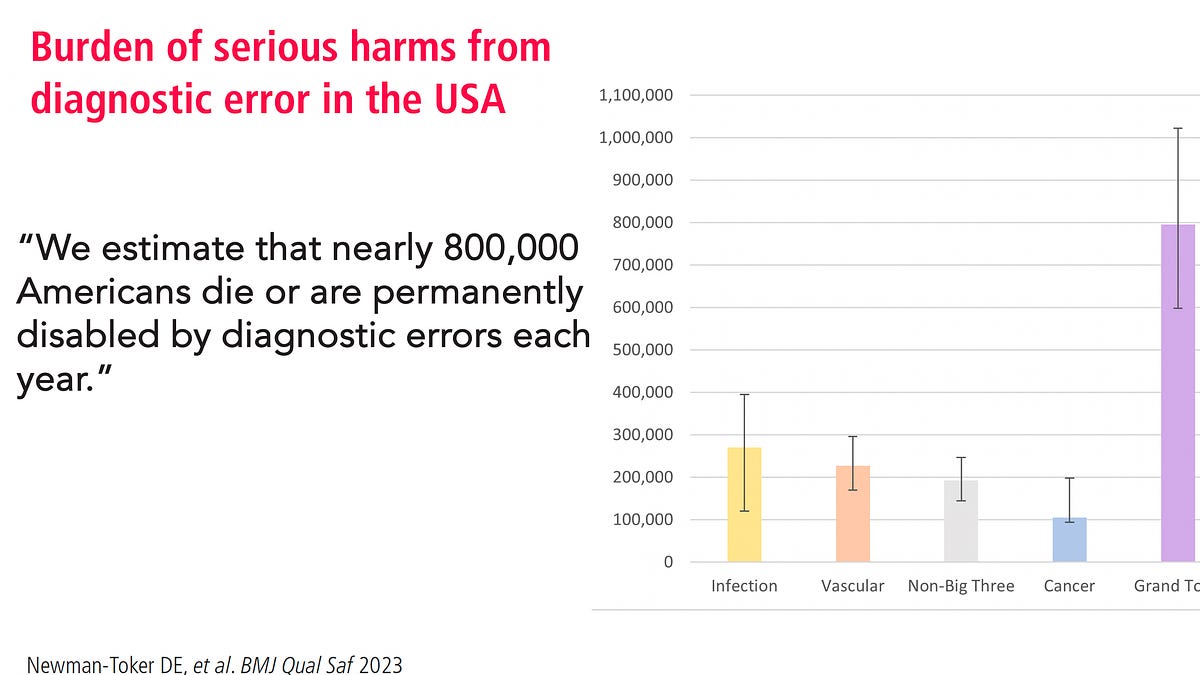

In many fields, AI is already superior to pure human piloting. If you haven’t come across the excellent work of Eric Topol in medical research, take a moment to read his stuff concerning AI. Here’s an example.

Research in imaging and diagnostics continues to conclude that including AI in workflows improves patient outcomes. In some cases it is presently better to include humans in the loop; in others, the machine does better standalone than any human or human+machine combo.

This is also what we have concluded at Cestrian Capital Research.

Our work here includes manual analysis of company fundamentals, manual analysis of stock charts, and AI-driven algorithmic analysis of patterns in markets, which we use to formulate specific trading strategies. The analysts at Cestrian, myself included, use both human- and machine-driven strategies in our personal account investing and trading; and the services we offer to our customers include both high-end human analysis and machine-driven signals.

The fastest-growing part of our business is machine-driven signal strategies. We have enjoyed great success with these algorithmic services, both in terms of the performance of the algos and the number of subscribers we have won and retained in these services.

My own take on the balance of machines vs. humans - at least in our work here at Cestrian - is as follows:

- Our algorithms are better at staying in a trend longer than any normal human can. Why? Because they don’t know what the trend is. They don’t know what money is. They don’t know what the Nasdaq or the S&P500 or $SMH is. They just see a stream of numbers and from that conclude whether a trend is likely to continue, or likely to fade. They don’t have fear and they don’t have greed, and to the best of my knowledge they don’t get hung up second-guessing themselves. (Perhaps we are just not privy to the internal dialog of the machine).

- Machine-suited trends are more often found in index futures, index ETFs, sector ETFs, commodity futures and ETFs - and for these purposes I include crypto in commodities - than they are in single-name stocks. This will change in the future, but for now there is too much unpredictable wetware influence on signal name stock price behaviour vs ETFs or futures.

- Human analysis still has an edge in some aspects of single-stock analysis, be that fundamentals, interpretation of earnings calls, or technical analysis. This human advantage may persist or it may not, but for now it is real.

My conclusions above are reached through a combination of (i) analysis of the backtested and live-trading performance of the algos we offer, taking into account both returns and risk management alike and (ii) trading both the algos and our own - my own! - human analysis alongside one another.

Effective tomorrow I shall no longer be trading index or sector ETFs using human analysis. Humans are just not as good at this as the machines we run. ETFs, you see - and index & sector futures are the same - aren’t too disturbed by outside influences like earnings or regulation or management team gyrations. The big liquid ETFs are machinelike in their pricing behavior and are, in my experience, best traded by a machine. Our SignalFlow Growth, SignalFlow Sector Rotation, YX Commodity Signals and SignalFlow Long/Short services do a better job than I think most any human could do trading indices and sectors. There are way better traders and investors than me in this world but I am not too shabby. And compared to my previous efforts to (i) navigate indices and sectors using long/short hedged ETFs and (ii) rotate in and out of sectors manually, these algos make life very easy and to date have performed very well. They use less capital (because they use rotation for risk management, not hedging) and perform with less volatility. This means that they have been making money quietly with limited stress for the user. Which compares very well to the heat and light required to run a long/short book manually.

If you read our stuff you’ll see a slight change in disclosures; for index and sector ETFs our Market On Open notes each day will refer to the algo or algos that cover the index or sector ETF in question. For single-stock earnings and other writeups, my investing and trading will remain manual for the forseeable future and disclosures will be unchanged.

You can read all about the AI signal services we offer, here:

Any questions at all, reach out to us using this contact form or you can e-mail us at minerva@cestriancapital.com .

Cestrian Capital Research, Inc - 9 February 2026