Opendoor Q4 FY12/25 Earnings Review (NO PAYWALL)

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Let’s Keep It Simple

by Alex King, CEO, Cestrian Capital Research, Inc

Opendoor $OPEN is a well-marketed stock with a newly-hired high profile CEO. So you’re going to read A LOT about its Q4 numbers all over the internet in the coming days.

We can keep it simple here. This is my take, reductionist perhaps but I think these are the essentials:

- Revenue continues to decline but I suspect this is just a lagging indicator of the work being done at the company.

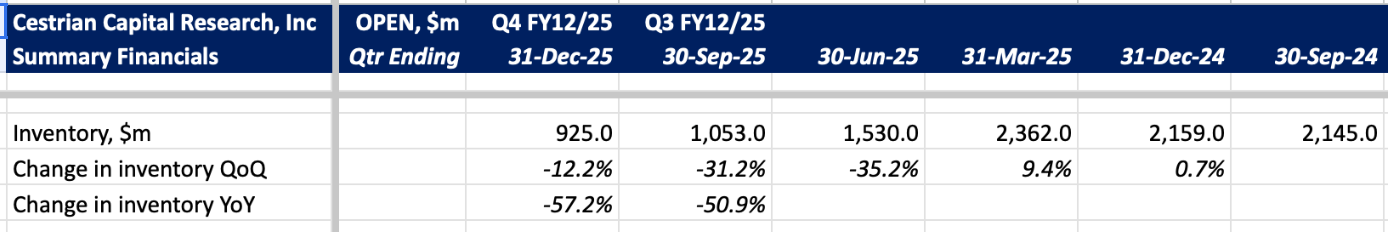

- Cashflow is very, very strong, driven primarily by the reduction in inventory of property.

- The balance sheet is in perfectly good shape for now.

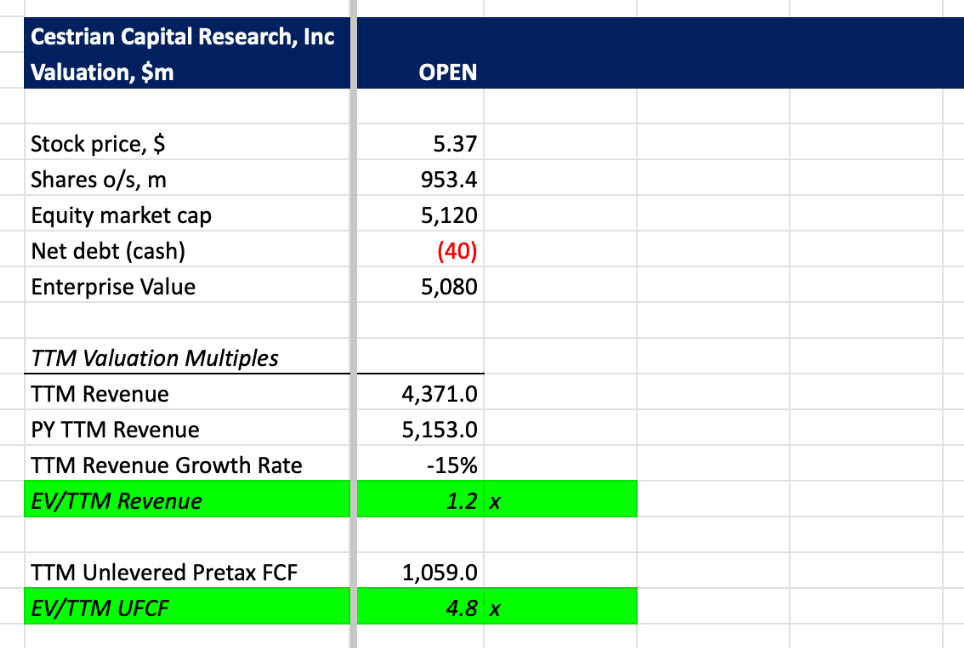

- The stock is cheap in my view, at around 1x TTM revenue / 5x TTM unlevered pretax FCF.

The chart is helpful insofar as you have a meaningful low of $4.20-ish below which you can place a stop. Yes, that’s a good deal below here but this is a highly volatile stock so, what do you expect?

If the stock holds over that level it has a shot at making it to $11-13/share before a more material correction. So about 5:1 risk:reward from here. You can open a full page chart, here.

Volume x price (gray horizontal bars) is spiking down here too, suggesting potential accumulation.

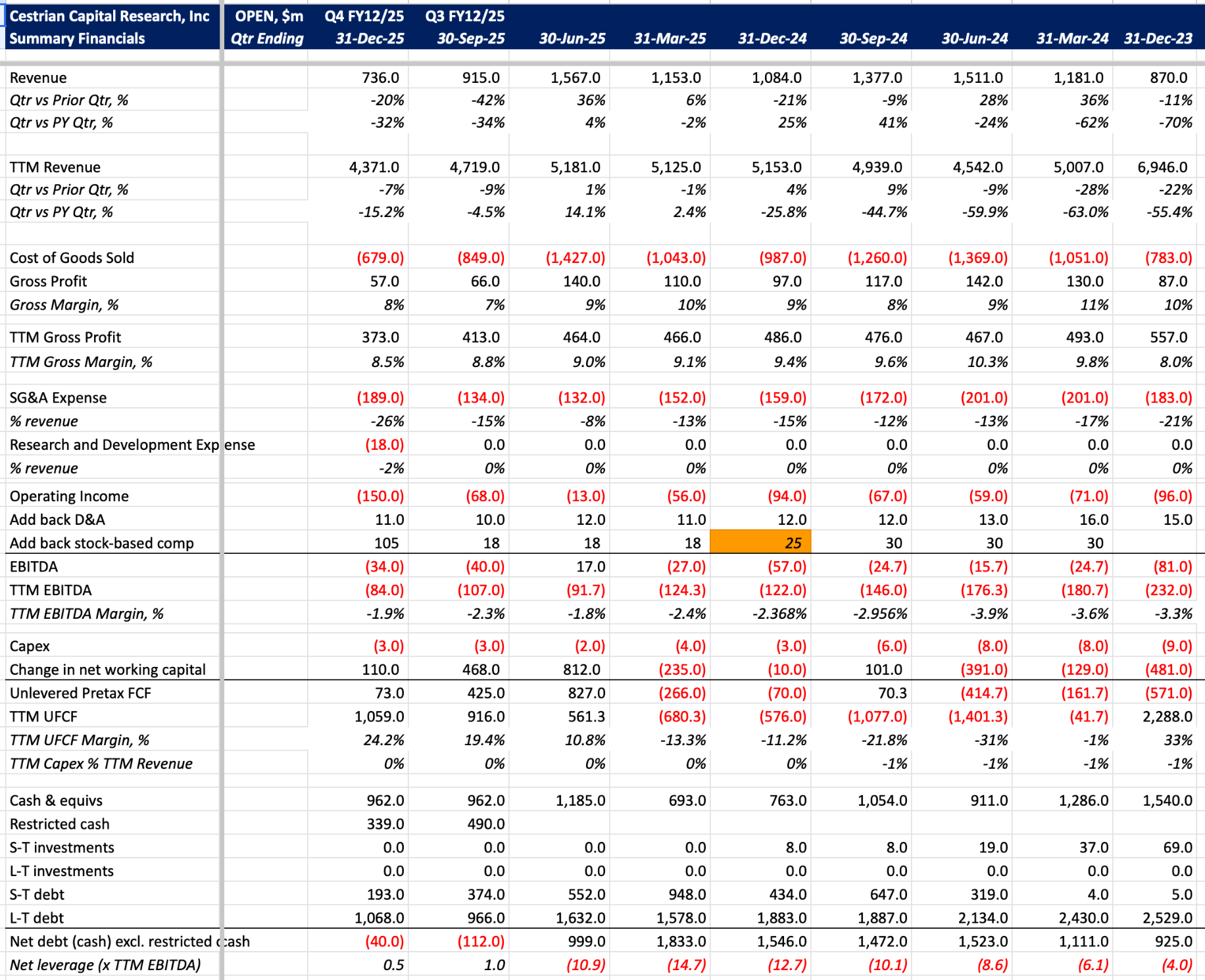

Here’s the numbers:

Here's the inventory unwind (that’s a good thing btw):

And finally the valuation:

Friday's close will tell you what the market really makes of this thing. Personally I am long $OPEN and likely to add to the position.

DISCLOSURE: Cestrian Capital Research, Inc staff personal accounts hold long positions in $OPEN

Cestrian Capital Research, Inc - 19 Feb 2026