Market On Open, Thursday 18 December

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Timing. It’s All About Timing.

by Alex King, CEO, Cestrian Capital Research, Inc

US CPI reported just now, coming in at the lowest level since 2021’s rate-hike-fever-dream commenced. Risk asset markets are happy right now, but it’s important we all understand why they are happy. Are they happy because the young people can afford more groceries now? So that the next generation have spare cash to invest in long-term productive assets? Maybe that they can take a little time out of their day to learn how to become more productive with AI, for the benefit of all?

Lol no. Markets are happy because the Fed is more likely to reduce rates further, and that means that everyone from your local Master of the Universe to your neighbor’s deluded meme-coin-trading basement-dweller can get their hands on (1) more leverage at (2) lower cost and then use that to go buy more risk assets. Yay!

Now this will resolve one of two ways (and, stop press, increased prudence on the part of investors isn’t one of them). Either the economy is going to maintain solid rates of GDP growth but at a structurally lower rate of inflation - that would be a wonderful thing for most constituents, except for The Internet Doomsayers, or the economy is slowing and that’s why prices are rising less quickly than expected. That would be bad for most constituents apart from, er, the bond market. Also Doomsayers.

It’s too soon to tell which, so in the meantime we can probably expect high-beta risk assets to keep on chugging the moonshine they discovered in the back of the drinks cabinet earlier this morning. If the economy is slowing in a material way, anyone high on Uncle Brian’s World Famous Poteen (alcohol %: no-one knows, and it melted the last equipment anyone used to try to test it) is going to get the mother of all methyl headaches next year. But if we do have an everything-good-here-move-along set of numbers in 2026, at sub 3% CPI, well, then this bull is going to run long.

For now we can just check in on the charts and use price and volume to tell us the story.

Want To Collect Cash The Easy Way?

I’m delighted to announce we now have more appeal to sober types. If your goal in investing is to grow your pile carefully, to avoid major drawdowns, to soak up the good dividends, and maybe add a little of those nice income stocks at the lows and trim them at the highs, we have just launched a wonderful offering for you.

Mark Bloom has been a contributing analyst of ours for many years, focusing on income stocks this whole time. With the rising level of interest (that’s a securities markets joke) in the income sector I’m thrilled that Mark has decided to launch Convivo Income Opportunities, a pureplay research service for income-driven stocks and ETFs.

Like every single one of our analysts, myself included, Mark did not grow up in public securities markets and as a result thinks differently - specifically he thinks as a principal investor. Members of Convivo Income Opportunities will benefit from this perspective I think - no hot-money high-octane option plays, just rock-solid analysis and real-money investing, with a view to the medium and long term.

You can learn more here. I hope you choose to join up. We have a low launch price on offer and I think this service will find great success.

US 10-Year Yield

That Wave 1 down is continuing.

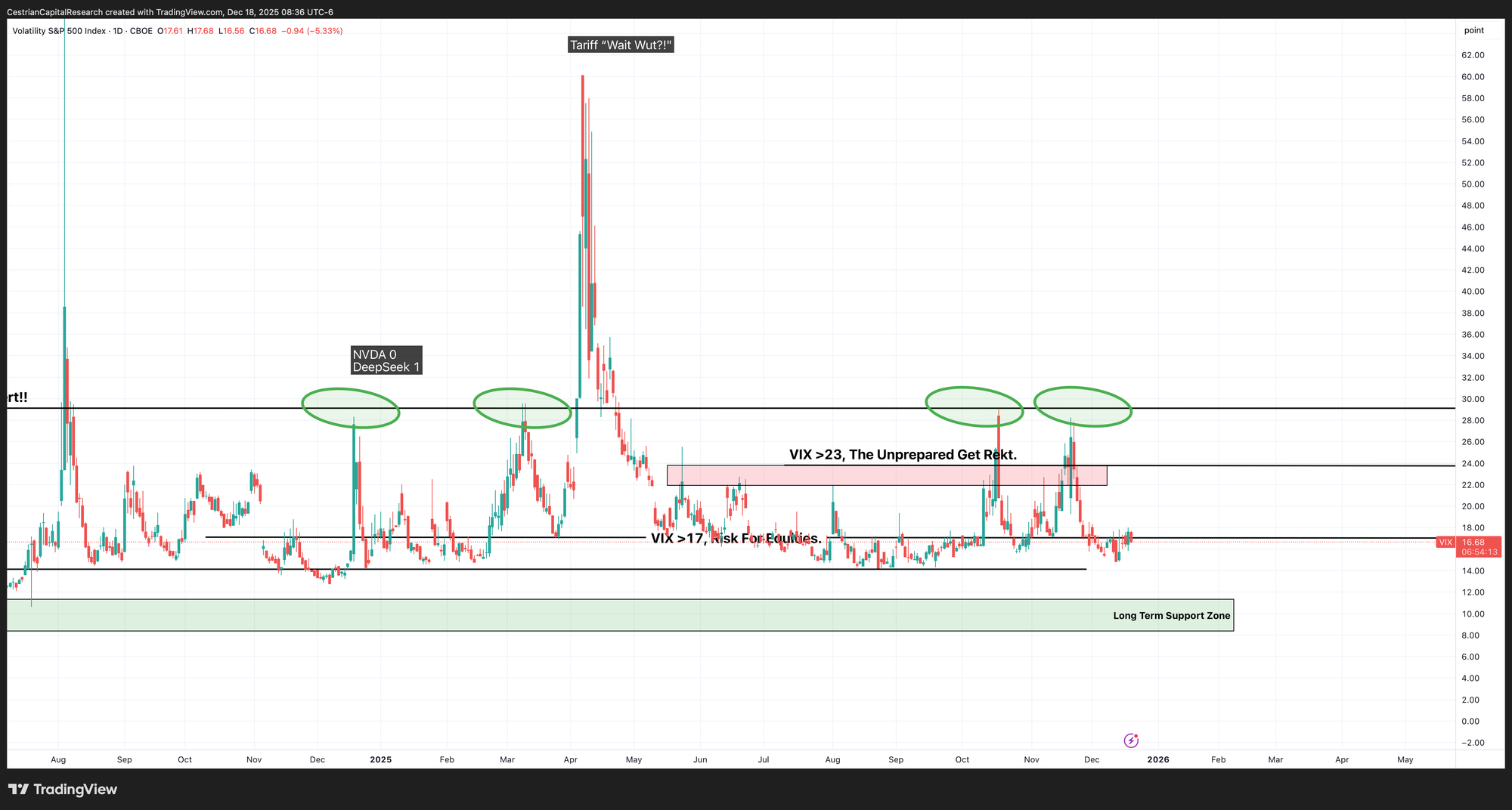

Equity Volatility

Back down below the 17 level. Bullish for equities.

Disclosure: No position in any Vix-based securities.

Now let’s talk about the S&P500, the Nasdaq, the Dow, bonds, gold, oil, crypto, and key sectors.