Market On Open, Friday 12 December

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

FOMC In The Rear View. Now What?

by Alex King, CEO, Cestrian Capital Research, Inc

I think we can declare the market-maker wrecking ball smorgasbord of pain mostly over now. If you were unhedged levered long or unhedged levered short or overexposed or chased or did pretty much anything other than nothing with your investments in recent days, chances are that Ken Griffin punched you in the teeth. If you managed to grab some short term profits here and there, kudos to you. Personally I subscribed to the Let-Ken-Be-Ken theory of FOMC and let the volatility wash over me.

So let’s check in on where we stand before Friday’s open. We’ll post another note after the close today just to round off the week.

17 Days Left Of Half-Price Commodity Algo Signals

Anyone with the foresight to join our Commodity Algo Signals service when it launched last month has had the opportunity to enjoy a tremendous run in silver prices whilst also avoiding the chop-and-drop in oil, all using highly liquid ETFs and simple once-per-day trade signals generated by our machine learning algos.

On 1 Jan, launch pricing comes to an end. Right now independent investors pay just $1999/yr or $249/mo to join - that doubles on 1 Jan. To join up whilst you can still grab this low launch price, go here.

US 10-Year Yield

With the planned rate cuts and stated liquidity provision, the 10yr yield “should” fall further from here. “Should” never made anyone any money however so as always we can just track it live.

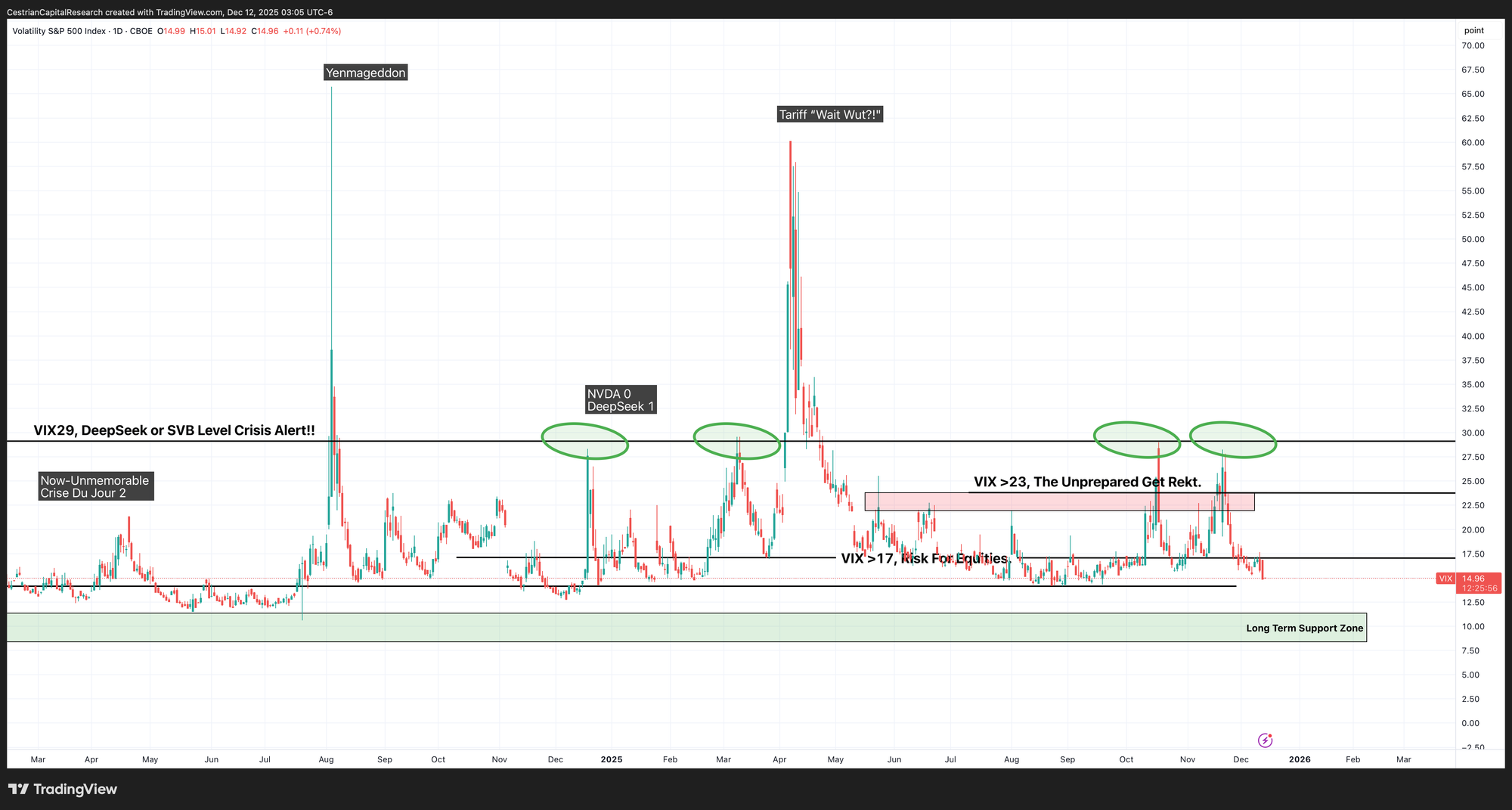

Equity Volatility

Quite a surprising - to me at least - volatility crush yesterday as the Vix dropped materially. With a dovish FOMC this is to be expected I suppose. Right now the Vix is telling you that demand for >30DTE SPX put options is muted, which means the S&P500 is free to make a bull run up into year end. Probably!

Disclosure: No position in any Vix-based securities.

Now let’s talk about the S&P500, the Nasdaq, the Dow, bonds, gold, oil, crypto, and key sectors.