In Pursuit Of Entropy: The Trade Desk ($TTD) Q3 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

When Chaos Is Your Friend

$TTD was one of the worst-performing stocks of 2025, and the year finished with a flourish when the name was unceremoniously ejected from the Nasdaq-100. As a result there will have been plenty of tax-loss-selling of this name into the close of December. That itself can act as a catalyst for a small rally in Q1 of course.

The company, as you likely know, provides a platform for brands to buy ad space in electronic markets. The company flourished as an open-internet player; walled-garden spaces like Facebook, Amazon and so on were closed to it but there was enough ad spend flowing through Google and connected TV and other open markets that it had plenty of growth opportunities. Those opportunities are curtailed a little (in fact) and a lot (in the mind of the market) by the advent of LLMs as the primary user interface to the open Internet. Right now you pay $x per month to use ChatGPT, Gemini etc; you don’t see any ads. You pay $0 per month for Google; there’s a lot of ads. Like that.

The more that the walled-garden players automate ad placement - Amazon is doing this increasingly within its Prime environment - and the more that LLM front ends consider doing this in their screen real estate - the worse life gets for TTD. The company is using AI tools itself to improve CPM and other metrics for its customers, with some success it seems, but that’s an incremental strategy not something that can overcome any fundamental change in Internet usage.

What will save TTD? Entropy. Chaos. The dissolution of monopolistic Internet front-end strategies. Fortunately, tech is pretty good at chaos. Whilst the goal of each individual tech company is to become a temporary monopoly in some valuable niche or broad play, such positioning tends to not last, because the monopoly rents that accrue usually attract competition offering something 10x better for 10x less (in the mind of the VC backing it) or a bit better for a bit less (in reality).

Anyway. The stock is at a technically pretty interesting place and I suspect it can do alright in the coming months.

Let’s take a deeper look.

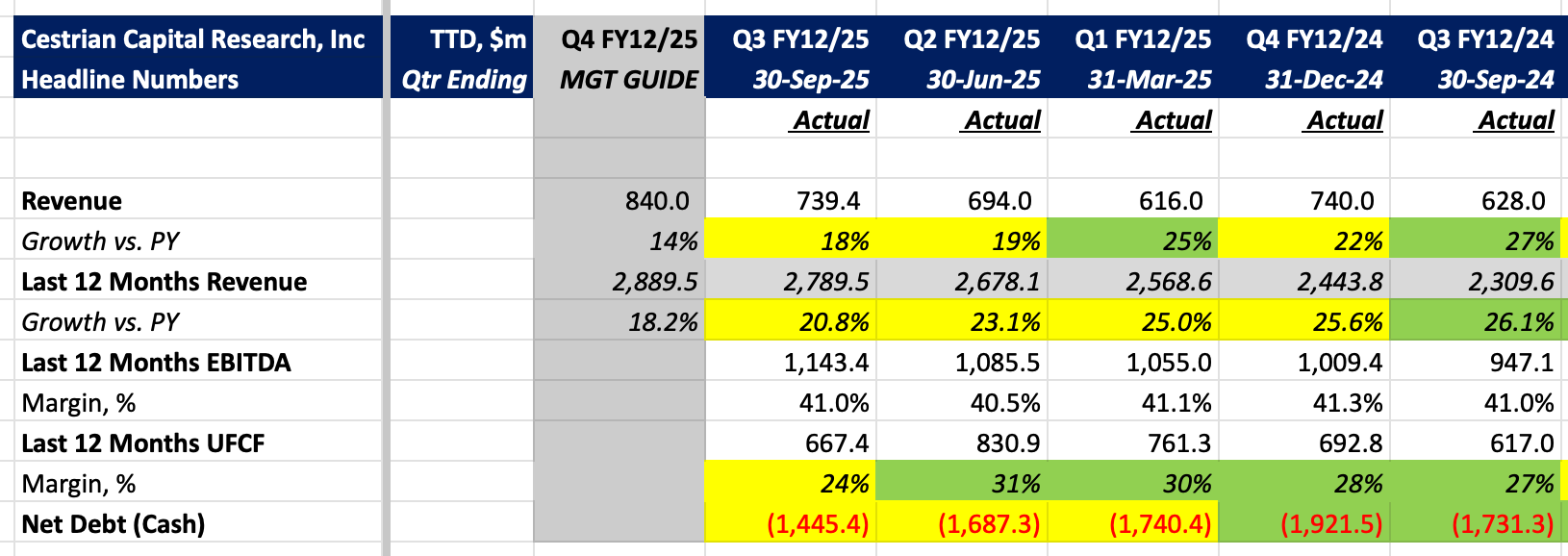

Summary Numbers

Next - the stock chart, valuation analysis, our rating and price projections.