SPY Down, ETH … Up?!?

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Welcome To Today’s Big Money Crypto Bulletin.

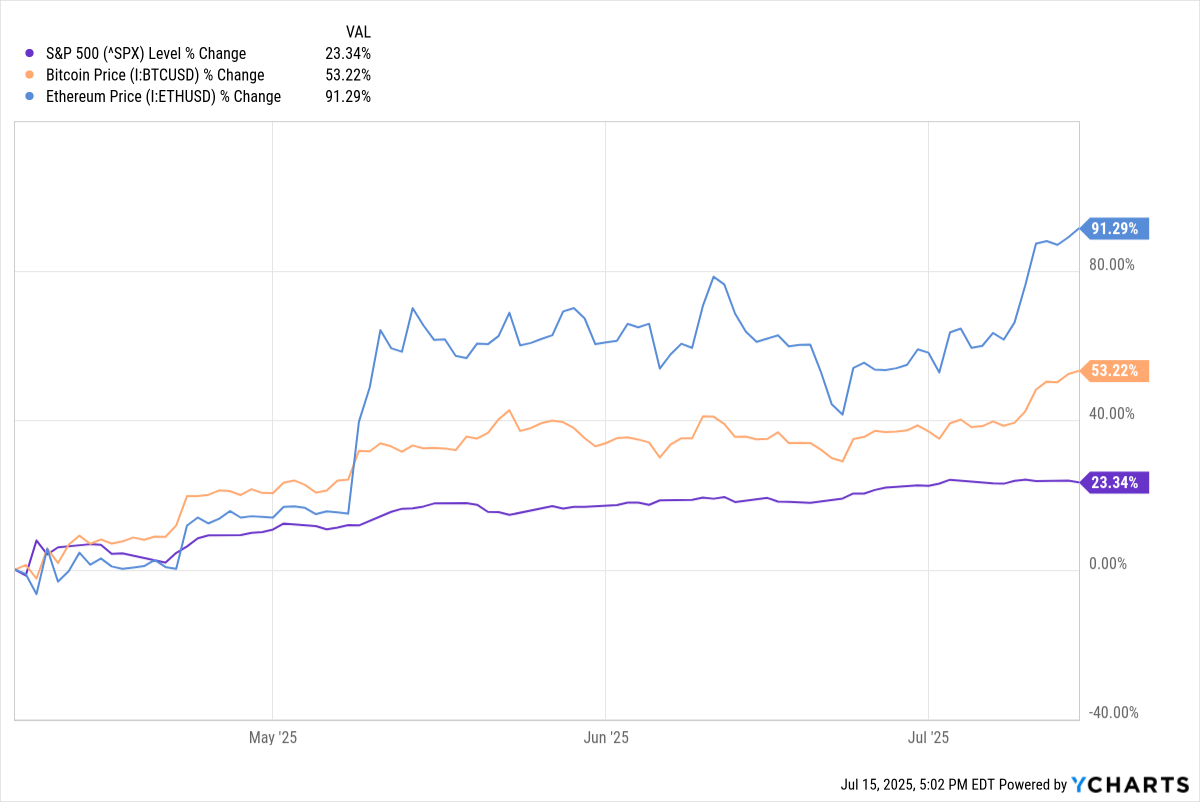

Well, Ether has put in a remarkable performance since the April market lows. Here’s its price performance vs. the S&P500 and vs. Bitcoin.

Today, after an initially strong start, the equity indices faded, with the Dow and S&P closing in the red and the Nasdaq more or less keeping its head above water.

Here’s how the three Big Money coins - Bitcoin, Ether, Solana - fared.

- Bitcoin down around 2.5%

- Ether up around 1.5%

- Solana down around 0.8%

Now, there was a time when a modest swoon in equities would see crypto running for the hills. That’s not the case at the moment. Right now it seems that the three Big Money coins offer uncorrelated returns vs. the S&P. That’s a big statement and it only takes one bear market to humiliate that opinion, but for now - it’s true.

Why? Because the utility of crypto is on the rise. Each of the Big Money Coins now has practical utility over and above being just a gambling chip. Ether and Solana, in particular, are in the process of establishing their ecosystems as part of the plumbing for asset tokenization (Ether) and lower-value transaction processing (Solana). This is not lost on Big Money, which wants in. And no better way than to accumulate stakes in these names via the ‘Treasury Holding Company’ model.

A ‘Treasury Holding Company’ is a lot like an investment trust from Ye Olden Dayes Of Yore, in the BS (Before Saylor) period. I think that came just after the Pleistocene, but you would have to check.

It is early days in the life of the Ether Treasury Companies and they trade that way. The largest, by ETH ownership, is $SBET. It is a hellishly volatile stock as you would expect. Here’s the recent history, as the stock approached the close today.

And here’s what’s happening in the post-market trading session.

If you are going to invest in crypto in the manner of Big Money and not in the manner of Chad The Crypto Bro, you have to learn to live with the volatility of these names.

Here’s another important Ether Treasury Company, BitMine Immersion ($BMNR). This chart starts a little after market close today, and it’s a 30-second candle chart.

Zoinks.

If you are very, very sharp and your trading volumes are small, perhaps you can take advantage of these after-hours runaway squeezes. If so, kudos to you. I can tell you that the largest asset managers will not be doing this - they can’t move enough money after market close in that post-market session, so they run to different rules. Since most participants outside RTH will be retail participants - and since everyone knows that - you should assume that there is an element of “whip up the poors so we can get some exit liquidity” of these outside RTH games. Act accordingly.

Enough for today. Live long and prosper, folks.

Cestrian Capital Research, Inc - 15 July 2025.