Market On Open, Thursday 12 February

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Curious Case Of Big Tech

by Alex King, CEO, Cestrian Capital Research, Inc.

Whilst the Dow is, as everyone in the world now knows, at 50,000, Big Tech has been nowhere since October last year. The stocks are rangebound and nobody is excited to own them. The dopamine is in software pureplays (doomed and going to 0 obviously) and memory pureplays (in permanent demand and going to infinity as everyone knows). Your regular ole Google and Amazon and Apple and whatnot? Meh.

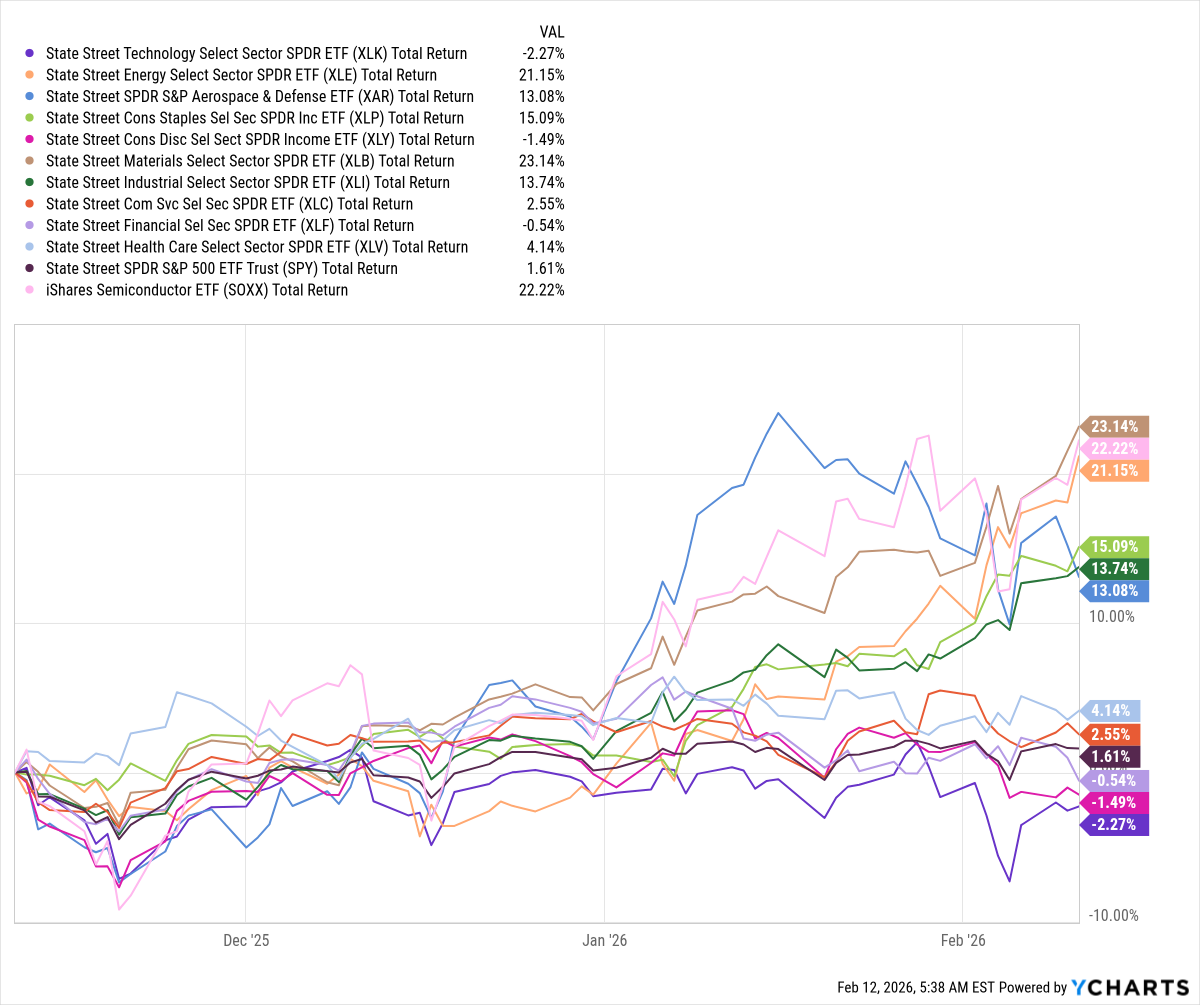

In the last three months, $XLK (the Big Tech element of $SPY) has been the worst-performing sector in the S&P sector ETFs we follow. Whilst energy, $XLE, is up 21%, semiconductor ($SOXX) up 22% and materials ($XLB) up 23%, tech is actually down 2%.

Now this is why sector rotation is such an important part of investing. In this last three months, the S&P itself is up just 1.6% on a total return basis (ie. including dividends). But if you had been in the top three sectors only, you would be up around 22%. By just owning big, liquid, simple, long-only, unlevered, no-options-no-crazy-stuff ETFs.

There are two ways to invest on a sector rotation basis, it seems to me. The first of these is manual analysis. It seems kind of steam-powered but if you watch the relative performance of these sectors over multiple timeframes and you check in on it every day and you are ice-cold inside, have no view about the world beyond that chart, then you can rotate between ETFs yourself. Sector topping out? Start trimming positions with a view to selling it all. Sector bumping along the bottom but showing signs of moving up? Start building up positions with a view to a full allocation before too long. And so on. This can be done, but it is difficult, and most of us aren’t cold enough to disregard our own opinion on when energy tops out or when software stops falling, etc.

If you want to run really ice cold, have a machine do it for you. You keep hearing about AI taking all the jobs and such? Well, sometimes it should do so, and sometimes the smartest thing to do is to use it not oppose it.

Our SignalFlow AI Sector Rotation service does the hard work for you. It chooses the sectors it thinks are in an uptrend, and stays in them for as long as it thinks the uptrend continues. Doesn’t overthink it. Has no worldview. Doesn’t know what HBM memory is. Doesn’t know anything about the Permian. And has done a great job so far as a result. This algo now runs on our latest SignalFlow v3.0 model which is designed to reduce volatility vs. prior models whilst still delivering outperformance vs. $SPY. In a combination of backtesting and live trading, this algo has delivered 18.2% annualized returns over the last 4yrs vs. 12.8% for $SPY. Since 1 January 2025 the algo on this basis the algo is up 27.3% vs. 16.5% for $SPY.

You can learn more here.

Righto. The market. Let’s get right into it. Today’s note is available to Inner Circle members only.