Is Ether Heading To $6500?

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Wall Street’s Digital Twinning Continues

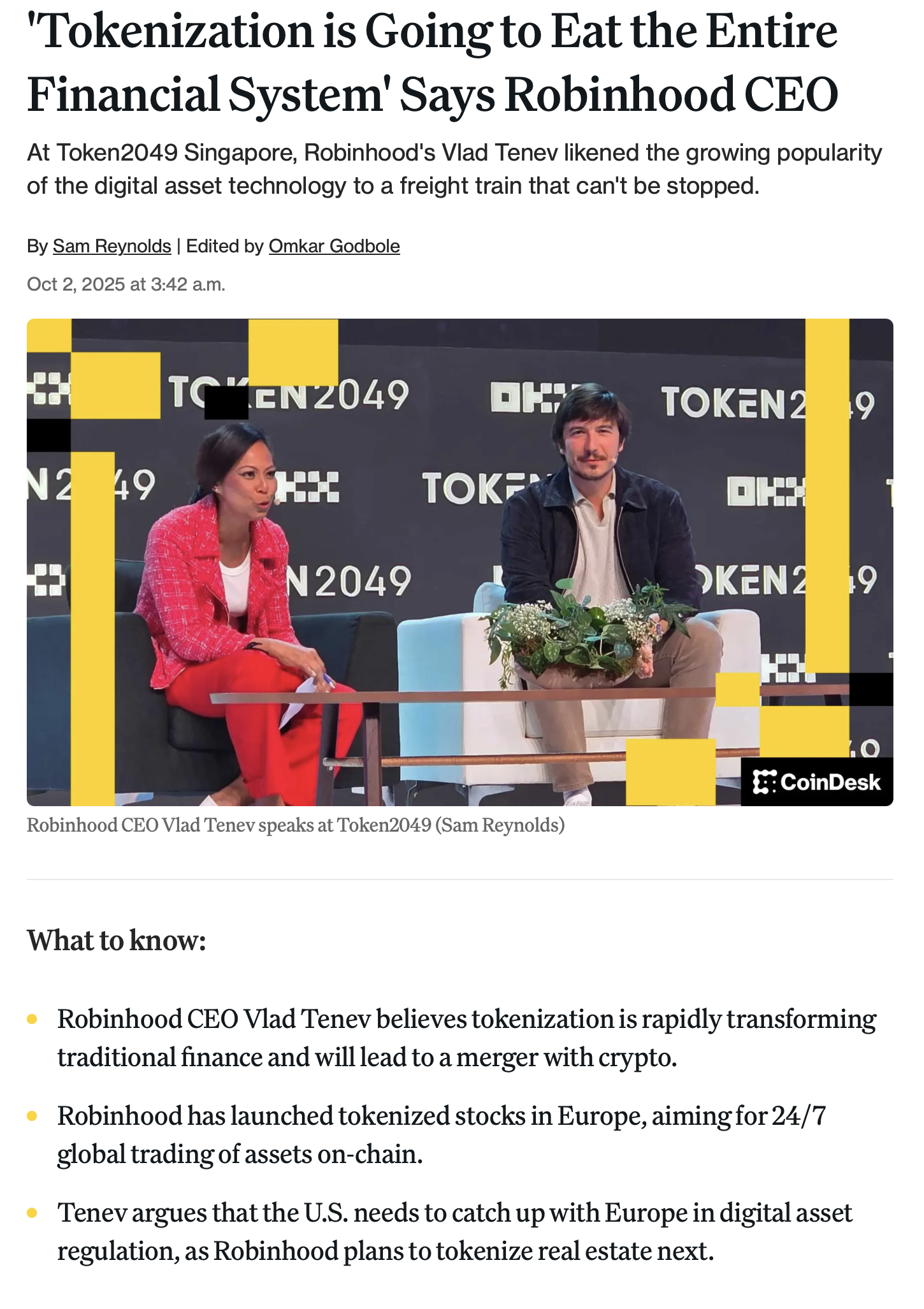

The adoption of tokenized assets - meaning the digitized representation of all manner of assets from buildings to stocks to art and beyond - continues. This is great news for asset managers, asset owners, brokers, everyone in the plumbing that embraces this move - because tokenization is in pursuit of one simple goal, new pools of liquidity. Where new pools of liquidity are found and accessed, fees will surely follow.

I believe the other logic behind tokenization is to end-run around regulations of various kinds; regulation as you know always lags the here and now of financial services. Tokenized stocks in Europe means, I suspect, a way to run around those pesky MIFID II and other consumer protection rules. We’ll see if I’m right about this or not, but if you think about the battles fought and won in crypto in the last 3-4 years, in fact crypto fought the law … and crypto won. That will give Robinhood et al the confidence to go again with tokens.

The primary beneficiary of tokenization is Ether; it remains the case that tokenized assets on an institutional scale will be held on the Ethereum blockchain, and if you want to play there, you need to own Ether. This is what lies behind the accumulation strategy underway at Bitmine Immersion ($BMNR), Sharplink Gaming ($SBET), EthZilla ($ETHZ) and others. And it’s what is powering Ether itself moonward.

Here’s Ether’s play for $5.5-6.5k as I see it.

I note the increasing inflows into the BlackRock ETH/USD ETF, $ETHA. It now has some $16bn AUM and is highly liquid. It tracks Ether fairly well.

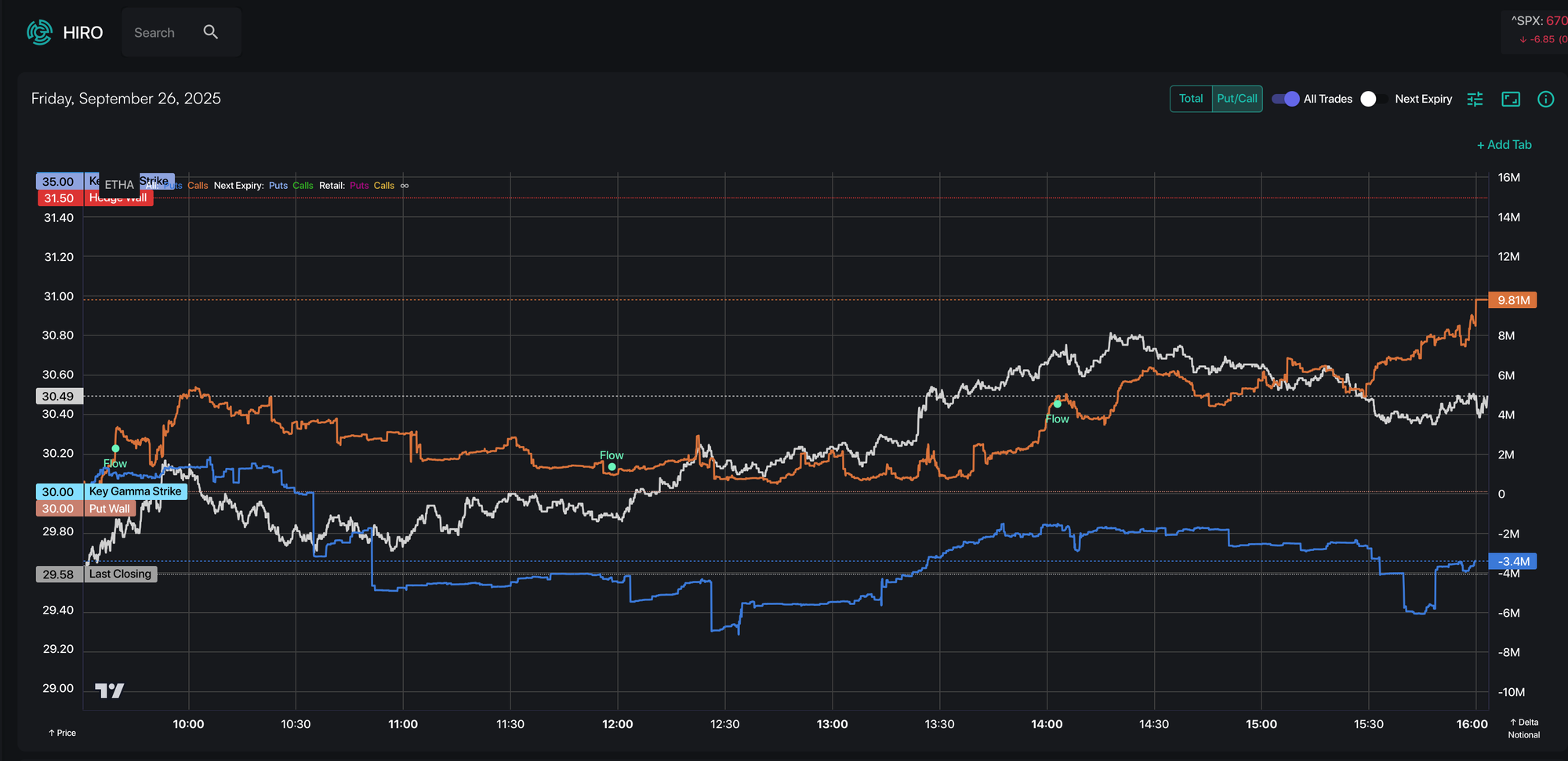

Option volumes are also starting to climb in the Ether ETF and treasury company sector. Here’s a snapshot from SpotGamma’s ‘HIRO’ (Hedging Impact of Real-Time Options) analysis of ETHA last Friday.

You can see the key levels are (i) the Call Wall at $31 (ii) the Put Wall at $30, and the options flow rising (implying options trades were likely dragging the spot price upwards). Today with ETHA at $33 - up through last Friday’s Call Wall as the options flow suggested could happen - it is worthwhile adopting this Big Money lens on Ether trading. Options and hedging analysis isn’t perfect but it brings another lens to the question of where price will move next.

If you’ve yet to use SpotGamma tools, you can sign up for their services here. Use coupon code CESTRIAN50 at checkout for a 50% discounted first month.

In our next Big Money Crypto post we’ll dig deeper into the Ether Treasury Companies. Look for that note later today.

Cestrian Capital Research, Inc - 2 October 2025.

DISCLOSURES: Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, $ETHA, $ETHE, $BMNR, $SBET, $ETHZ. Cestrian Capital Research, Inc is an affiliate partner of SpotGamma - if you sign up for a paid subscription to SpotGamma, we may receive a referral payment.