Market On Open, Wednesday 18 February (NO PAYWALL)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

One Day It Shall Be Spring

by Alex King, CEO, Cestrian Capital Research, Inc.

I don’t know if in the physical world it’s true that ’the darkest hour is just before the dawn’ but I do know that in investing and trading, the point at which any sensible person feels they should just throw in the towel is usually the point at which things start to stabilize and improve. The US equity indices are a touch below all-time highs, nothing scary there. International equity indices continue to move up nicely. But crypto and software, sheesh, some pain has been inflicted there, and then some.

In general, when something has sold off hard and volume is starting to spike at the lows, it’s wise to be skeptical of the “it’s going to fall another 50%” crowd. Not always but often, this narrative isn’t there to help the consumer of the message, but rather the commissioner. In software, for instance, I don’t know if the bottom is in, but a lot of people seem to think it is (or at least a lot of people are covering their short positions, which is often the same thing).

Here’s $IGV (full page version, here).

For a higher-confidence new long position you may want to wait to see if IGV gets up and over its 8-day simple moving average (the red trendline in the chart above). If so, a long position with a stop a little way below that 8-day may offer a nice risk/reward opportunity.

Crypto has a similar look by the way, and our own Yimin Xu will tell you that is no coincidence.

Why are Bitcoin $BTC and software $IGV trading almost tick-for-tick? (MUST READ)

— Yimin X (@yxinsights) February 17, 2026

It’s not a coincidence. It’s about DURATION.

Both asset classes are long-duration expressions of liquidity.

Software equities derive most of their value from terminal cash flows discounted far… pic.twitter.com/tGFZ9MlUoo

Here's Ether, which is thinking of making a stand down here. It is holding over the 8-day in early trading today; holding over the .886 Fibonacci retrace of the move up from the April lows to the August highs; and volume x price is starting to spike.

We'll see if this holds - if so Ether has a shot at surprising people (a lot) to the upside.

Speaking of Yimin - here’s something more people should be using:

Crypto By Numbers

If you’d like to invest in or trade crypto without fear or greed, without trying to balance narrative vs. reality, without having to worry about what Michael Saylor or Tom Lee just posted, then you should consider using our YXI Crypto Algo service. Simple to use but powerful beneath the surface, this is a simple risk on (buy or hold) / risk off (sell or stay away) signal for the top cryptocurrencies (Bitcoin, Ether, Solana, Ripple) and related stocks (Strategy, Coinbase, Robinhood). You can use the signals for native crypto or for crypto ETFs. If you had been using this from inception you would have missed the whole October liquidation event and all the selling since. You would also be up nicely on Strategy ( $MSTR ), unlike most everyone. And as crypto starts to recover, you would have been receiving risk-on signals free of mindgames. Personally? I use this daily. (I tried to beat it with manual trading. Couldn’t. So now I just follow the algo and have been (i) more profitable and (ii) less stressed ever since).

Learn more here:

Righto. The market. Let’s get right into it. Today’s note is on a NO PAYWALL basis. This stuff is normally reserved for our Inner Circle members.

US 10-Year Yield

I am going to stick my neck out and say that the 10yr yield is going to start with a 3 before too long. And stay there awhile too.

Equity Volatility

The Vix continues to move up. Vix options expiry today, which may see a trend change from tomorrow, we’ll see.

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

Still no evidence of the world dumping its Treasuries.

I would expect to see a re-test of the 200-day soon; I think it will hold and that this rally in bonds will continue.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

As for TLT, with added crack cocaine for fun (*).

For algorithmic signals in TLT choose SignalFlow AI Bonds or YXI Systematic Signals.

(*) side effects may apply.

Gold

Gold futures lost the 21-day yesterday - this needs to be reclaimed for a move up to continue. If the 21-day EMA (green trendline in this chart) becomes resistance then GC can fall to the 50-day SMA (blue trendline) at 4700ish, expect a lot of crying in the casino from late levered longs if that happens.

Disclosure: I am positioned in gold according to our Commodities Algo Service and our SignalFlow AI Growth Service.

Bitcoin

Bitcoin is lagging Ether, Solana, Ripple, all of which are over their 8-days; BTC is not.

Ether

Price action beginning to look constructive. But I have been hurt before and have commitment issues here.

For algorithmic signals in Bitcoin, Ether, Solana, Ripple and key crypto-related stocks like $COIN $HOOD $MSTR, choose YXI Crypto Signals.

Oil (USO / WTI / UCO)

That declining resistance line held once more.

CL_F now below its 21-day EMA.

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETFs. Read the fund documentation if you are considering using these instruments.

Looks like UCO may lose the 200-day SMA.

For algorithmic signals in oil, gold and other commodities, learn more about our Commodities Algo Service.

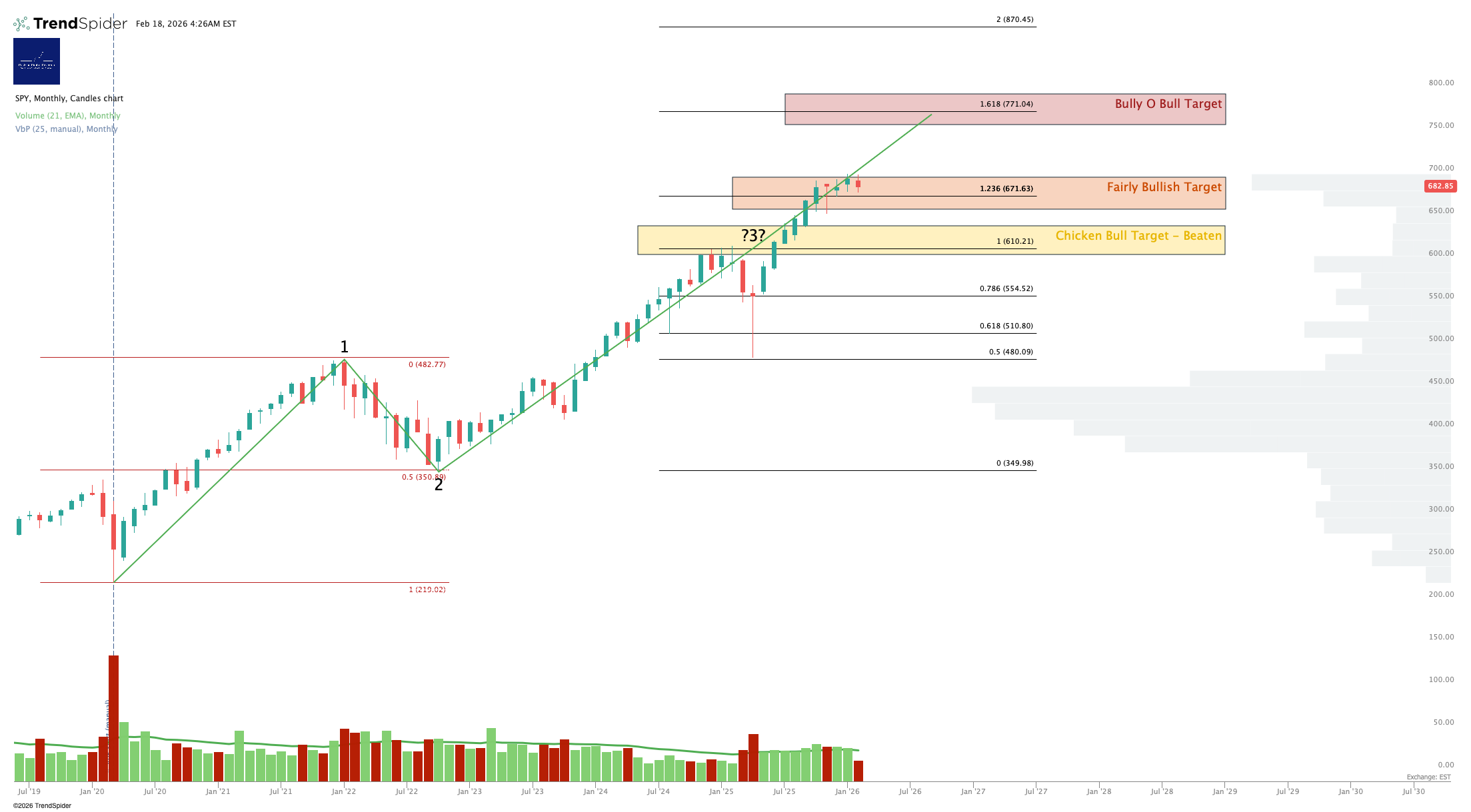

S&P500 / SPY / UPRO

No change all week really. Just sideways chop.

$675-698 is the range for some months now.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

The UPRO range has been $112-123 again for months now.

For algorithmic signals in the S&P500, consider SignalFlow AI Long-Only For $SPY.

Nasdaq-100 / QQQ / TQQQ

The volume x price up here is marked. That is bearish until proven otherwise I would say. I think the QQQ will hit $740-750ish in time but I would not be at all surprised to see a correction into late Q1 / early Q2 as per last year - reason - that vol x price bump. Happy to be wrong.

I think if any further selling takes place, the 200-day at $580ish should hold.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETFs. Read the fund documentation if you are considering using these instruments.

Another way to look for support in the QQQ is to look for resistance in SQQQ. If we get more selling in the QQQ, look for it to hold the line when SQQQ approaches its 200-day SMA at $82-83.

For algorithmic signals to help you play the Nasdaq and the S&P on a long/short basis, consider our upgraded long/short service.

Dow Jones / DIA / UDOW

Not much selling of the Dow up here, which is generally bullish beyond the Dow.

As you can see, very different price action in the Dow vs. the S&P or the Nasdaq of late. DIA is up and over its 8-day SMA in premarket trading by the way.

3x Levered Dow - UDOW Long / SDOW Short

Note - Leveraged ETFs. Read the fund documentation if you are considering using these instruments.

UDOW may see another attempt at the ATH soon.

Disclosure: No position in the Dow.

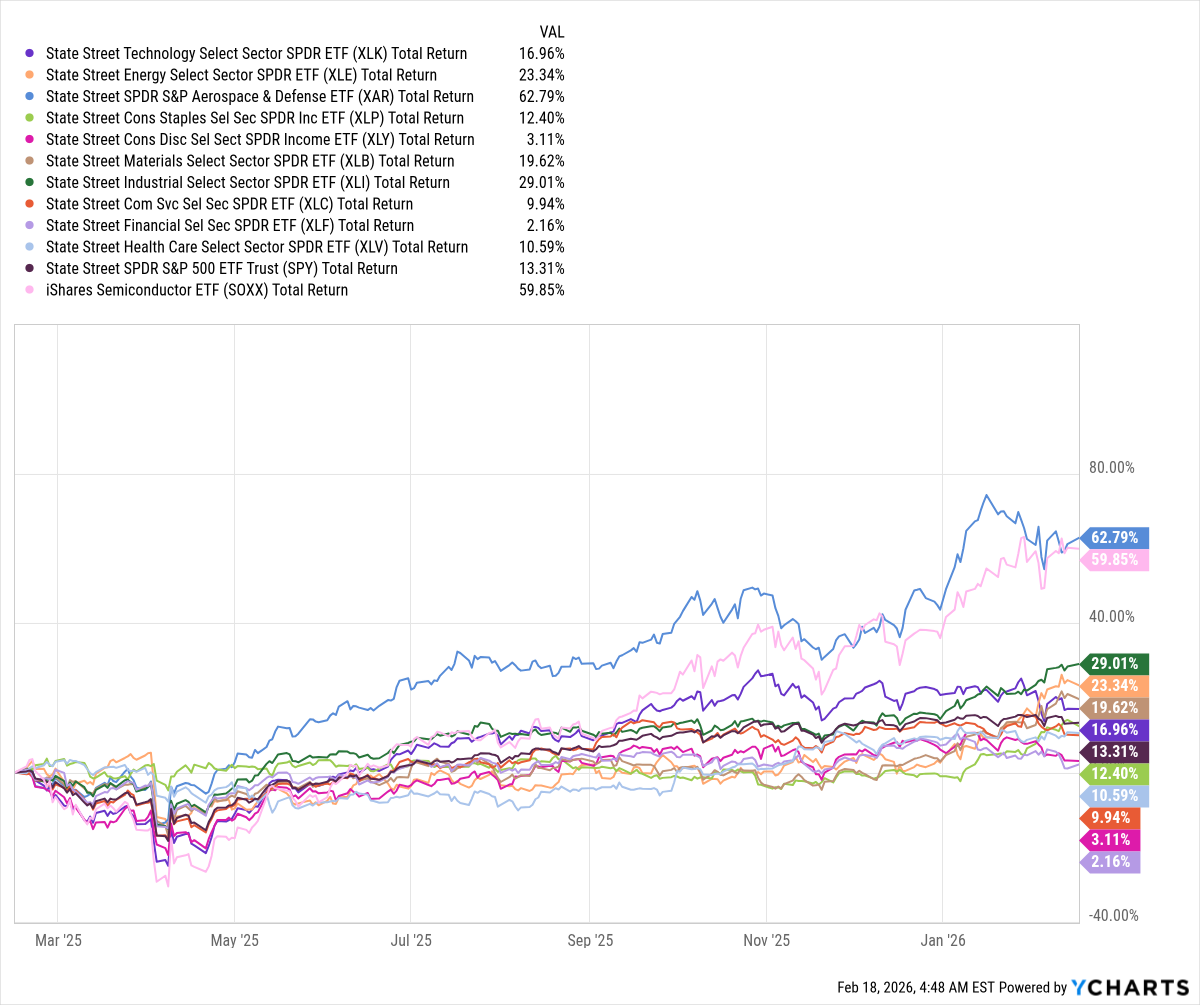

Sector Rotation

This is the last twelve months’ movements. Investors should have an eye on potential profit-taking in semiconductor and defense, and on rotation into consumer discretionary and financials. Yes I know. But that is how sector rotation works - “just when you least expect it, just what you least expect”.

For algorithmic signals to help you rotate through the sectors to keep ahead of the market itself, consider SignalFlow AI Sector Rotation.

SOXX (Semiconductor)

Looks like it’s ready to sell off. Hasn’t done so yet.

For help navigating high growth sectors, consider our SignalFlow Growth algorithm.

NEW! International Equity Indices

Canadian equities have been on an absolute tear.

For algorithmic signals to help you rotate through the countries to keep ahead of the US market, consider SignalFlow AI Global.

Alex King, Cestrian Capital Research, Inc - 18 February 2026