Market On Open, Thursday 4 December

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Great Flush

by Alex King, CEO, Cestrian Capital Research, Inc

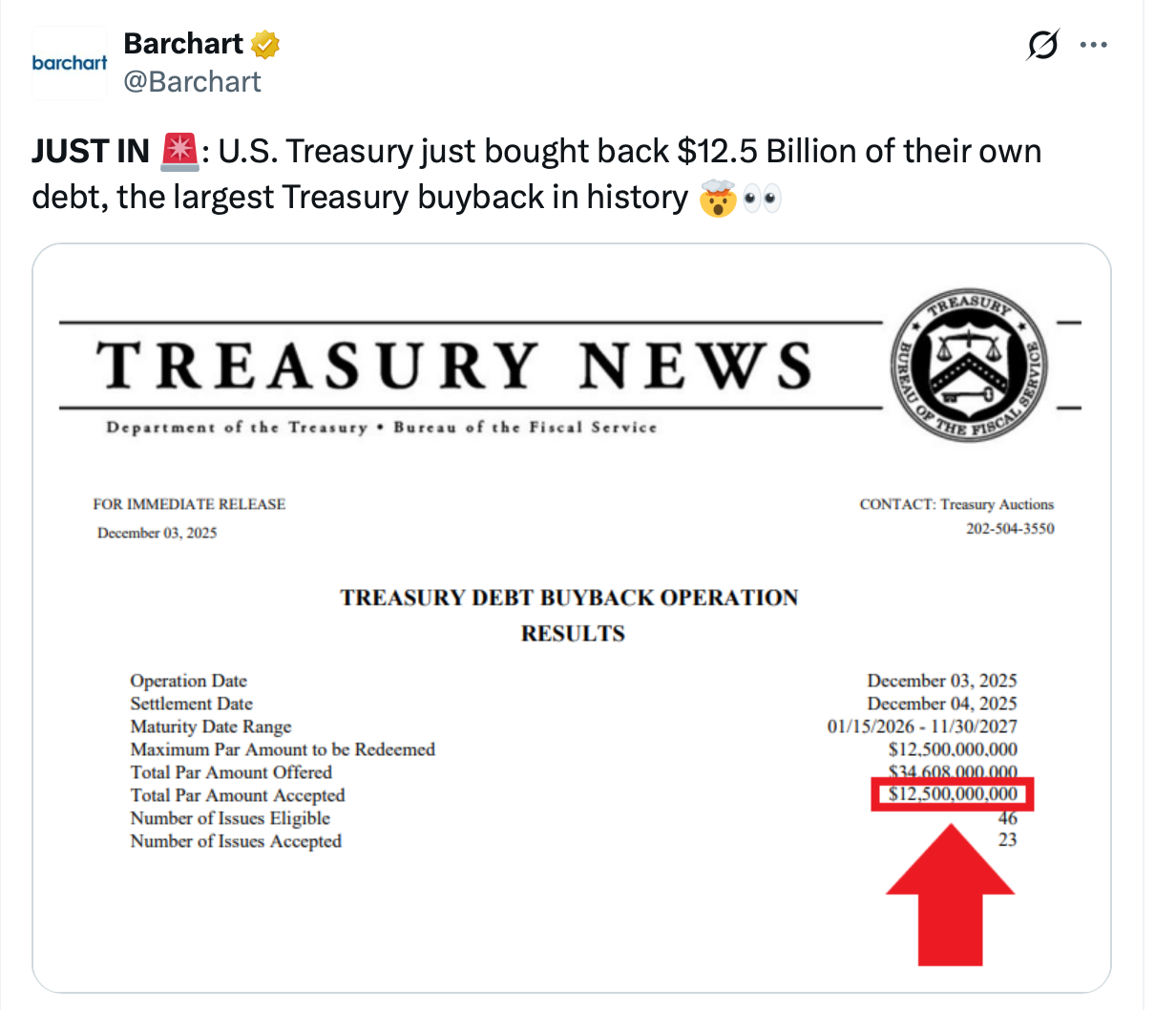

I think we are about to see a sea change in liquidity, both the supply and cost thereof. It seems a done deal that the next Fed chair will be Kevin Hassett, which suggests loose monetary policy. It also seems a done deal that QE-type policies will be adopted, whether by Treasury or the Fed or both.

It's tough to read the real economy right now; whilst a number of official sources of data are unavailable, the proxy data is unclear. ADP payroll numbers look weak; Black Friday spending looks strong; but it is claimed much of that Black Friday spending was financed ie. paid for on the never-never rather than with actual money. If the underlying economy is indeed strong, then one need have no fear for stocks, since the combination of economic strength and monetary stimulus will push prices up far from here for a long time. If the underlying economy is weak and we’re in a last-hurrah phase in equities fueled solely by liquidity, then it’s time to get ready to protect profits and/or cash out. I don’t mean today. I do mean watch the charts we publish here every day and, of course, in Slack Chat for Inner Circle members. We now have our base case (blowoff top then selloff) and bull case (continued march upwards) charts set up and we are very focused on not getting this wrong.

Initially the excess liquidity will, I think, make its way into the riskiest of assets, which is why you see Ether on a tear from its recent lows right now. We show that below in the Crypto section.

So let’s get to work. Bonds, volatility, equities, sectors, crypto, oil … we have it right here for you as always.