Synopsys Q4 FY1/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis on this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Nearly There, Not Quite

Alex King, CEO, Cestrian Capital Research, Inc.

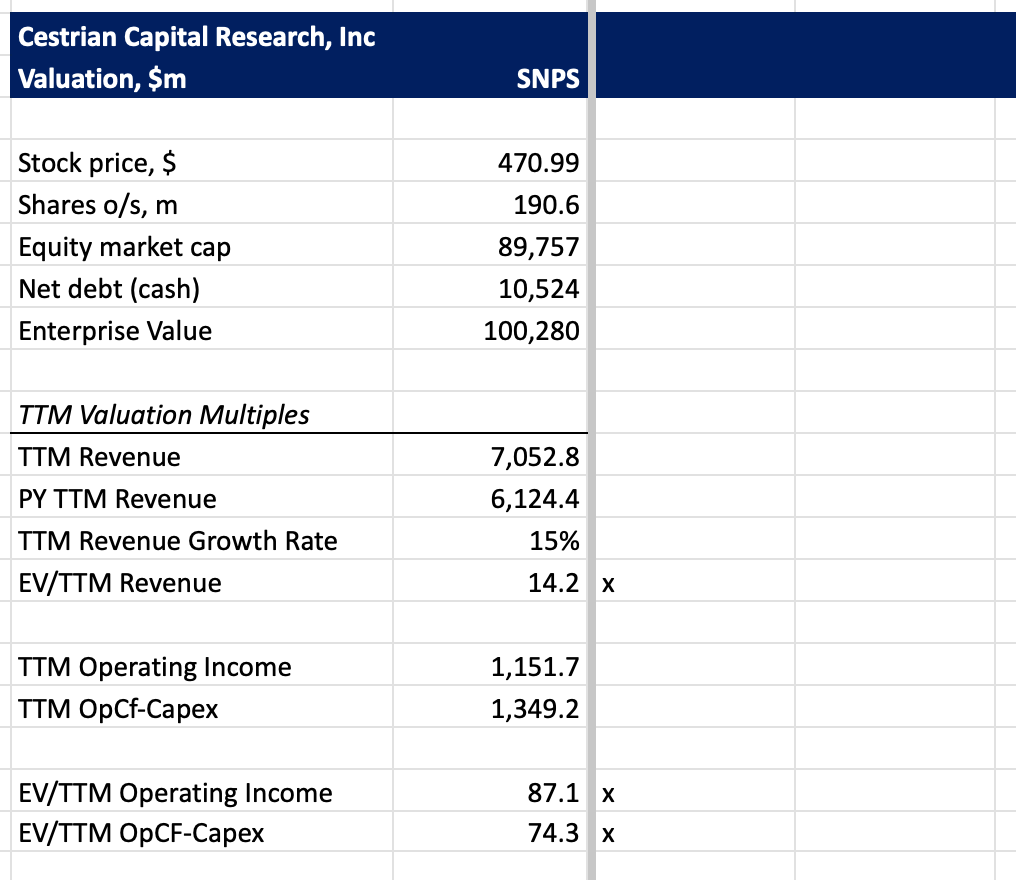

Synopsys stock is sitting in the timeout zone right now, otherwise known as “below the 200-day moving average”. The problem with stocks below their 200DMAs is that, to use a well-researched technical term, “anything can happen”. Firstly, enough programmatic trading is set up to automatically sell stocks when they drop below the 200DMA, so the very act of falling below the line is a bearish catalyst. Secondly, as a stock approaches its 200DMA on the way back up, the line can often act as sturdy resistance, not least because a whole lot of short interest lives right below that line and will defend it vigorously.

SNPS’ fate lies with the AI capex boom. More spending on chips, more spending on the IP that SNPS licenses and the software tools that SNPS sells. It’s as simple as that really; watch the chart and watch the spending by hyperscalers. Same for Cadence (CDNS), the yin to SNPS’s yang, or vice versa, I’m not sure.

An easy long trade when stocks are in this mode is - wait to see if the stock crosses up and over the 200-day and turns it into support; then consider opening a long position with a stop a little way below the 200-day. So if it resumes its quest to dig for victory, your loss won’t be too painful; but if a renewed moonshot gathers momentum you’ll find many programmatic buyers jumping in as it leaves the 200-day in its wake.

We rate SNPS at Do Nothing for now.

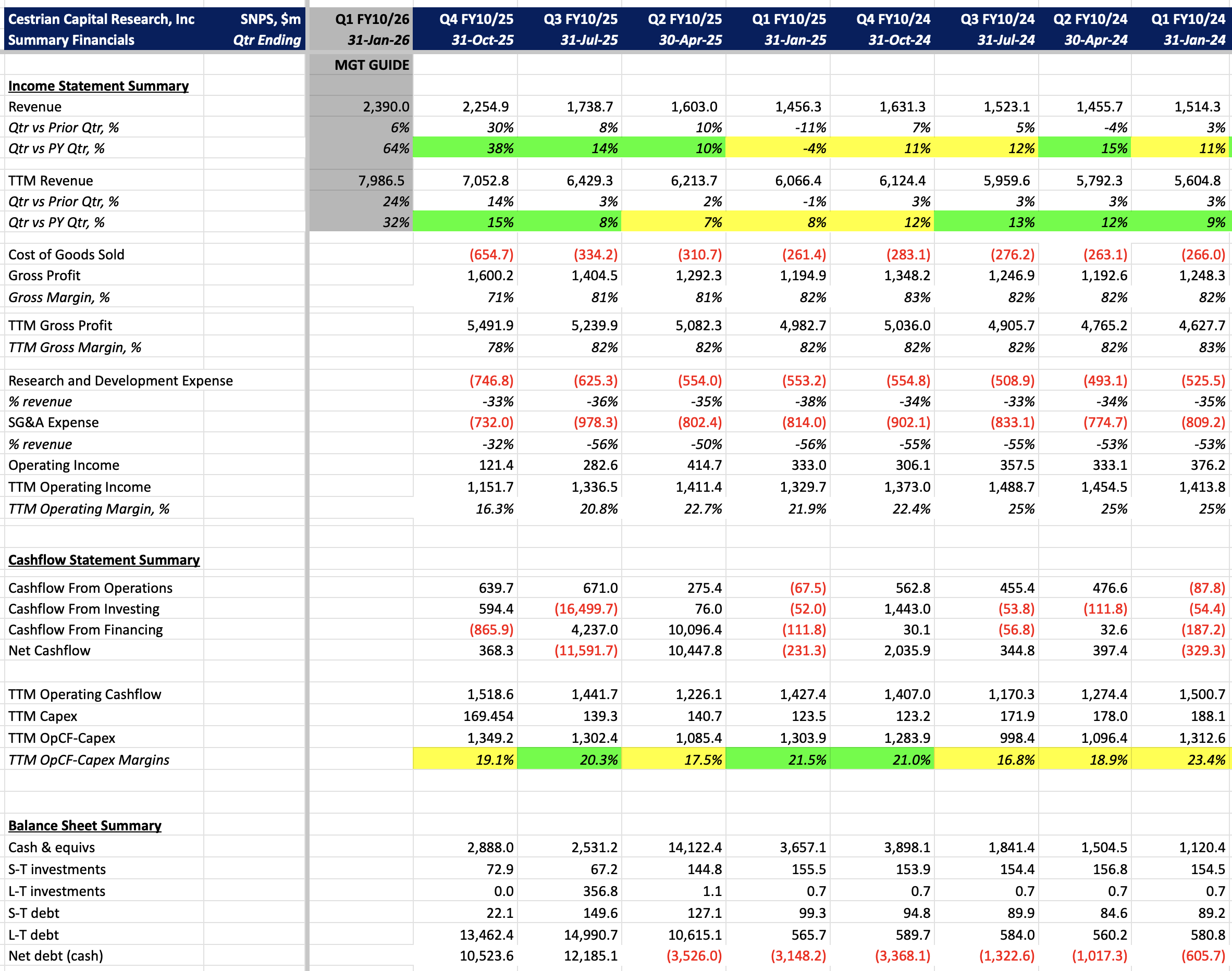

Fundamentals

There are complex acquisition and divestment effects within the financials so looking for a smooth trend in earnings or revenue is fruitless. Personally I would watch the net debt level - that ought to come down quickly over time if the management team is doing its job correctly.

Valuation

These are the headline multiples but honestly with the large-scale acquisitions (of Ansys) and divestments (of a software division) then you can either spend 16 hours attempting to pro-forma the TTM numbers for what you in your own mind believe would have existed if the business had been in its current form for twelve months, or you can just watch the net debt and the stock chart. Personally I choose life.

Stock Chart

All about that thick purple line, the 200-day simple moving average.

Rating

Do Nothing.

Cestrian Capital Research, Inc - 12 December 2025