Intel Corporation (INTC) Q4 FY12/25 Earnings Review (NO PAYWALL).

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Pay It Forward Please!

This note is free, no paywall or other requirement to read it. If you like it, please share it everywhere you can think of and ask folks to sign up to get more of our free stuff.

Now, onto the recovering hobo from Santa Clara.

It Was A Good Day

by Alex King, CEO, Cestrian Capital Research, Inc.

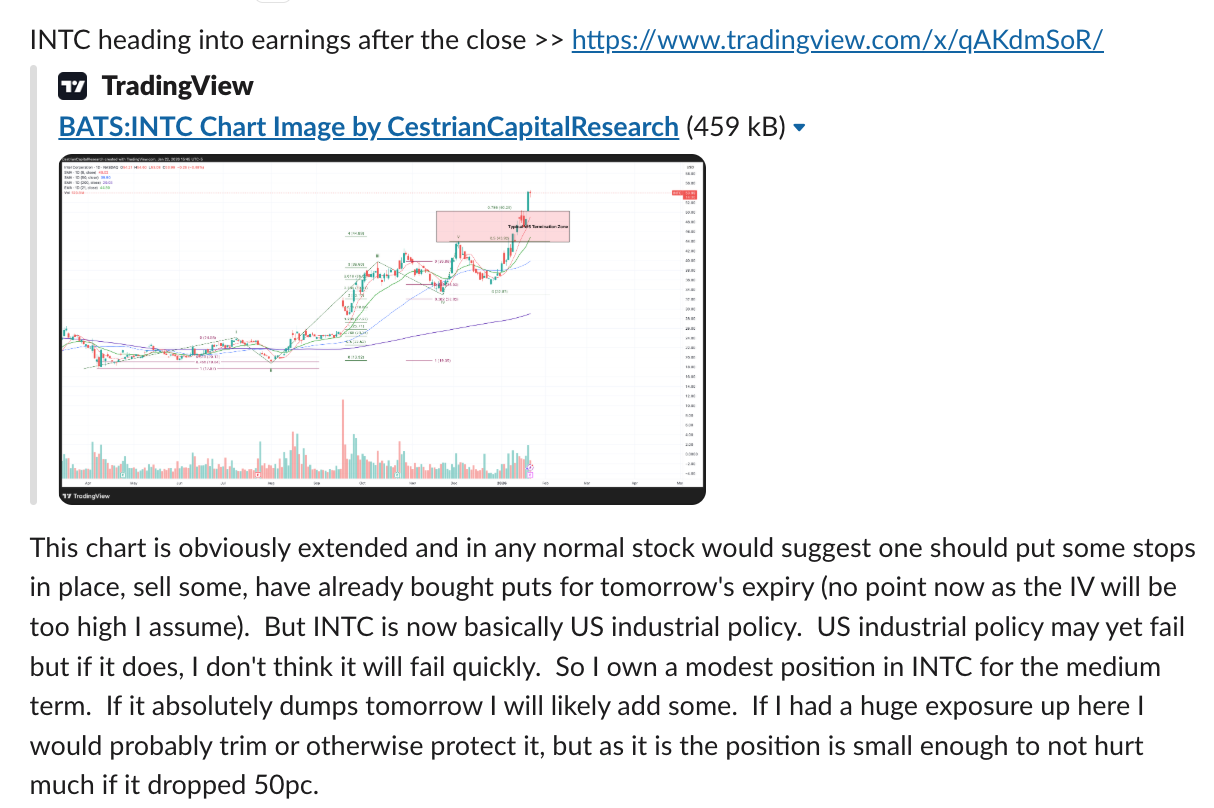

Intel stock was running hot into earnings, as we flagged in our Inner Circle chat yesterday and again today before the close.

The stock got smacked to the tune of about 12% after the print and the earnings call, which was so bad that it is back to the price it was …. yesterday.

I think the turnaround at Intel is going as well as could be expected of this Leviathan. There are positive noises coming out about the 18A fab and its advanced process abilities (underside power routing for one). They are winning some share from TSMC here and there - from AAPL for example. And of course the whole thing has a carrier wave being US industrial policy, which has enormous might behind it so that if it fails, it won’t be for want of money or effort. This is all a great context in which to own the stock.

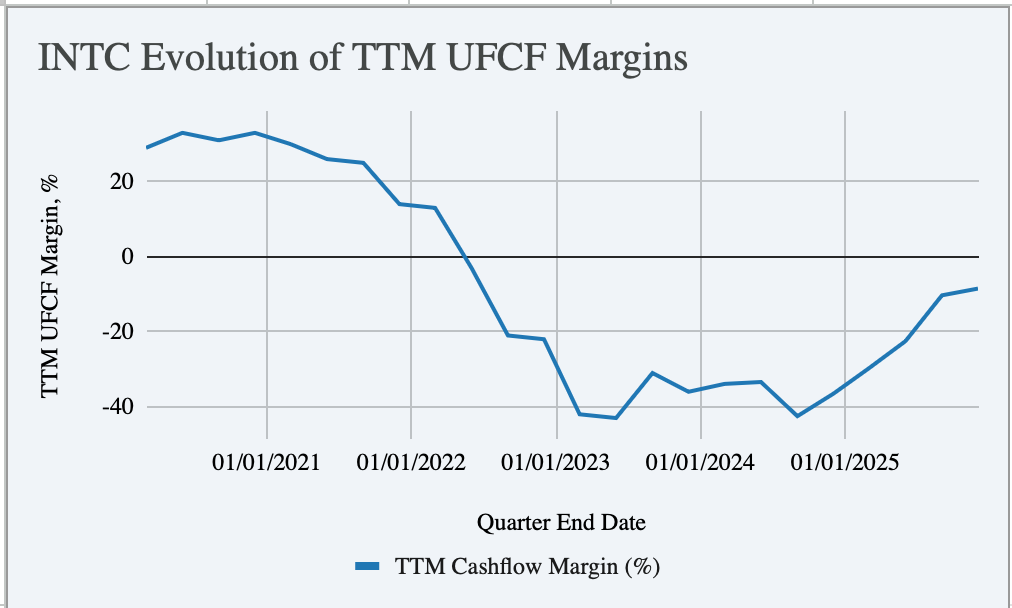

TTM unlevered pretax cashflow margins tell the story. Here’s peak (Q1 2020) to trough (Q3 2024) and now climbing towards breakeven.

That's what good looks like in turnarounds folks.

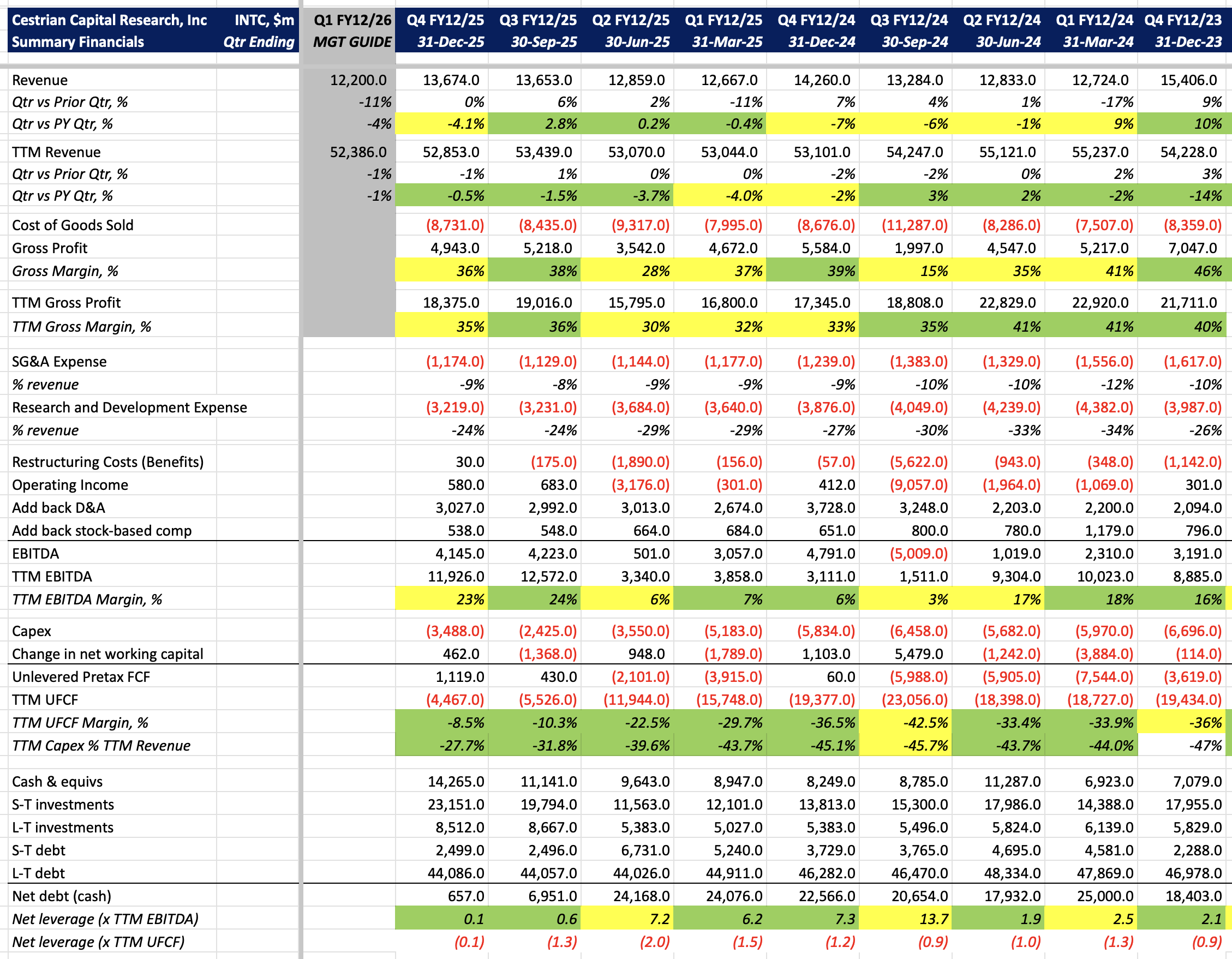

Here’s the full set of numbers.

TTM revenue growth is almost back to flat now (was -4% at the lows) and net leverage is just 0.1x TTM EBITDA (was 13.7x at the trough!). The company is very nearly in a net cash position.

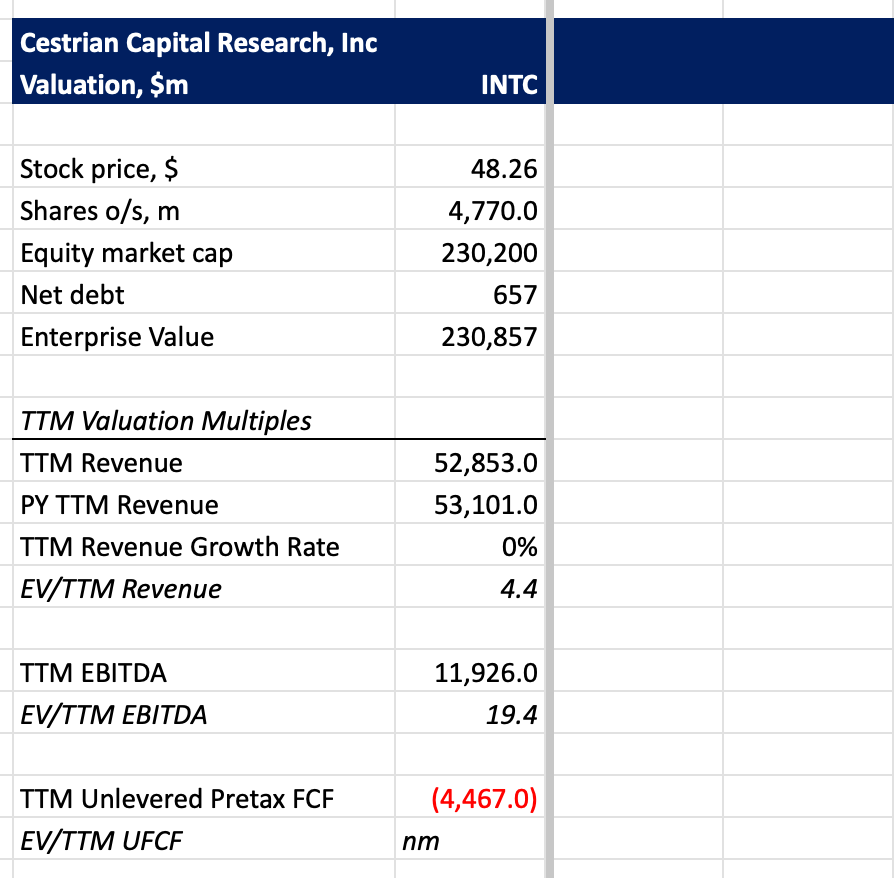

Valuation is a little punchy but as EBITDA and cashflow should grow nicely over the next 1-2 years, that should become more attractive in time.

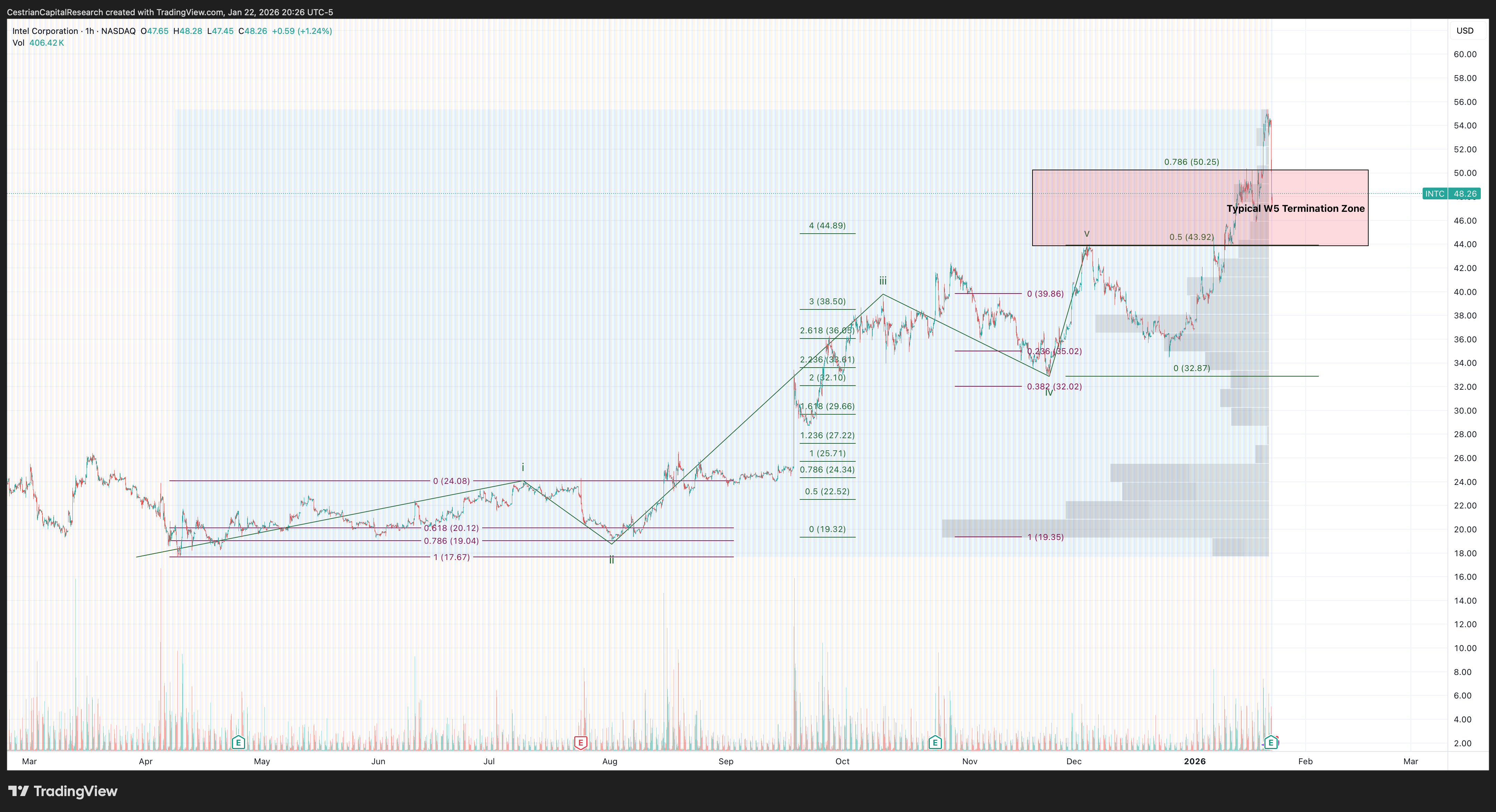

The stock chart remains extended. This one is on the hourly to show the drop after hours today. You can open a full page version, here.

We rate at Hold, because I think the name can go much higher in the coming years. As regards buying dips, personally I would wait to see where the stock closes tomorrow (Friday) - that’s when you have all the information about how large investors consider earnings vs. the long term outlook.

I remain long $INTC personally; I am thinking of adding but yet to do so. As always I will post a trade disclosure alert to our Inner Circle members before any such trade.

Thanks for reading our work - and don’t forget to share this note!

Cestrian Capital Research, Inc - 22 January 2026.