Market On Open, Wednesday 4 February

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Sum Of All Hopes And Fears Can Be Found In … Mountain View???

by Alex King, CEO, Cestrian Capital Research, Inc.

Google ( $GOOG , $GOOGL ) reports earnings today after the close.

That is a very extended chart and the big spike in volume x price (gray bars on the right hand side) is suggestive of possible distribution ie. bigs selling at this ATH level. On the other hand it seems to me that Google is set to continue its leadership in AI, and in addition its stake in SpaceX is set to be revalued - if not this quarter then next - given the recent SpaceX / x.AI / X merger that put a new ATH on SpaceX stock.

Megacap earnings season so far has been a damp squib save for Apple. Microsoft printed great numbers, stock dumped. Meta printed great numbers, stock ran up and then gave up its gains. AMD printed good numbers, stock sold off. And so on. So far in tech the standout print has been Palantir, but even then, the stock (which was weak coming into earnings) has struggled to hold its gains.

So a lot rests on Google. A great print and a great reaction, up goes the Nasdaq. Anything less than that and I think we’re in for a correction in February, in tech (and therefore the indices) at least.

Yikes Or No Yikes

This should not, of course, worry you. Because being a smart investor you don’t have all your eggs in one basket nor even one index. You probably already rotate capital from sector to sector. But if you don’t? You should think about doing so. It’s a great way to try to stay ahead of the market whatever the weather.

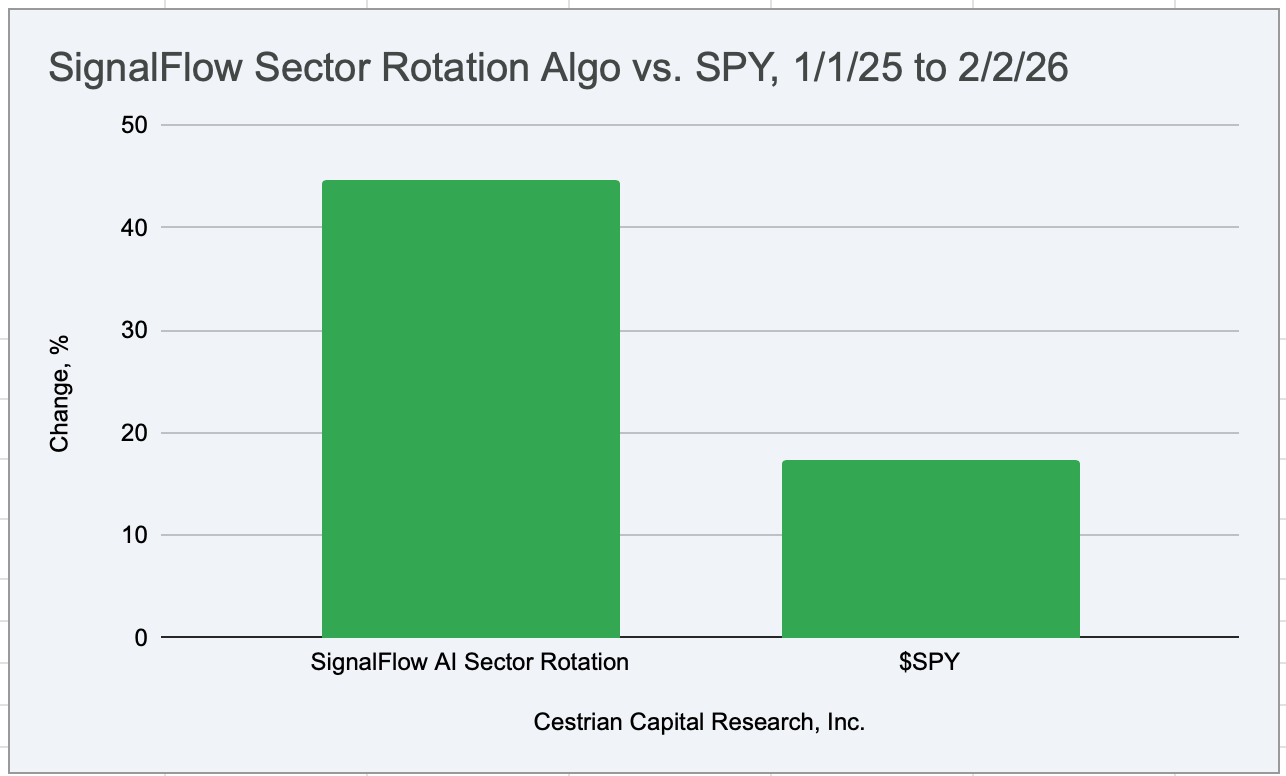

Our SignalFlow AI Sector Rotation algorithmic signal service is having a good run. It’s a simple service, it just helps you move your money from sector to sector, just like the largest asset managers do, to take advantage of uptrends and to avoid downtrends. It uses simple ETFs, no leverage, no shorting, no options, nothing weird or difficult. Here’s how it’s doing:

I myself trade this algo religiously. It is very low effort, requiring no more than three trades per day (and often no trades) - it prints its best ideas each day after the close and the returns above assume that the user places those trades at the next open. It comes with its own discussion channel where you can reach senior Cestrian people including the Ph.D. author of the model. You can learn more about it here.

Now let’s get to work. Today’s note is available to our Inner Circle members only.