Market On Open, Monday 19 January

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Martin Luther King Day Issue

by Alex King, CEO, Cestrian Capital Research, Inc.

It’s MLK Day today, so, equity and bond markets are closed; futures markets have been open albeit with modest volume. I’ve used some futures charts below so we can get a read on how the market has digested the weekend’s events so far.

Absent yet another sales pitch from me I want to post this that cropped up on X last week. You see me say often “you can’t trade the news, there is no edge in the news”. You can ignore me if you like. But I wouldn’t ignore Renaissance Technologies, the greatest money manager there has ever been.

As a public securities investor and trader, my journey has been:

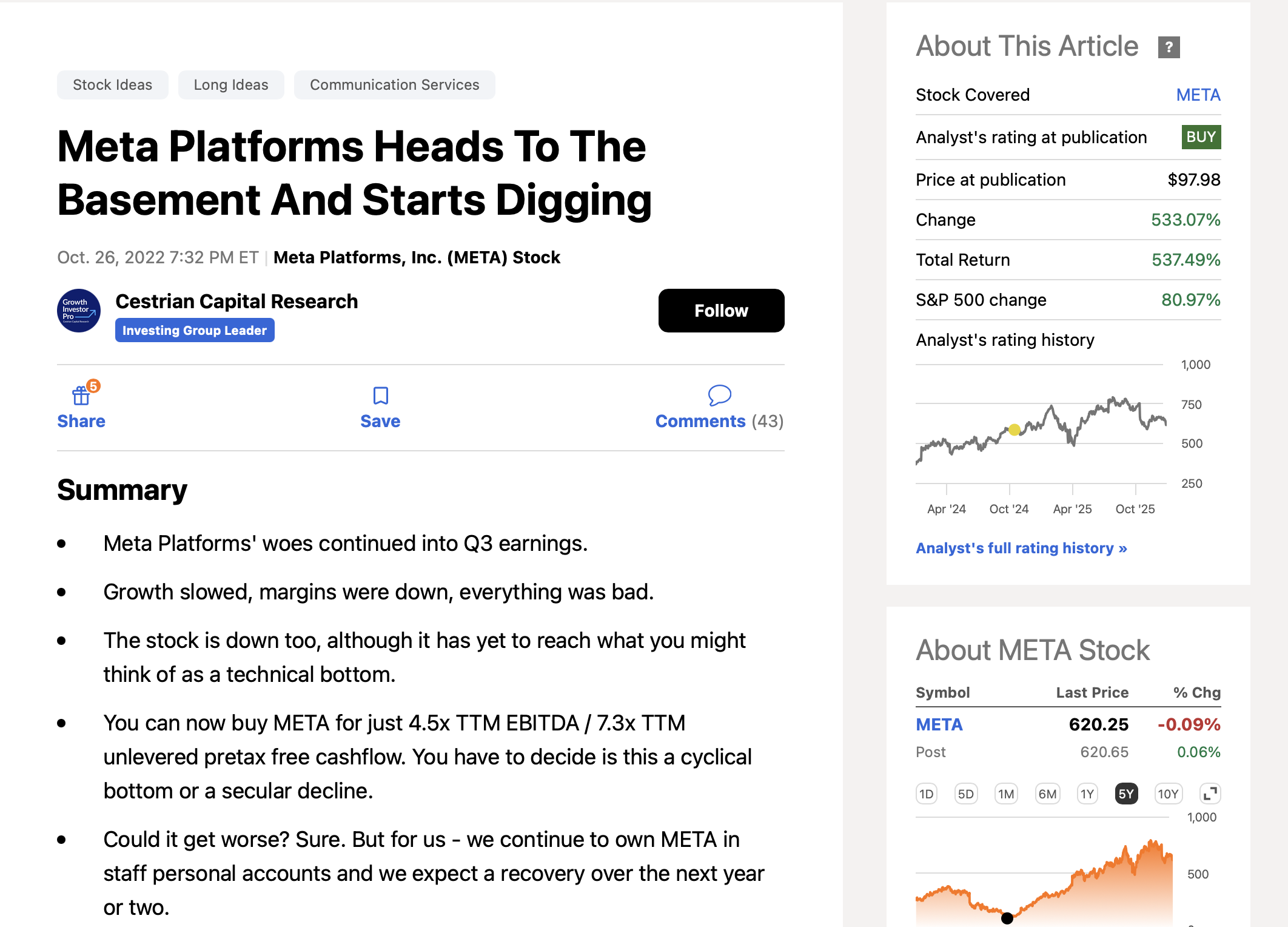

Purely fundamental analysis - identify high quality companies using detailed financials, identify buy and sell points using valuation multiples. This is a good bedrock; it means you always know what you own, it helps you avoid obviously bad businesses, and it can give you screamingly good entry points when everyone has abandoned high quality names - like $META in late 2022 which was trading at around 7x trailing twelve months’ cashflow. We published this note on Seeking Alpha in October 2022. It was quite a good call.

Then Fundamentals + Technicals. I found that the missing part from fundamentals was knowing when to sell and how to really time a dip-buy correctly. Technical analysis isn’t voodoo and it isn’t really that complicated, though its practitioners like to dress it up as something that non-soothsayers cannot do (the better to sell Substacks!). It’s just a way of looking at when is Big Money selling (ergo one should probably sell) and when is Big Money buying (ergo one should probably buy). Chart jockeys tend to ignore critical overlays like the volume x price and Wyckoff Rotation schema that we use - that’s what adds weight to understanding price pivots.

And now Fundamentals + Technicals + Algorithms. As you know, because I never stop banging the drum (why would I? they’re cheap, and so far, they work great), we provide a library of algorithmic signal services covering equities, bonds, commodities, crypto and more. I use them each and every day and I’m in my third decade of money management. Why? Because they are emotionless. Fundamentals are facts; no emotion there. Valuation triggers (cheap, buy; expensive, sell) are opinion, so emotional. Technical analysis (pattern interpretation) is opinion, so emotional. Algorithms - good ones - are pure numerical analysis, no emotion. In using our SignalFlow Growth and our Crypto Signals services for instance, I have been able to hold onto bull runs in positions for much longer than I ever would have by using only fundamentals and technicals.

Anyway, enough. Now that ultra-cheap distributed computing has made Renaissance-level algorithm power available to all of us, for what is chump change vs. the money you can make with them, I think anyone not using algos is just leaving money on the table for no reason. As I used to!

Let’s get to work.