Market On Open, Thursday 22 January

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Never A Dull Moment

by Alex King, CEO, Cestrian Capital Research, Inc.

Emotion in markets can be your friend, or it can be a wrecking ball.

During the easy-up phases of bull markets, the “I’m A Genius!” phase, you don’t have to do much. Frankly the less you do, usually the better. Own the S&P500, own the Nasdaq, some U.S. government bonds, some cash, maybe pick a stock or two that you like. And don’t tinker with it too much. In years like 2023 and 2024, that gets you “number go up” without much cognitive load.

During the tricker parts of the bull, which is I think where we are now, what you have to do to keep winning is to change your mindset. If you adopt the fit-and-forget approach there is a good chance you will leave significant amounts of money on the table and even lose money as your “I’m A Genius” methods that worked so well in 2023-4 stop working. Most all human investors suffer from this - when our methods start to produce losers not winners, we assume that we were having an off day, or that we didn’t focus enough on the entry price or the stop loss or something else. We very rarely sit back to think, well, if the system that was making me money has suddenly started costing me money, do I need to change the system? The answer is usually “yes”. This seems to be a problem for human psychology. The theme of “it will work better next time if we apply the rules more perfectly” crops up across many aspects of life. We seem to default to a kind of linear view of history and of the future - what we have now is what we will always have, and all we can do is try to refine it and improve it at the edges.

Here’s a classic from our Inner Circle chat today showing that such errors are universal - they apply even to the Masters of the Universe.

All that tells me is that their system is broken and they need to change it. But try telling a bunch of echo-chamber-residing Analyst God Junior Masters Of This Corner Of The Galaxy Only that they have to raise their game. And wait till you get An-splained as to how you are merely a normie and don’t understand and blah.

Well, one of the things we try to do in our work here at Cestrian is not get hung up on method A, B, C but instead to constantly re-evaluate what is working. Usually this means trying to keep ahead of the pack somewhat. There was a time about five years ago when market participants paid little attention to something called “remaining performance obligation” as reported by subscription software companies. We found an edge there by looking for those names where RPO was large vs. TTM revenue and where RPO growth exceeded TTM revenue growth; that implied potential revenue acceleration in the future. This trick worked, until it didn’t, which is probably because enough other people discovered the trick and thus the edge was arbitraged away. So we stopped treating it as an edge and went looking elsewhere. Basic Elliott Wave analysis worked great for a while until FinX got Elliot Wave religion, whereupon the target levels became danger zones because yon Masters learned to trade against them. Now we mix in some moving averages, some volume profiles and some very special sauce to keep our edge. And infuse the whole thing with some LLM-executed analysis. It’s going well.

At present we are enjoying great success with our algorithmic services - so far they have yet to be hit by any, er, “adverse idiosyncratic moves” - for anyone who wants to reduce their workload by outsourcing it to the machine, these are wonderful services to have. SignalFlow Growth is now up some 73% from 1 January 2025 to date, vs. a little over 16% for the S&P500. And all it does is pick three ETFs every now and then. (Its Ph.D author tells me there is a little more depth to it than that by the way, but as far as the actionable output, nine characters per day is all you have to read).

We are also racking up the innovation and the wins in our flagship Inner Circle service. We continue to add sector coverage and expertise, most recently in biotech, where our published ideas are up across the board, a 70%+ gain in just a few weeks in Moderna for instance. We achieved this with a combination of deep sector expertise coupled with rock-solid fundamental and technical analysis methods. (Editors note: also a generous helping of luck).

Here’s our note from 2 December last year, now published on a no-paywall basis.

I'm proud of what we’ve accomplished and where we’re going in our flagship service. Want our best work? Join us.

Join The Cestrian Inner Circle.

"Over the past three years I have found great value in the Cestrian Inner Circle service. Most importantly, Alex's batting average in his recommendations is way more than enough to pay for the service and make me prosperous. He is also a great communicator. He makes complicated things simple and talks and writes with logic that is easy to follow, whether one is a novice or seasoned investor. And he provides actionable information. While several services cover all the possible outcomes on an issue, with Alex you get a clear and comprehensive perspective along with his recommendations on the most likely outcomes. Last, but not not least, he is most thoughtful in all ways in running his service.” - longtime subscriber, January 2026.

Markets are going to be tricky in 2026. Join our superb Inner Circle service to get our best work, real-time real-money trade disclosure alerts and an incredible, mutually supportive community of traders and investors who actually work together to help us all make more money.

By the way - our chat community has some simple rules which underpin its all-business focus. You won’t find any yelling, stock-shaming or memefoolery here. Nothing wrong with any of those things, I love FinX with the best of them, but here at Inner Circle? We’re here to make money. So our Rules of Chat are:

- Keep it clean, it’s a family show

- Leave your personal politics at the door

- There’s no such thing as a dumb question

These simple rules deliver a chat environment that year after year our members describe as an oasis, a blessed relief from the constant noise elsewhere online.

Anyway, let’s get to work. Today we’ll talk about U.S. government bonds right here before the paywall, because there is a lot of Monday-morning quarterbacking going on as regards this topic.

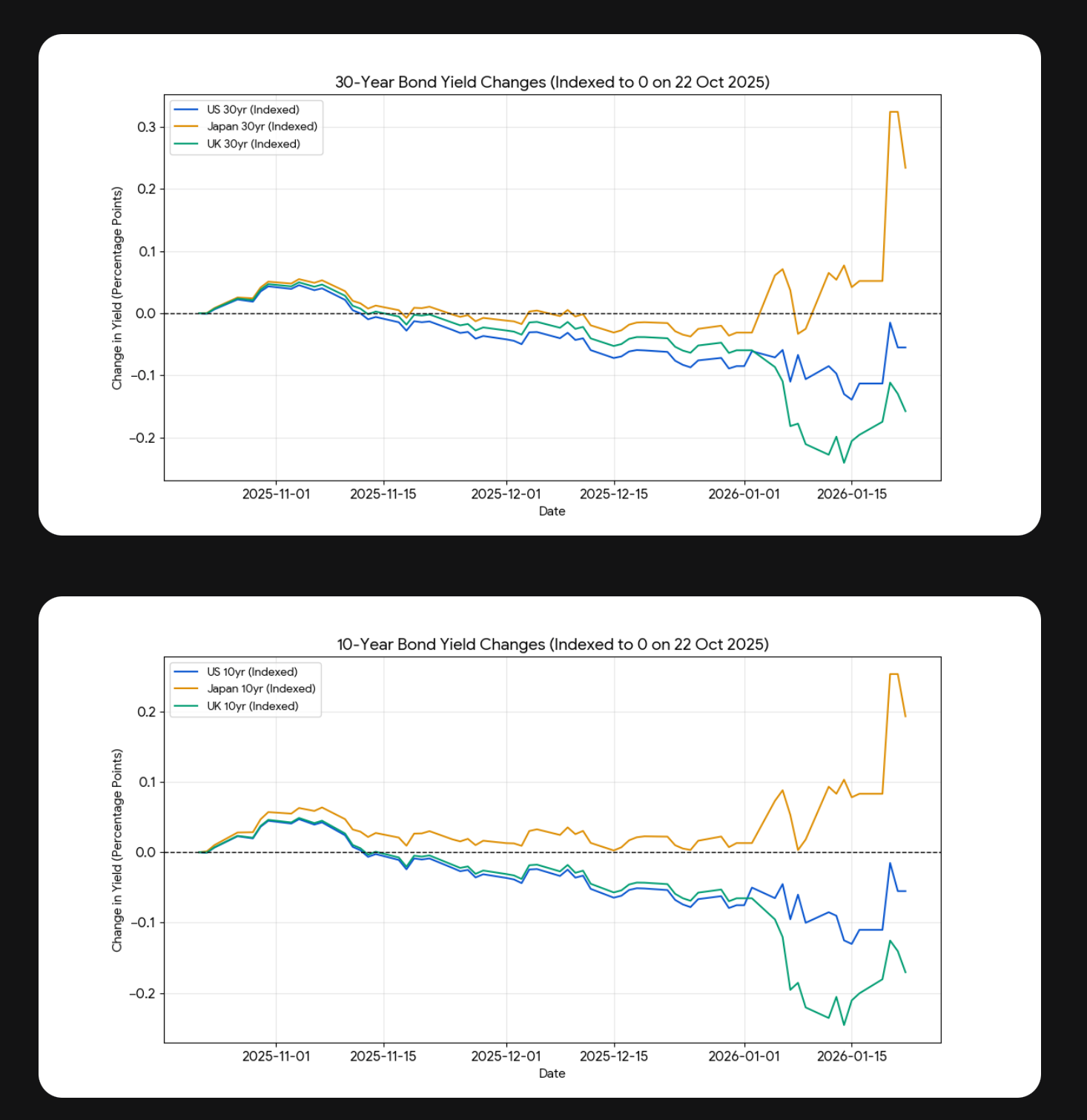

US 10-Year Yield

Continues to move the wrong way vs. the Administration’s intended outcomes.

We can blame Danish pension funds selling U.S. Treasuries if we like, or we can look at Japan.

I think the plain fact is that money is getting more expensive, led by Japan. How the Administration deals with this in order to refinance its debt at lower yields is a very tricky question. We can discuss the “Run It Hot” approach another day.

Now let’s go on to talk about the Vix, the S&P500, the Nasdaq, international equity indices, key sectors, oil and crypto, as we do each and every day for our Inner Circle members.