Market On Open, Thursday 7 August

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Trade The Market In Front Of You, Not The Market In Your Head.

by Alex King, CEO, Cestrian Capital Research, Inc

This remains one of my favorite tweets of all time, though probably not for the reasons the tweeter would imagine. Posted during the depths of the Covid crisis, it absolutely nailed the modern economy in one snappy quip.

I don’t think even AOC knows how good this was. And nothing has changed. Nothing will change. We’re on an accelerated path to further division between the asset economy and the labor economy. If you own assets and you manage them well, kudos, you’re all set. If you sell your labor for a a living, I have news for you, it’s not going to get any better. What can you do about it? Get some assets. Start with a lemonade stand if you have to. Think I’m joking? I’m not joking. Then grow those assets.

I know of no easier way to grow assets than to learn to trade and invest. If you learn how to do it right - which anyone moderately numerate can do - then it is akin to alchemy, the creation of money from money. You can start with the day’s takings from that lemonade stand. And then make like Forrest Gump.

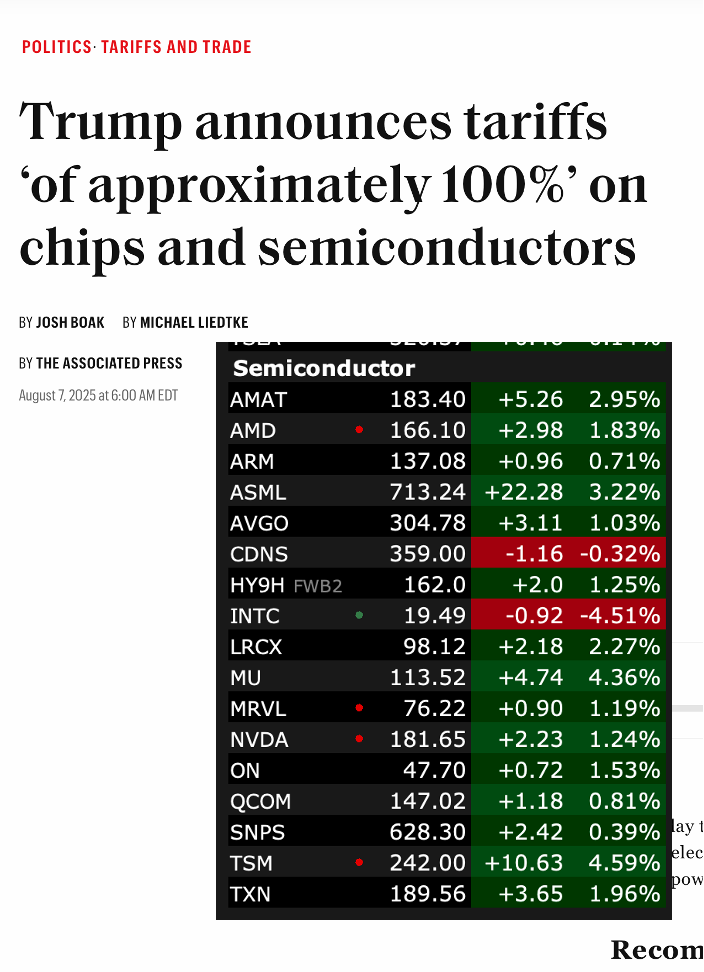

As for the new Late Stage Capitalism moment? Semiconductor is where it’s at. Allow me to explain.

It is often said that financial markets are not the real world. But this is a false statement. Financial markets are entirely unrelated to how the world appears to be. They are very closely related to how the world really is.

The disciplines of philosophy, political science, history, social science, economics and others all seek to identify and understand how the world really is. These disciplines attempt in different ways to look beneath the surface to understand the superstructure beneath. They mostly fail. If you want to know the structure beneath the economy however, just follow stock prices. It really is that simple.

Here’s an absolute classic for the ages. It’s as good as the Late Stage Selfie banger above.

Who should be the primary winner from this? Intel. Right? Hilarious. Taiwan Semiconductor, the clue being in the name, up 4.6%, INTC, the Make Santa Clara Great Again candidate, down 4.5%.

From that and other such examples you can use price - the surface - to deduce how the world really is beneath the surface. Believe me, it’s much more effective than trying to induce what prices will be from what you think is going on down there.

So. Let’s get to work.

Don't Get Left Behind.

If you didn’t read it already, read this, now. And I mean now.

Next up - our daily subscriber-only take on the US equity indices, volatility, bonds, oil, crypto, and key sector moves.