Market On Open, Tuesday December 30

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Rise Of The Machines

by Alex King, CEO, Cestrian Capital Research, Inc

If you YOLO’d into precious metals because FinTwit told you it was a good idea, you are liable to be riding the crazy train to nowhere. Don’t get me wrong, X is a wonderful place once you figure it out, but until you’ve spent years finding and following and whittling down to the handful of X postooors that actually share useful insights, you’re likely to be just getting spoon-fed opiates of the financial kind in order that you can provide exit liquidity to bigs. That being the primary use case of FinTwit for Wall Street of course.

If on the other hand you started accumulating commodities before their moonshot, say for instance with a dead-inside machine at the helm? Then you’re probably in better shape. Particularly if you avoided oil, which for now is trending down in the larger degree, maybe catching a short-term bid, not sure yet.

If only there was a way to do this without employing a team of real-asset experts at a cost of many millions of dollars per year.

Oh wait! There is!

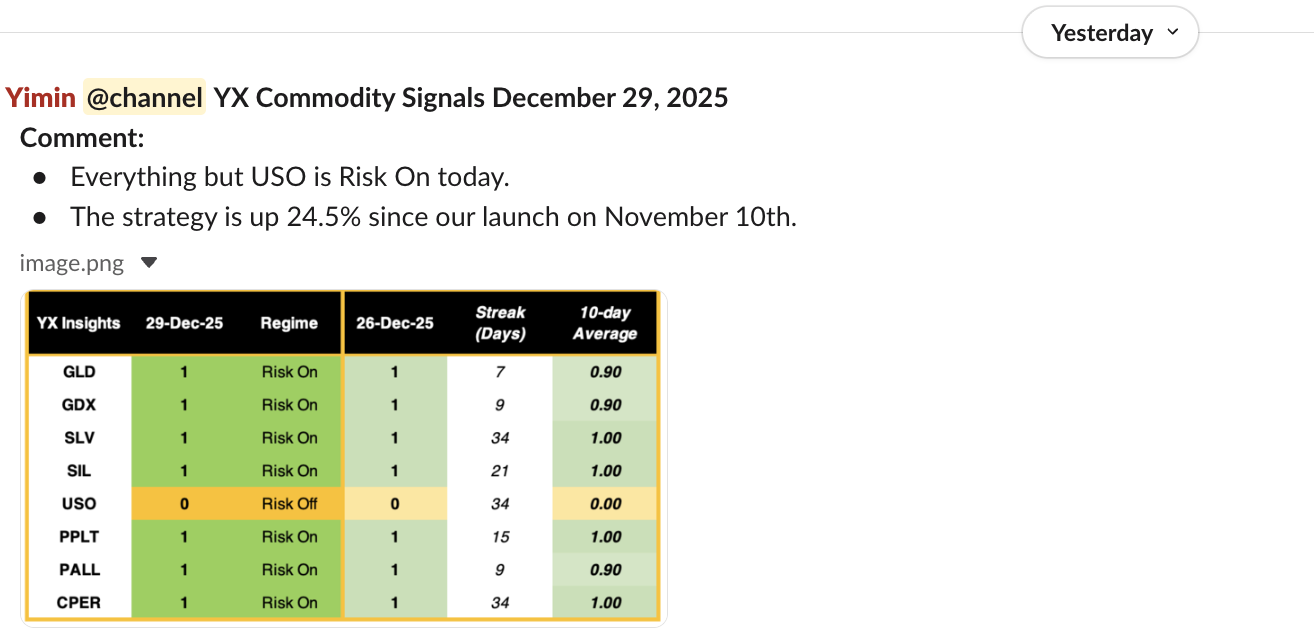

Here’s how our YX Commodities Algo Signals service has been doing lately. This is yesterday’s pre-market-open alert posted for members at that time.

Yup, you read that right. The machine is up 24.5% in about six weeks across a diversified basket of metals.

Now, as everyone knows, silver bros (yes that’s a thing now) were rekt yesterday because (i) A MAJOR TIER-1 MONEY CENTER BANK BLEW UP (source: a host of lying FinX accounts) and/or (ii) there was a hike in margin requirements by the CME and/or (iii) silver had run up a lot already and had to cool off some [you choose your own explanation, I have yet to see any evidence of (i) though!] .

Did this destroy the machine’s success? It did not. I trade this algo set personally, have done since service inception, and I can tell you I’m up +44% on $SLV and +26% on $SIL since I started. Those results probably differ from the service a little bit as I think I bought in over two tranches in each name, but nonetheless I am feeling pretty smug about that. What’s more I have faith in the algo to flip “risk off” on assets as they weaken so that even if silver does hit the deck for real, I would expect the algo to get me out with solid gains. Why? Because the core of the algorithm works on a similar multifactor basis to Yimin’s crypto algorithms, which have printed gains on the way up and dodged many bullets on the way down.

So, nothing in this world is certain, and the algo services could turn Skynet on us all tomorrow, no-one knows, but until then I find myself very comfortable using them.

Incidentally, and it would be remiss of me to not try to help you to save money - I am always thinking of you, dear reader - the YX Commodity Algo service doubles in price on 1 January. Take a look to see if this is something that will help you. More details here.

Now, below our latest daily review of equities, bonds, sectors, crypto, oil, gold, volality and more, in our Inner Circle service.