GOOGL 2025 Q2 Earnings Update

By Yimin Xu on July 24, 2025

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Tired of all the Dividend accounts on FinX celebrating their win in GOOGL, despite the fact that it only pays a 0.4% dividend yield?

I have good news for you. You are getting even more GOOGL content from me today covering the latest earnings. We break down exactly how to think about GOOGL’s business performance, valuation, and price action in a methodical manner.

Spoiler alert - GOOGL landed a solid set of earnings report, with valuation still being reasonable. The long-term potential for GOOGL’s stock is very compelling. But we could get a potential short-term pullback, setting up for a very strong buying opportunity.

By Yimin Xu, July 24, 2025

🛩️ My private channel at Cestrian to provide winning trade ideas in two key areas:

- Macro Instruments across SPY, QQQ, TLT, USO, GLD and BTC

- Magnificent-7 stocks and PLTR

1. Business Highlights

Alphabet Business Breakdown

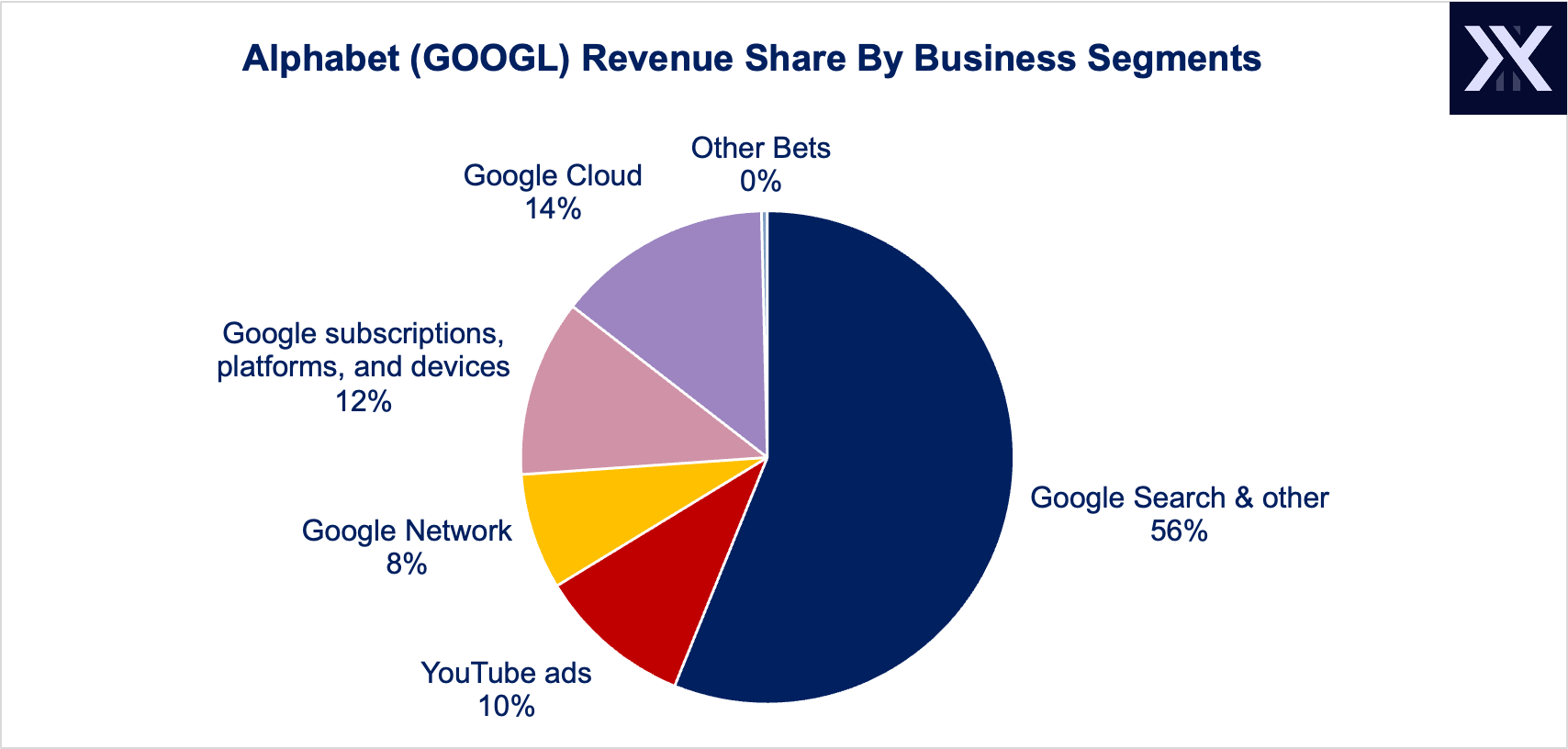

Most of Alphabet’s money machine is, surprisingly in the Golden Age of AI, still Search. Search makes up 56% of GOOGL’s Q2 revenue.

Google Cloud takes a distant second place, contributing towards 14% of the revenue. Cloud is closely followed by Google subscriptions, platforms, devices, YouTube ads (I pay Premium to not watch them, which goes to the Subscriptions revenue), and finally Google Network.

Waymo operates under Other Bets, which brings in negligible money right now.

Alphabet Q2 Performance

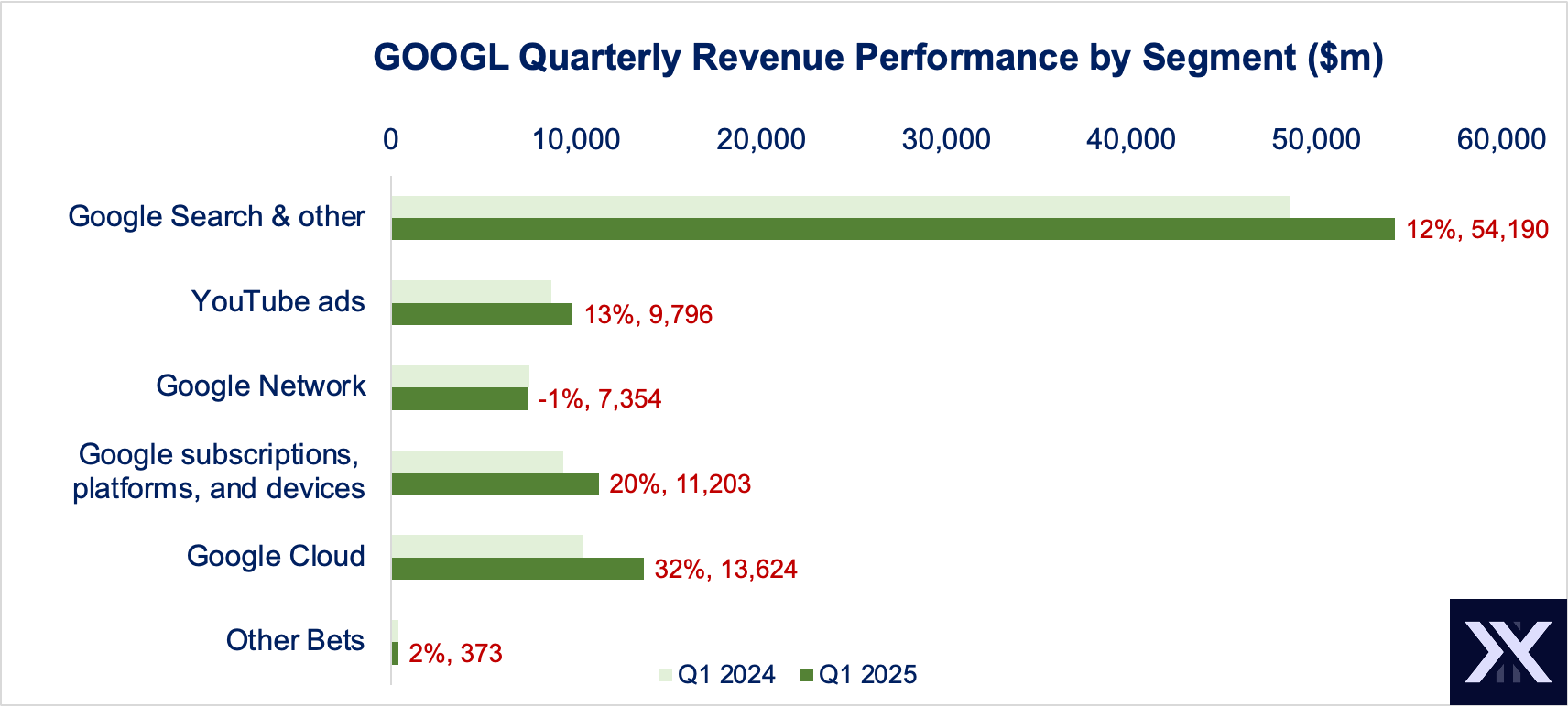

Google Search is very resilient, up 12% YoY to $54 billion. That’s a $200 billion annual run rate. TSLA’s entire annual revenue is half that. Google Search’s AI Overview boasts over 2 billion monthly users and has led to 10% more queries globally.

YouTube ads grew by a similar 13% YoY to $10 billion, thanks to Shorts. YouTube Shorts average over 200 billion daily views. Its monetisation is now approaching parity with the traditional in-stream ads in the US.

Most impressively, Google Cloud grew by 32% to $13.6 billion. That puts the annual run rate over $50 billion. A lot of growth has been driven by the enterprise usage of Gemini.

Google subscriptions, platforms, and devices are up 20% YoY to $11 billion. There was strong growth in YouTube and Google One subscriptions.