Palantir Continues To Defy Gravity

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

House View

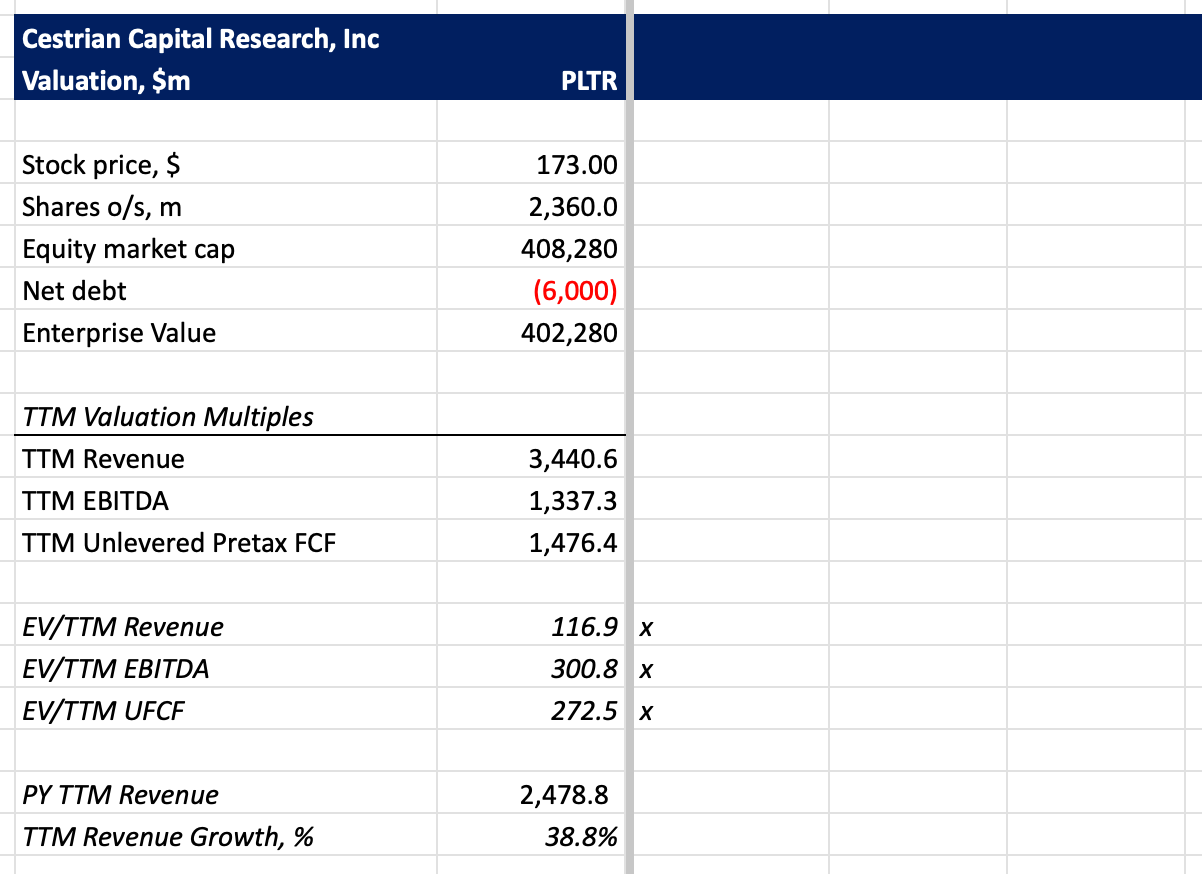

Palantir is clearly an expensive stock, currently trading at over 100x TTM revenue and over 270x TTM unlevered pretax FCF. I think it’s safe to say that at some point those multiples will drop and take the stock into a correction with it. The probability of that is rising, as you will see from our chart below, but the fundamentals are so exceptional that I think any major correction will be market- in origin rather than company specific at this point. Those fundamentals are truly impressive. Growth is accelerating, gross margins holding up, cashflow margins are rising and the balance sheet is collecting and keeping cash. It’s a superb company which any investment manager would want to own at the right price. Would a prudent investor jump in with both feet now? I doubt it, but that was probably true when the stock was 50% lower too. Price trends like this one can keep going even when all analysis says they should stop.

Stock Rating

We rate Palantir at ‘Distribute’ which, yes, is heresy, but anyone who doesn’t take profits here has a way higher risk appetite than most. If you own PLTR and don’t want to sell, consider at least a hedging strategy. Direxion offers an inverse PLTR ETF you could consider in this light - PLTD - here.

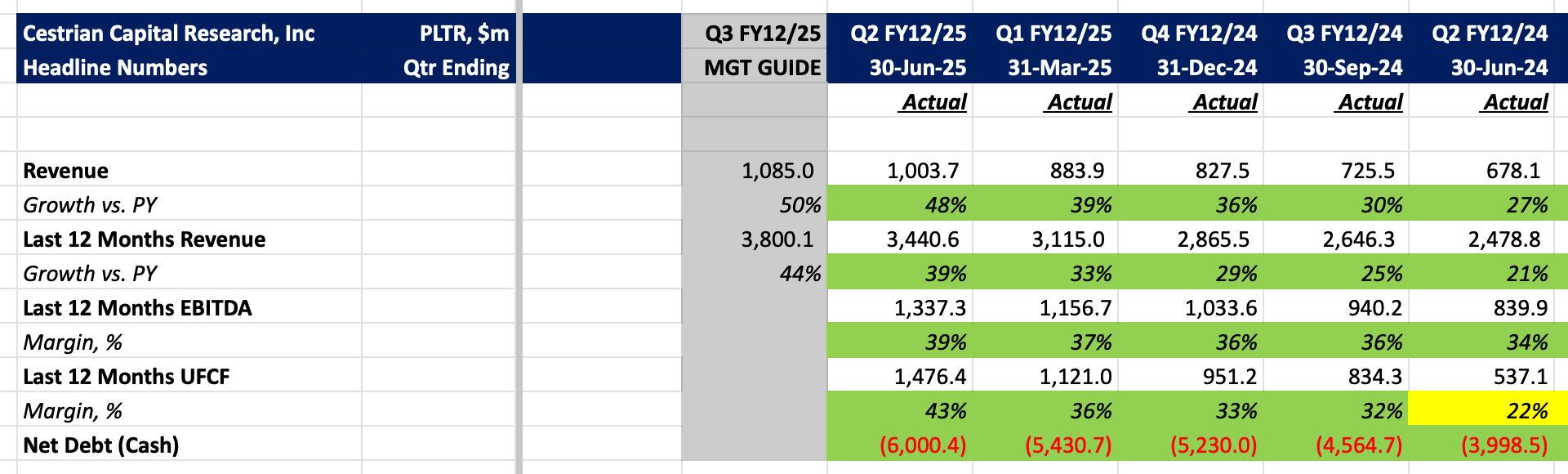

Financial Fundamentals

Here’s the headlines.

Stock Chart

If you start the clock at the May 2024 lows, PLTR is right around the 100% extension of Waves 1-3 placed at the Wave 4 low. That’s a big Wave 5. It can keep going up from here of course, but this level is a sensible place at which to take some gains or hedge to lock them in.

You can open a full page version of this chart, here.

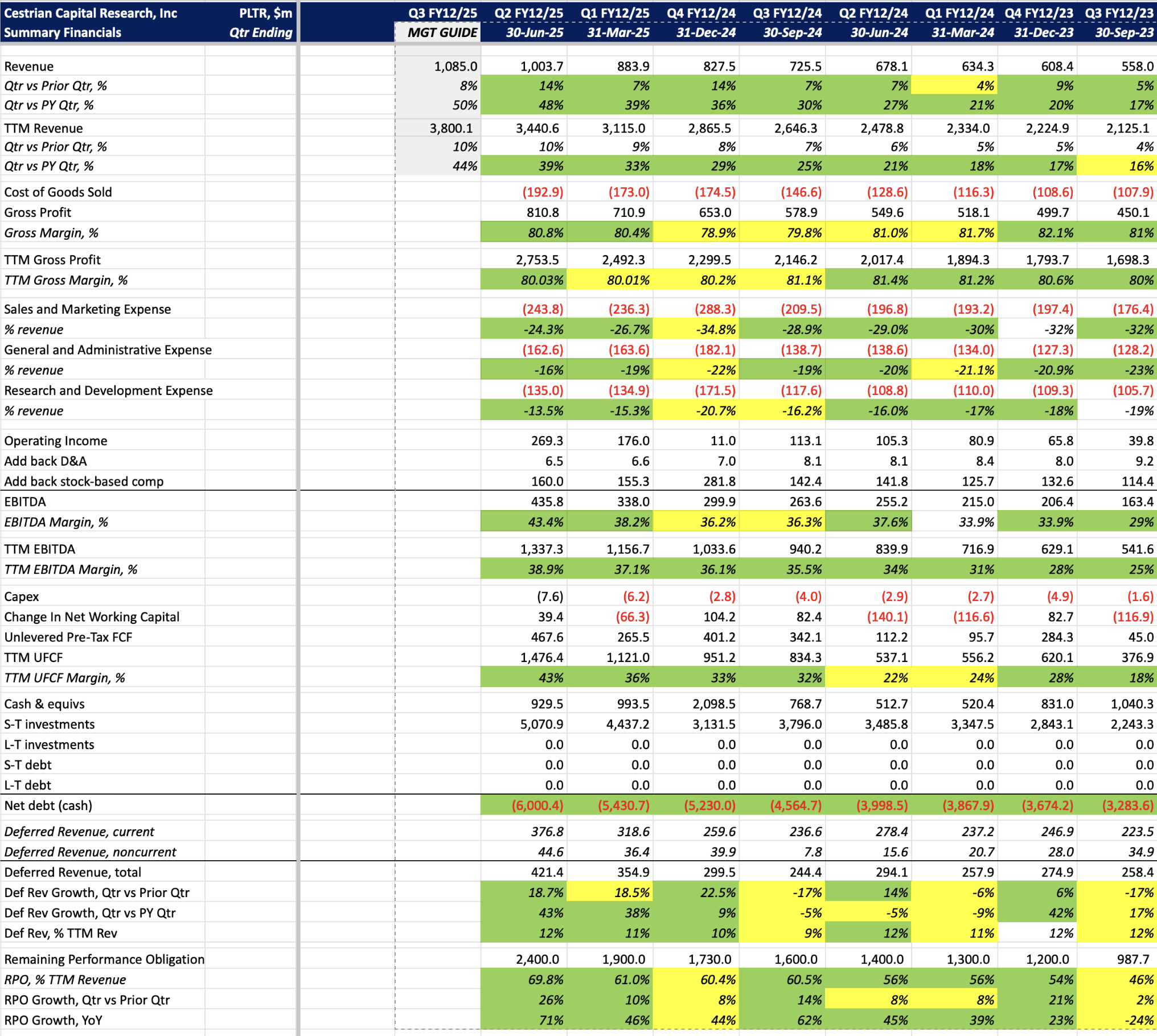

Appendix: Detailed Fundamentals And Valuation

Valuation Analysis

Fundamentals

Cestrian Capital Research, Inc - 5 August 2025.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold no positions in $PLTR.