Invivyd - Company Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

A Look Back At Q2 FY12/25 Earnings

by Nathan Brinkman.

“Vaccines can only take us so far. Antibodies are the natural next step. More protection. Less vaccine.” - Invivyd homepage.

Invivyd is a biotechnology company focused on developing antibody-based alternatives to traditional vaccines. The company has built a proprietary platform designed to rapidly create, adapt, and optimize antibodies to increase neutralization capabilities against evolving viral targets.

Currently, Invivyd markets PEMGARDA, an EUA-approved monoclonal antibody for COVID-19. While it offers strong neutralization activity, it lacks patient convenience features such as intramuscular administration, which limits its adoption as a true vaccine alternative.

VYD2311 represents a more advanced iteration of Invivyd’s technology, combining high neutralization capacity, high-concentration formulation, intramuscular delivery, and an extended half-life of approximately 2.5 months. Given recent CDC recommendations for frequent COVID-19 boosters in immunocompromised populations, a long-acting antibody providing sustained protection could present a commercially attractive alternative. Clinical studies suggest monoclonal antibodies may reduce the risk of symptomatic infection by 71–94%, compared to the relatively modest 36% hospitalization reduction seen with vaccines in immunocompromised patients (and yes, I'm assuming you're also symptomatic, if you’re going into the hospital).

The VYD2311 “Declaration” and “Liberty” clinical trials are expected to kick off during the 25/26 “sick season” with the potential first clinical read in sometime mid-2026. The Liberty study will explore the safety and tolerability of a VYD2311 co-administration with mRNA-based Covid vaccines to confirm tolerability of the antibody over vaccines. Depending on the initial data, Invivyd expects a follow up study examining the long-term protection profile and potential use in other populations (i.e. infants).

Looking forward, Invivyd wishes to leverage a direct-to-consumer model similar to Hims/Hers — offering flexible, appointment-style prophylaxis options for discretionary use occasions such as travel or events.

High Level Evaluation

Pipeline

- 1 - EUA product (PEMGARDA)

- 1 - Entering phase 3 (VYD2311)

- RSV and Measles in pre-clinical phases.

Market Potential

COVID-19 vaccines generated roughly $3B in U.S. revenue in 2024. With about 6.6% of the population immunocompromised and antibody therapies generally priced 2–5x above vaccines, Invivyd’s COVID-focused pipeline could realistically target $400M–$1B in annual revenue. Broader population adoption and cross-virus expansion could widen that range

Partnerships / IP

No big name partnerships, no approved patents found (only applications). Portions of the platform licensed from Adimab. However, if patent approval aligns with product approval, there will be lengthy exclusivity. Currently, there is little to no competition in the Covid-19 monoclonal antibody space.

Funding

As of their June 30, 2025 financials, Invivyd had an estimated 6–7 months of cash remaining. A $57.5M equity offering completed on August 22, 2025 extends its runway to roughly 1.5 years at current burn rates, likely sufficient to fund the VYD2311 clinical trial.

Regulatory Position

Invivyd has limited regulatory experience and no approved products outside its EUA authorization. Lack of prior BLA/FDA success and absence of orphan or fast-track designations could make future approvals more challenging

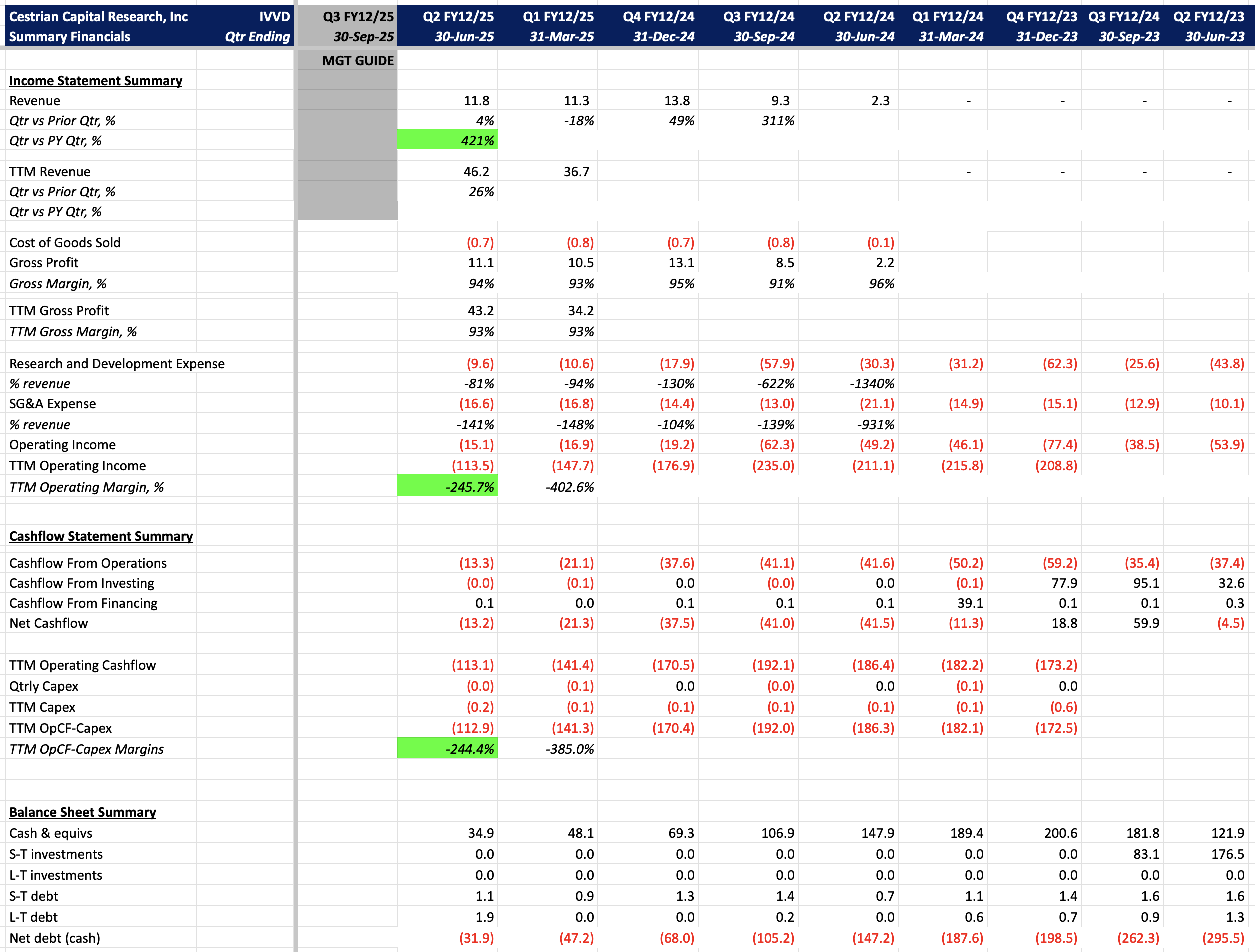

Financials

Increasing TTM revenue and margin. At the time of this print, it only appeared that there was only enough cash on hand to carry the company for another 6-7 months, without covering the cost of the upcoming clinical trial. However, Ivivyd reported a public stock offering of $57.5m on August 22, 2025, which may likely cover this cost or provide sufficient funding to maintain the business at current spending for 1.5 years (including cash on hand).

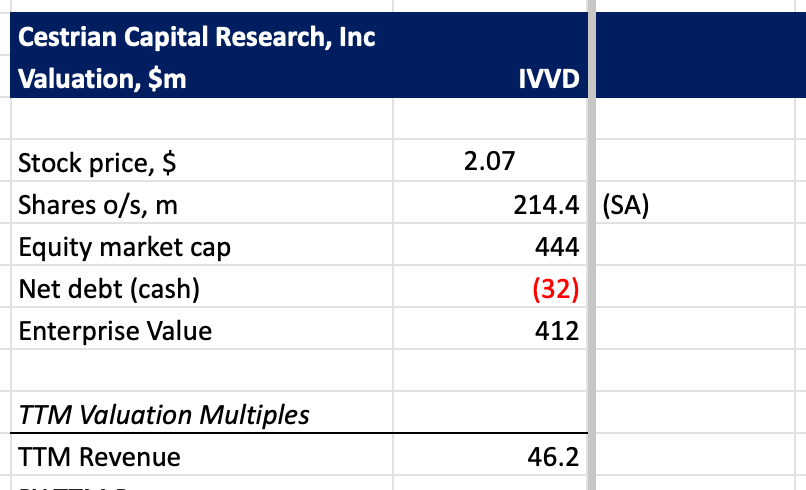

Valuation

As of 10/21/2025, currently trading at 9.3x EV/TTM Revenue, which is slightly above the industry average of 5.5-7x (not a peer comparison). This reflects optimism about VYD2311’s prospects, given the recent news on FDA acceptance of their trial program.

Chart

Typical startup pattern. Since 2023, most trading volume has centered between $0.75 and $1.25, consistent with early-stage biotech trading patterns. Recent gains suggest short-term overvaluation following positive news.

Conclusion

I would rank IVVD low on market potential (right now only Covid-19) and low on their regulatory position. Although they have EUA on PEMGARDA, without much proven regulatory experience in approvals and trial design, approval of VYD2311 could be a lengthier process than anticipated or risk failure due to inadequate design.

Given its current valuation premium and early-stage pipeline, IVVD remains a speculative play best suited for investors willing to trade on upcoming clinical and regulatory catalysts rather than near-term fundamentals. If the recent post-news price pump wears off, I may enter at $<1.25 expecting some positive future clinical trial news in mid-2026.

Nathan Brinkman, 21 October 2025

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long position(s) in IVVD.