Market On Open, Tuesday 23 December

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

All That Glitters Is In Fact Gold (*)

by Alex King, CEO, Cestrian Capital Research, Inc

(*) also silver, platinum and a couple others

As everyone knows, the key to making money in the market is tech.

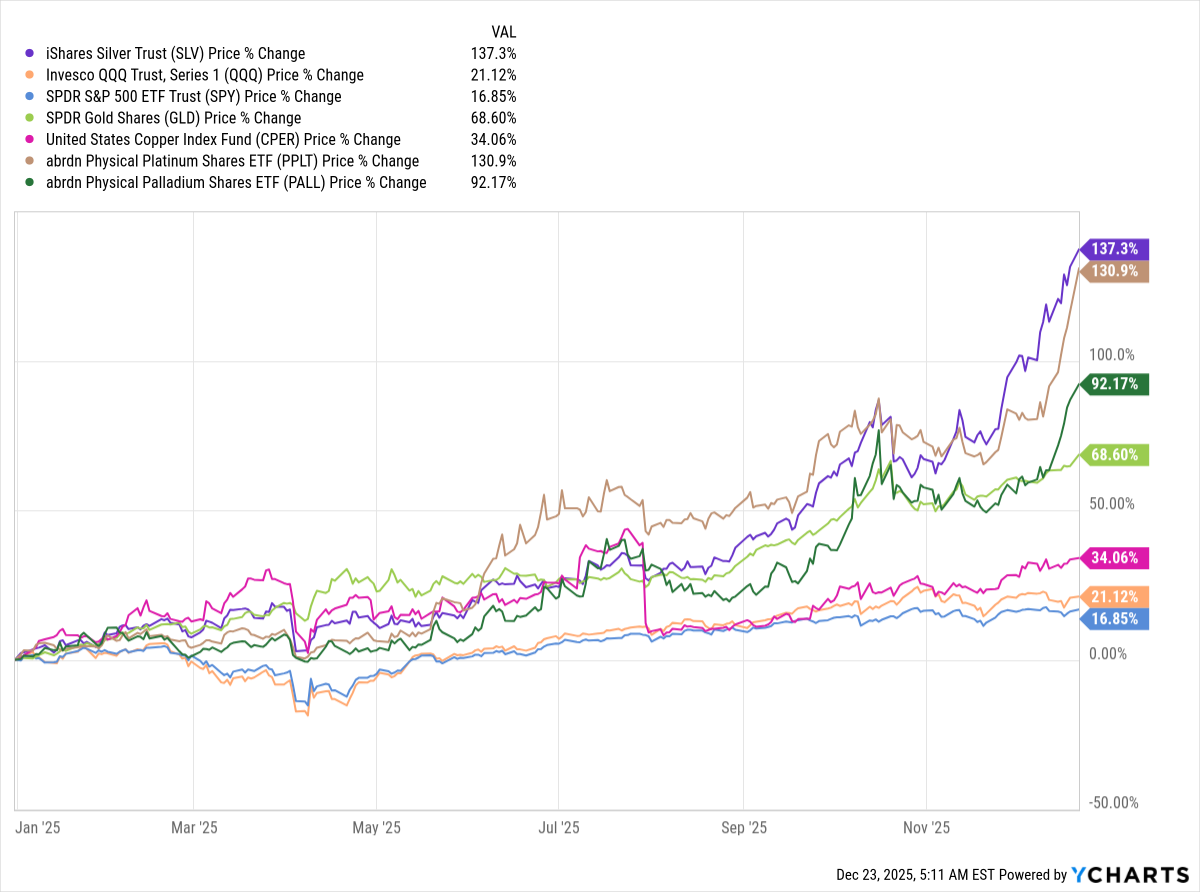

Well, not this year it wasn’t. The best-performing of the equity indices, the Nasdaq-100, has returned around 21% YTD. Commodities have left the Nasdaq in the dust. Copper +34%, Gold +68%, Palladium +92%, Platinum +130%, Silver +137%.

Now, I know not so much about commodities. I can probably fake a conversation based on what I read in the Wall Street Journal last week but do I really understand the dynamics of the palladium market? Can I bore you for hours on the topic the same way I would be happy to do as regards the inefficiencies of AI models and why solving that is the key to the tech capex crisis and power grid overload? I cannot. You may be thankful for that, I don’t know. What I do know about commodities is that they are the ultimate in trend-trades. Metals don’t have earnings and they don’t have finfluencers, not yet anyway. If you want to make money from metals - and to avoid losing money - I think there are two ways to do this. One, technical analysis. Get good at the voodoo and it can serve you well. But it is diffcult, time consuming, and hard to separate from your own emotions and capital exposure or lack thereof. Or two, get a machine to follow the trend for you.

Algorithms are bad at many things but they can be very good at one thing which is following a price trend. And our YX Commodities Signal service has picked this up very well. I trade these signals myself, religiously, because I trust the machine to follow the price trend more than I trust myself to become rapidly expert in metals markets each one of which can consume a lifetime of study. And the service has delivered. Since launch merely weeks ago I find myself 20%+ up in multiple metal ETFs and my only regret was not allocating more capital to the strategy in the first place.

Has the commodity run finished? Is it all downhill from here? I don’t think so personally (because on the quiet I do actually do some analysis and charts and whatnot) but if the price trend does top out, I expect our signal service to flip to “Risk Off” in the relevant metals. From experience in 2025, all our algo services hold on to price trends longer than I myself would - as a human I continually worry about “did this top already?” - the machine doesn’t worry about that, it just considers the price just printed and decides whether it thinks that was a top, or not. Using pattern recognition methods. Not its stomach lining, or moon phases, or chart voodoo. I shall be continuing to trade this service in 2026.

Launch pricing on YX Commodity Signals ends 31 December. Until then the service is only $1999/yr for independent investors, or $3999/yr for investment professionals (monthly subscriptions also available). On 1 Jan prices double.

You can sign up here:

Now, below our latest daily review of equities, bonds, sectors, crypto, oil, gold, volality and more, in our Inner Circle service.