Occidental Petroleum Q3 FY12/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

The Magic Number

by Alex King, CEO, Cestrian Capital Research, Inc

.618, the Golden Ratio, the Magic Number. Nonsense, right?

Tell it to $OXY. On the longer term chart, the stock found support at the precise .618 retrace of the move up from the Covid lows to the 2022 highs. Full page chart, here.

Right now the stock in the smaller degree is hovering right around the .618 retrace of the move from the Liberation Day lows to the September highs. Full page chart here.

We rate $OXY at Accumulate between $40-52/share, because it looks like Big Money is accumulating in this range - per the volume x price profile (gray horizontal bars on the right hand side of this next chart).

If the stock reaches $53 we’ll move to Hold in anticipation of the stock moving up through the lower-volume (= less supply of stock from sellers) Markup Zone outlined above.

Oh yes. Valuation and fundamentals.

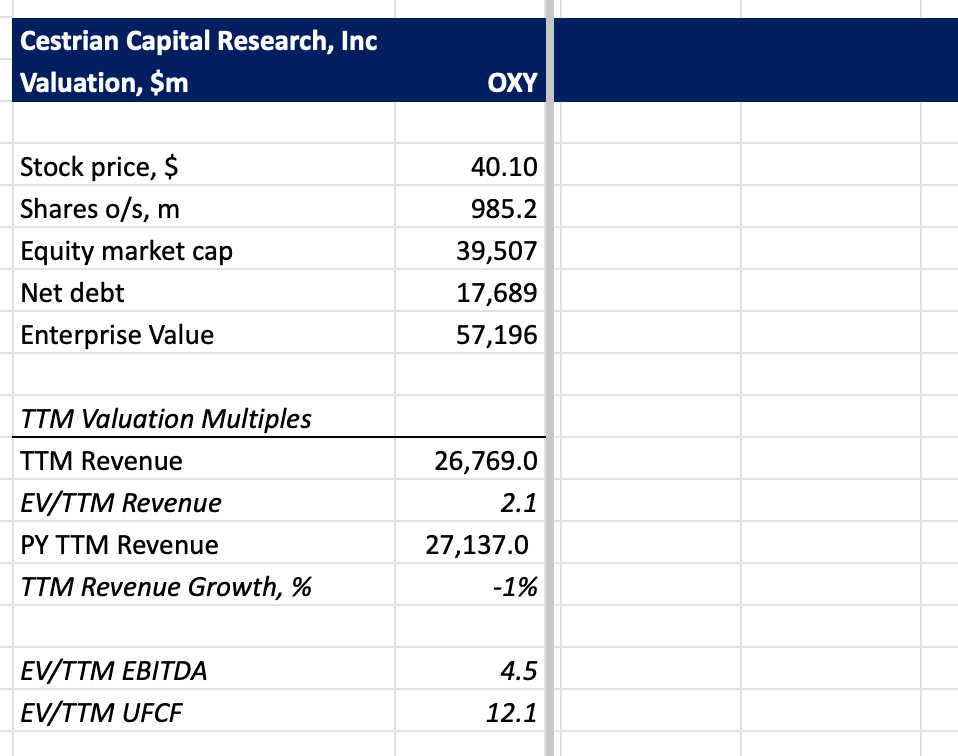

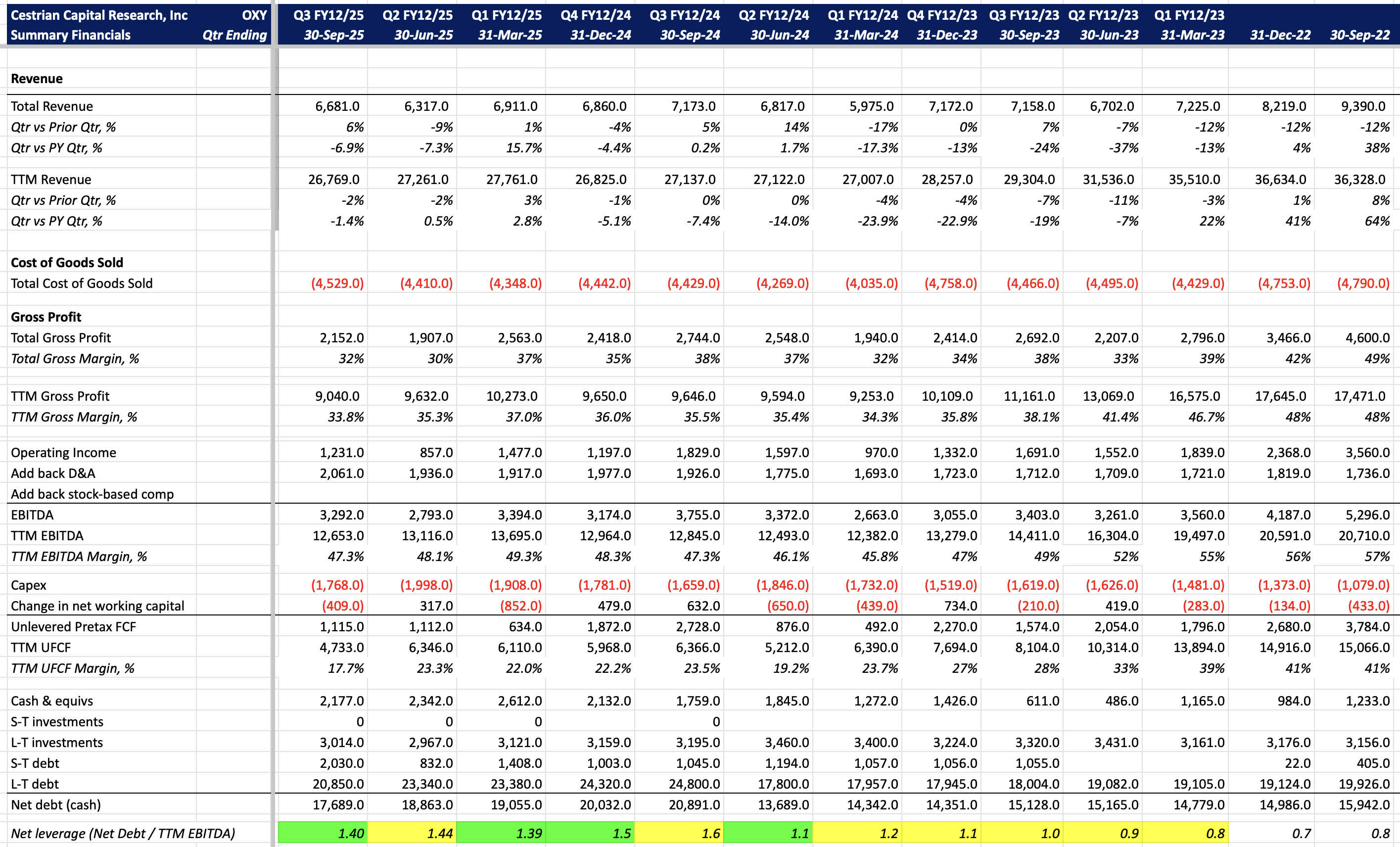

Inexpensive in my view.

Leverage is declining, revenue is steady, cashflow margins trending down a little but that’s probably short term.

Alex King, CEO, Cestrian Capital Research, Inc - 23 December 2025

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts hold long positions in $OXY.