Market On Open, Tuesday 3 February

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

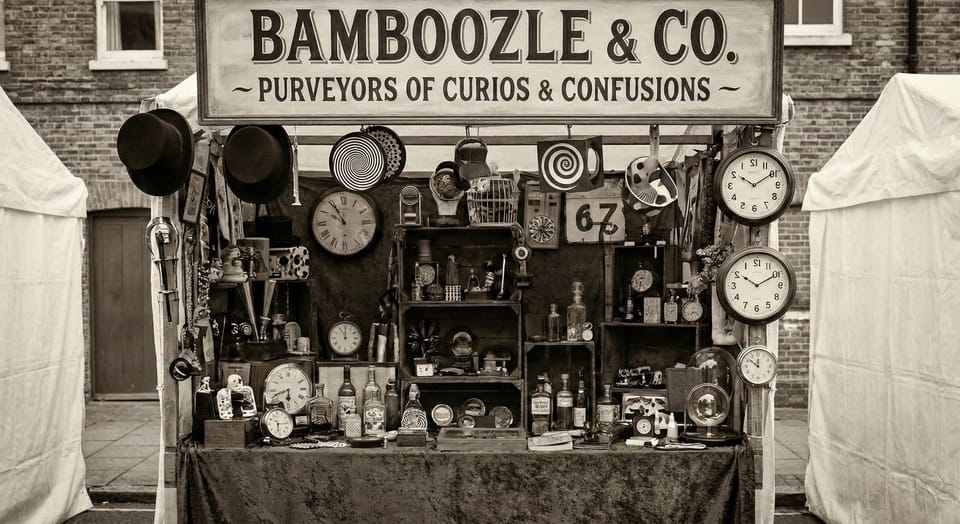

Nothing Like A Bamboozle To Keep You On Your Toes

by Alex King, CEO, Cestrian Capital Research, Inc.

Got spirally eyes yet? Good! Mission accomplished. The metals markets and crypto markets have closely resembled one another over the last few days and have each wrecked hearts, minds, wallets, careers, families and solvency all around the world. Yet this is the life we chose. Anyone reading this note for some reason thinks they can navigate markets sufficiently well to be something other than a source of funds for your nearest brokerage.

Fear not. For it is perfectly possible to be serially successful in securities markets. But to do so you need the following key ingredients:

- Restraint. Never go all-in on anything. Don’t get in a position where a handful of adverse moves could finish you off.

- Time. Never be in a position where idea X has to work dammit by time Y. If you use options, do it well and do it carefully, with risk management built in.

- Understanding. Don’t follow someone else blindly into an investment or a trade. If you do this, when things go against you, you won’t know what to do; if the commentator, analyst, guru or furu does something you don’t agree with, what then? Follow blindly once more or make your own decision when on the back foot? I can’t say this strongly enough. You need your own thesis and risk assessment for each investment or trade you place. A notion of how much loss you are prepared to take and how much upside you are shooting for. And total detachment when you take the loss or the profit.

- Absolute control of your emotions. This is how you should feel depending on situation: (i) unrealized gains - no feelings. (ii) unrealized losses - no feelings. (iii) realized gains - no feelings. (iv) realized losses - no feelings.

This game, played well, is no fun at all. But it is also not a chore. It can be treated as a kind of math puzzle where your goal is simply, number go up. And if number go down briefly, work out why, regroup, go again. Until your eyes are so old they can no longer focus on the screen. By which time number will hopefully pay for you to go do something that is fun, and you can just switch your ill-gotten gains into an income account instead.

Here at Cestrian we practise what we teach, and we teach it all day long in our real-time Inner Circle service. As our many wonderful subscribers have attested!

Heads Up For Our Free Readers

Our new low-cost Cestrian Circle membership is a great way to access some of our best work. We provide two research notes per week for just $39/mo or $399/yr. This week we feature a full market assessment note and a rapid-response note on Palantir $PLTR earnings, published right after the print yesterday. Note, you must be an independent investor to join Cestrian Circle. This subscription is not available to investment professionals.

You can learn more here:

Now let’s get to work. Today’s note is available to our Inner Circle members only.