Qualcomm Q4 FY9/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Semiconductor Stock In “Cheap” Shocker

By Alex King, CEO, Cestrian Capital Research, Inc.

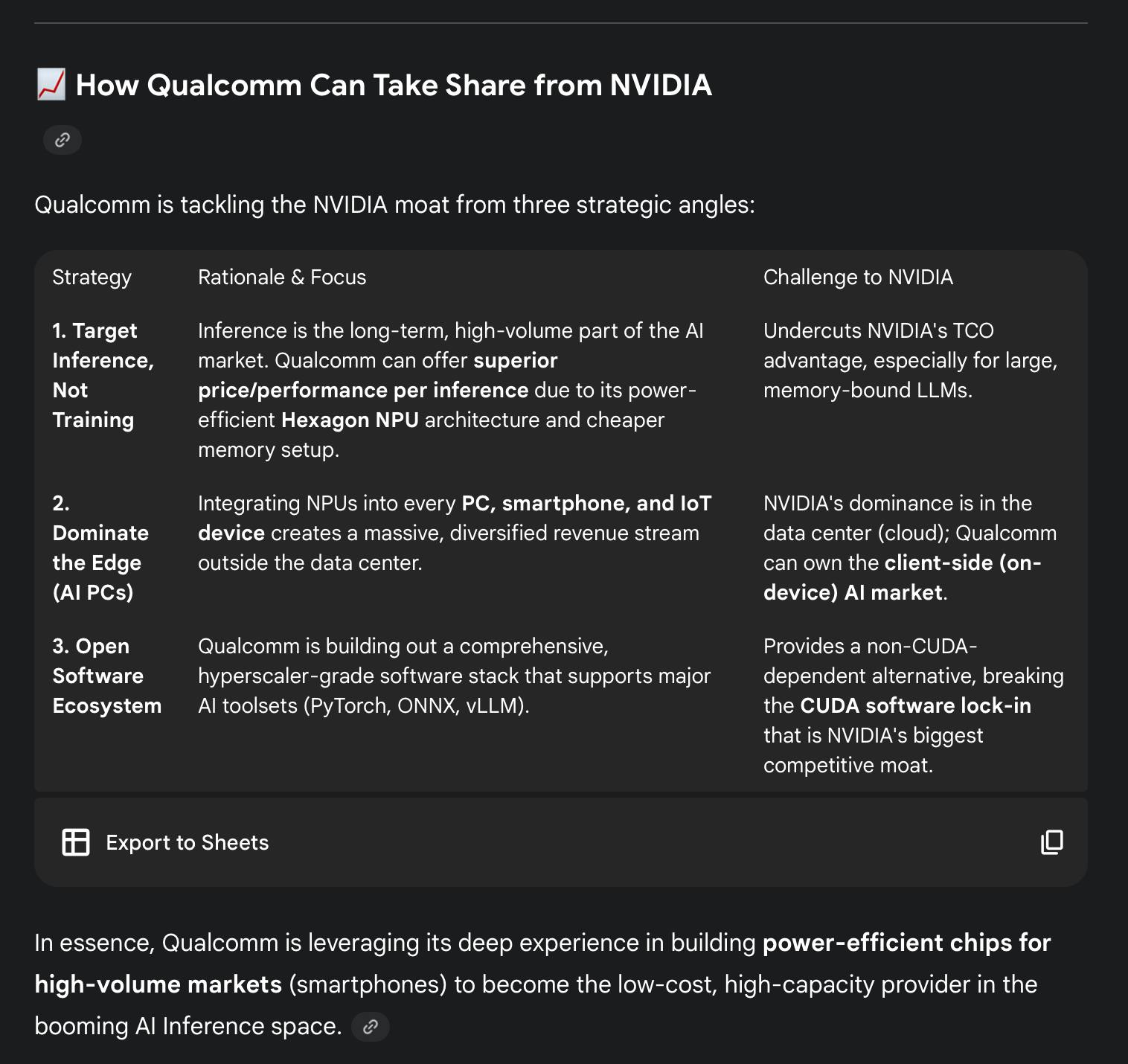

Qualcomm, I think, has a shot at sustaining its growth in the coming years; the key dependency in my mind is whether capital continues to be available for AI datacenter buildout. The company is one of a handful of chip vendors that may succeed in dislodging NVDA’s monopoly. You know that customers are looking for NVDA alternatives, because no-one likes all that winning and in particular no-one likes being beholden on price and volume to one vendor. And you know that if 2-3 trusted suppliers pop up with alternatives to the NVDA GPU paradigm, customers will happily go that way. To me the most likely candidates to benefit from customer desire to cut costs (by which I mean total cost of ownership, including the power bill) are $AVGO, $ARM, $AMD, $QCOM and maybe $INTC.

Google Gemini summarises it thus:

If, big if, the company can succeed in this direction then the opportunity to buy Qualcomm stock at the current level (12.1x TTM unlevered pretax cashflow / 11.6x TTM EBITDA) is a good one.

As always, stock price action matters more than fundamentals or a theory of why growth etc, so I personally am basing my investing decisions on the chart - but it is just possible that the long term timing here is good. The primary risk to trying to play a long-term Qualcomm growth opportunity is the overall market environment - if the market turns bear after this long bull run, QCOM stock will be hammered like everything else in semiconductor. So if you choose to play, manage risk accordingly.

Full numbers, valuation, stock chart and rating below.