mRNA Strikes Back: Moderna’s Attempt at a Sequel (MRNA Q3 FY12/2025 Earnings Review)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Dead Or Alive?

by Nathan Brinkman

Moderna is a biotechnology company developing messenger RNA–based therapeutics and vaccines across infectious disease, oncology, rare diseases and autoimmune diseases. The company generated unprecedented revenues during the COVID-19 pandemic and is now in transition toward a multi-product commercial business supported by a deep late-stage pipeline, long-term platform patents, and expanding manufacturing capacity.

Moderna’s strategic emphasis is on seasonal respiratory vaccines, latent virus vaccines (viruses that lie dormant in the body and may cause disease later), and mRNA-based therapeutics, while leveraging its mRNA + LNP delivery platform for longer-duration growth beyond COVID-19.

Since the end of the pandemic, Moderna’s stock has been beaten down, currently trading at approximately 90% of its all time high. Negative perceptions of mRNA vaccines, falling sales since the pandemic, and lackluster sales of mRESVIA are the cause. Can Moderna pick its bloodied self off the ground and turn themselves into a profitable “therapeutics” company? Is there a future beyond COVID-19? Let’s have a look.

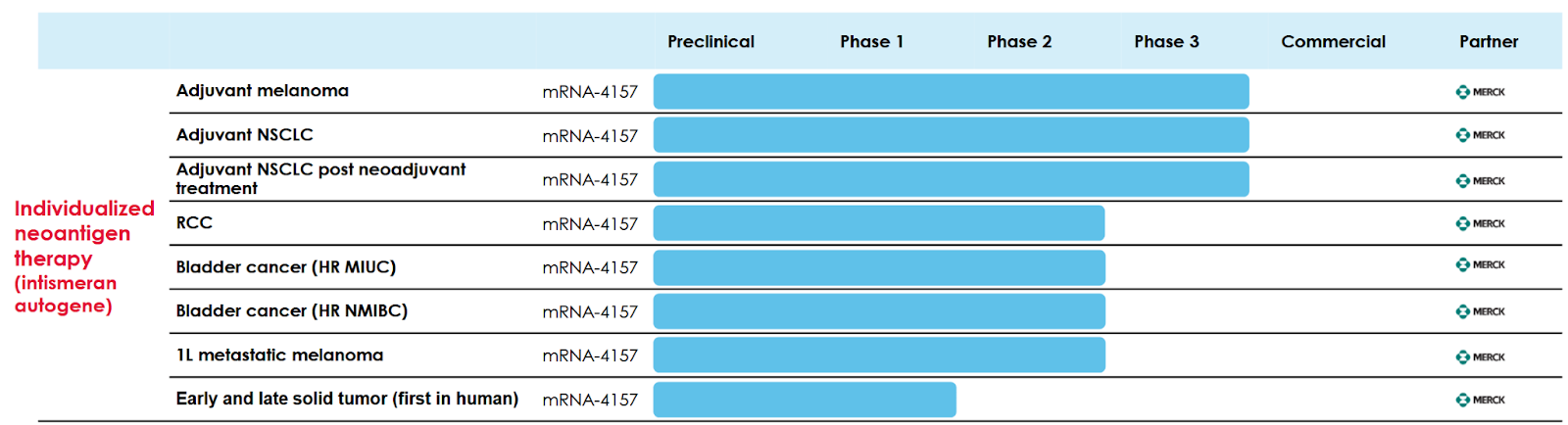

Pipeline

- 3 Commercial Products accounting for their current revenue (COVID-19 and RSV Vaccines)

- 4 Late-Stage Assets (Phase 3) including flu, flu/COVID combination, and Norovirus vaccines. One asset in 3 forms of cancer in combination with Merck’s Keytruda.

- 12 Mid-Stage Assets (Phase 2) in pandemic flu, latent virus vaccines (CMV, EBV), bacteria vaccines, two rare disease therapies, and 2 cancer therapies.

- 9 Early-Stage (Phase 1) across all therapeutic areas.

Probably the most important program in the pipeline, is mRNA-4157 which is currently being co-developed with Merck. Phase 2b showed that “the combination of mRNA-4157 and pembrolizumab (Keytruda) demonstrated a durable and meaningful improvement in recurrence-free survival (RFS) and distant metastasis-free survival (DMFS) in patients with high-risk, resected melanoma compared to pembrolizumab alone.” Currently there are 8 ongoing clinical studies in collaboration with Merck.

Moderna’s pipeline breadth is positive, supporting a transition away from a single asset emerging biotech, assuming most late stage assets are successful.

Market Potential

COVID-19 vaccine revenue peaked at >$18B in 2022, dropping materially to <$5B in 2024 and trending toward a stable endemic market. Moderna’s long-term revenue mix will increasingly depend on:

- RSV market size: ~$7–10B global peak (Moderna competing with GSK/Pfizer but targeting broader adult/older adult coverage).

- Flu vaccine market: ~600M annual doses worldwide; Moderna targeting premium pricing via higher effectiveness.

- Combination flu/COVID (mRNA-1083) could capture a consolidated booster market, potentially >$5B depending on adoption.

- CMV alone is estimated at $2–5B annually with no current approved vaccine.

- EBV represents both prophylactic and oncology-linked expansion opportunities.

- Personalized cancer vaccines (PCV) with Merck have early proof-of-concept; market potential could exceed $10B if efficacy generalizes beyond melanoma.

Moderna is transitioning toward a multi-asset commercial model with realistic mid-2030s revenue potential between $10–15B annually if key programs succeed.

Partnerships / IP Position

- Merck (MRK) – Co-development and commercialization of PCV cancer vaccine programs.

- Vertex (VRTX) – mRNA delivery programs for cystic fibrosis.

Moderna maintains one of the deepest mRNA patent portfolios globally and platform portfolio has >10yrs expiry in all cases with some ongoing legal disputes.

Funding / Cash Position

- >24 months cash on hand with likelihood to fund its pipeline into the late 2020’s without needing to raise further capital.

Regulatory Position

Moderna is transitioning from “single EUA product company” to a multi-asset regulatory organization with multiple late-stage programs including global regulatory interactions. However, the company has limited experience with non-pandemic regulatory pathways.

mRNA-4157 Regulatory Designations:

- FDA Breakthrough Therapy Designation (granted February 2023; for melanoma in combination with Keytruda)

- EMA Priority Medicines (PRIME) Designation (granted 2023)

mRNA-1647– Cytomegalovirus Regulatory Designations:

- FDA Fast Track Designation (granted 2019)

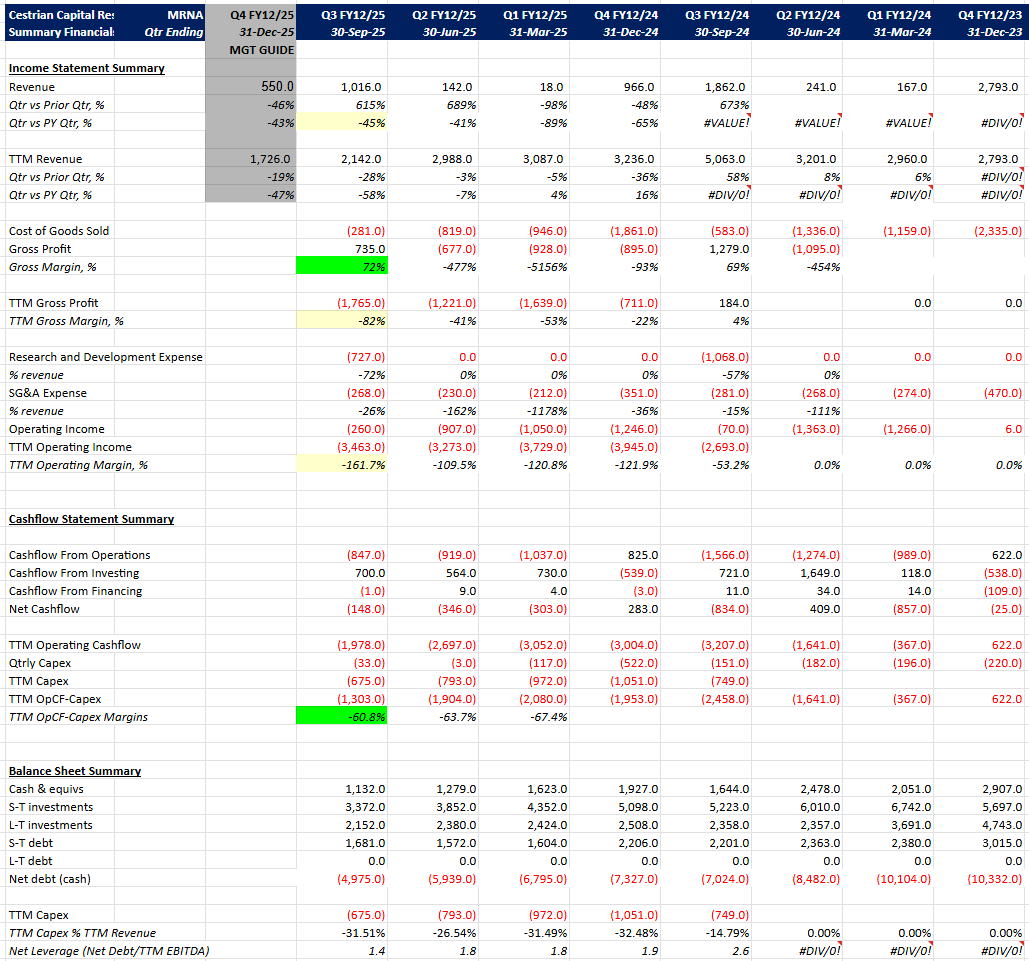

Financials Q2 2025

- Revenue has declined from Covid / RSV vaccines sales but remains material.

- Gross margins remain variable due to seasonal sales of vaccines.

- Cash runway remains extremely strong.

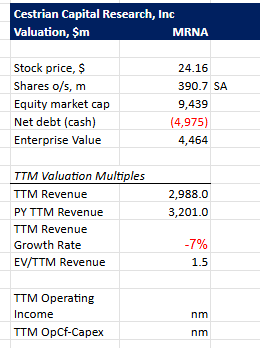

Valuation

Moderna currently trades (1.5) below my industry average EV/TTM Revenue of 5.63 and is below BioNTech at approximately 2.17. A moderate discount.

Chart

You can open a full page version of this chart, here.

Volume appears consistent with institutional accumulation, but volatility will likely remain tied to pipeline news. If the stock drops below $20, something bad has happened!

Conclusion

Moderna’s near-term fundamentals are pressured by declining COVID revenues, lack of RSV vaccine uptake, and high R&D investment.

Based upon my assessment, Moderna has promising quality and is trading at a deep to moderate discount.

Rated Accumulate but with a sell-stop-limit order in mind, somewhere in the $20-22 range depending on your risk appetite. The stock is currently at $24.

Nathan Brinkman, Cestrian Capital Research, 2 December 2025.

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts hold long position(s) in $MRNA