Market On Open, Thursday 5 Feb

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Tech 101

by Alex King, CEO, Cestrian Capital Research, Inc.

I say this with the benefit of (i) being old and (ii) having spent almost all my professional life as a technology investor.

This is why tech is always the best asset class to own over the long term: it is the perfection of capitalism, which is to say it is a perpetual deflation and value transfer machine.

Technology development reduces the cost of doing stuff. That means that if you work in an industry that does stuff, you’ll probably be out of a job soon. The money that customers used to pay your company will be diverted to the company that sells the tech that does your stuff now. Customers love it because the tech makes it cheaper to do your stuff. And tech loves it because now tech gets the money and you don’t. Customers happy, tech happy, people who used to sell stuff, not happy.

Since maybe 1860 when tech meant machine lathes and trains and things, this has been happening. You were a weaver, weaving stuff? Sorry, no longer. You drive a premium horse-drawn carriage to take rich people from here to there? Sorry pal, the workhouse is thataway. You sell phone calls at $4/minute? Not any more you don’t! You run a beautiful department store offering an immersive customer experience amongst the finest of … buddy you haven’t paid your lease in a year now.

Software, as Mr. Andreesen said in 2012, is eating the world. Has been for decades. And now, in a just wonderful twist, software is now eating …. software? This is karmic revenge of the highest order. Those software developers and sales execs whooping it up with the fancy car paid for with stock-based comp, and the Presidents’ Club Mai-Tais? Hooboy. Now they’re looking over their shoulders, I can tell you. If you’ve ever worked at Acme Megacorp during multiple rounds of layoffs, hoping to dodge the call to the 5th floor (in yesteryear) or the WhatsApp message followed by your meager belongings delivered to your door by an UberEats (the contemporary experience), then you will know the wonderful moment when, at the end of the layoff process during which HR have been patrolling the corridors like the Power Behind The Throne That They Secretly Believe Themselves To Be, that call to the 5th floor / WhatsApp is routed to … the HR team. Who are promptly laid off on account of there being less Human Resources to glare at all day long with a faux-knowing look (the actual function of the HR people). Never is anyone more shocked than the VP of HR when it turns out they are not in fact the God in the Corporate Machine but merely a message-taker. And this is what life is like in enterprise software right now. If you work in enterprise software, will you survive? Maybe. Is there any way to tell? No. Who came for you? Other software people, that’s who. Your own brethren. Et Tu, Brute [force attack]!

Here’s what panic looks like amongst the software people. This is $IGV, a software ETF. You can open a full page version of this chart, here.

That is a chart which is either going straight to the Gates Of Hell (a stop-loss a little below the Liberation Day lows will save your soul in that event) or it is going to see a big ole short squeeze which will deliver some nice upside for a short time. Look at the volume x price spiking down here at the lows (and plenty of funds have been short IGV or its constituents for a while now - they have nice gains to bank by buying back). I would not try to be a hero in either direction here, but the stop is very close at hand and there may be more juice in the bounce than is usual. Because, dare I say it … not all of software has been eaten, yet. And it is just possible that some of these Masters of the Universe who have been short software coming into Q1 … maybe they have had some influence on the fearmongering rolling down the 295 right now.

Anyway that’s it for software from me for now.

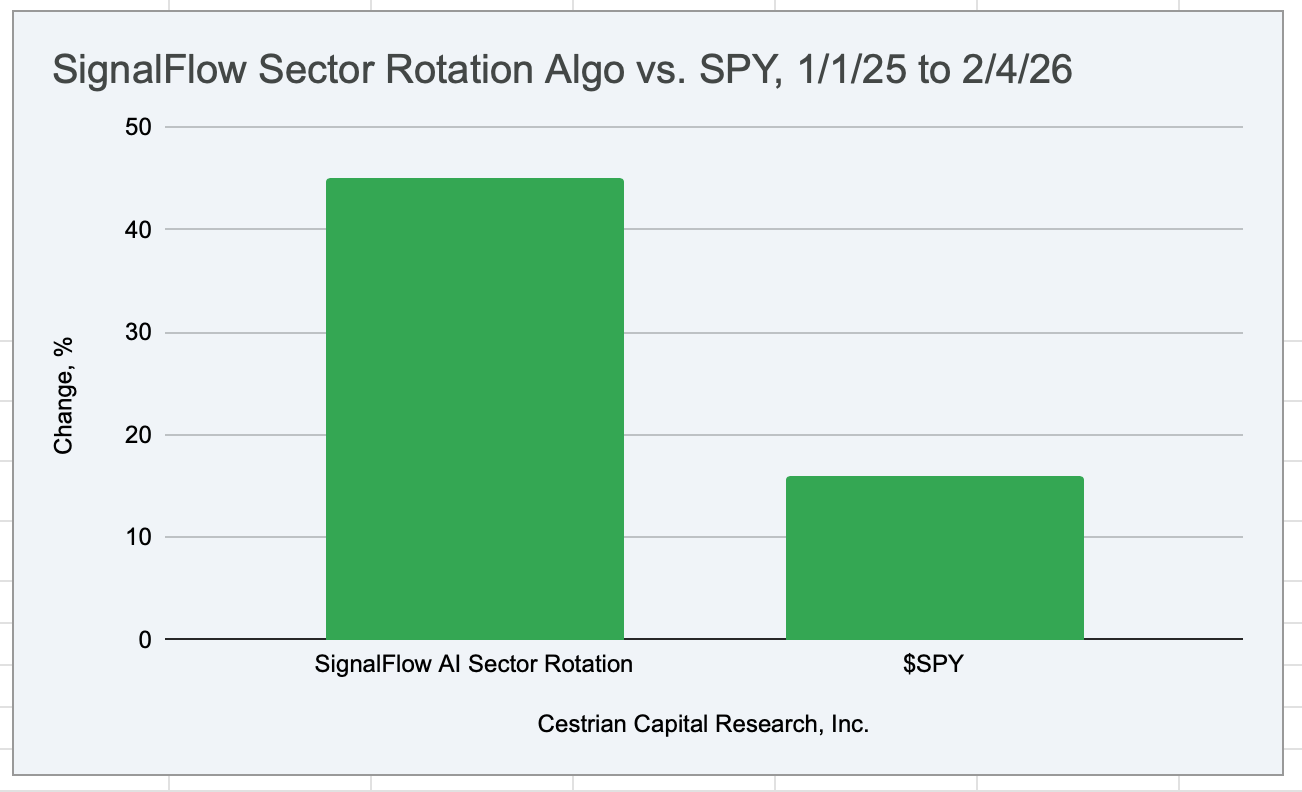

Want to know how you could have avoided this whole self-debasement frenzy in tech? You could have already rotated out of software last year, that’s how. Know how you could have done this? You could have been a subscriber to our SignalFlow Sector Rotation service, which uses, yes, AI, to work out what’s hot and what’s not. It helps you use simple sector ETFs to ride the good waves and miss the wipeouts. No options, no leverage, nothing inverse, nothing weird. Just simple sector ETFs. Despite which it did this already:

Learn more here:

Now let’s get to work. Today’s note is available to our Inner Circle members only.