The AI Trade Lives! Broadcom Q4 FY10/25 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis on this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Just Climbing The Stairs

Alex King, CEO, Cestrian Capital Research, Inc.

Here’s the Broadcom stock chart, inclusive of the dump on Friday following earnings printed Thursday after the close. You can open a full page version, here.

The chart looks bullish to me - it’s making a higher low since that Wave 4 low, and it looks on track to climb to somewhere between $450-525 before a material correction.

Don’t let anyone tell you the earnings were poor. The earnings weren’t poor.

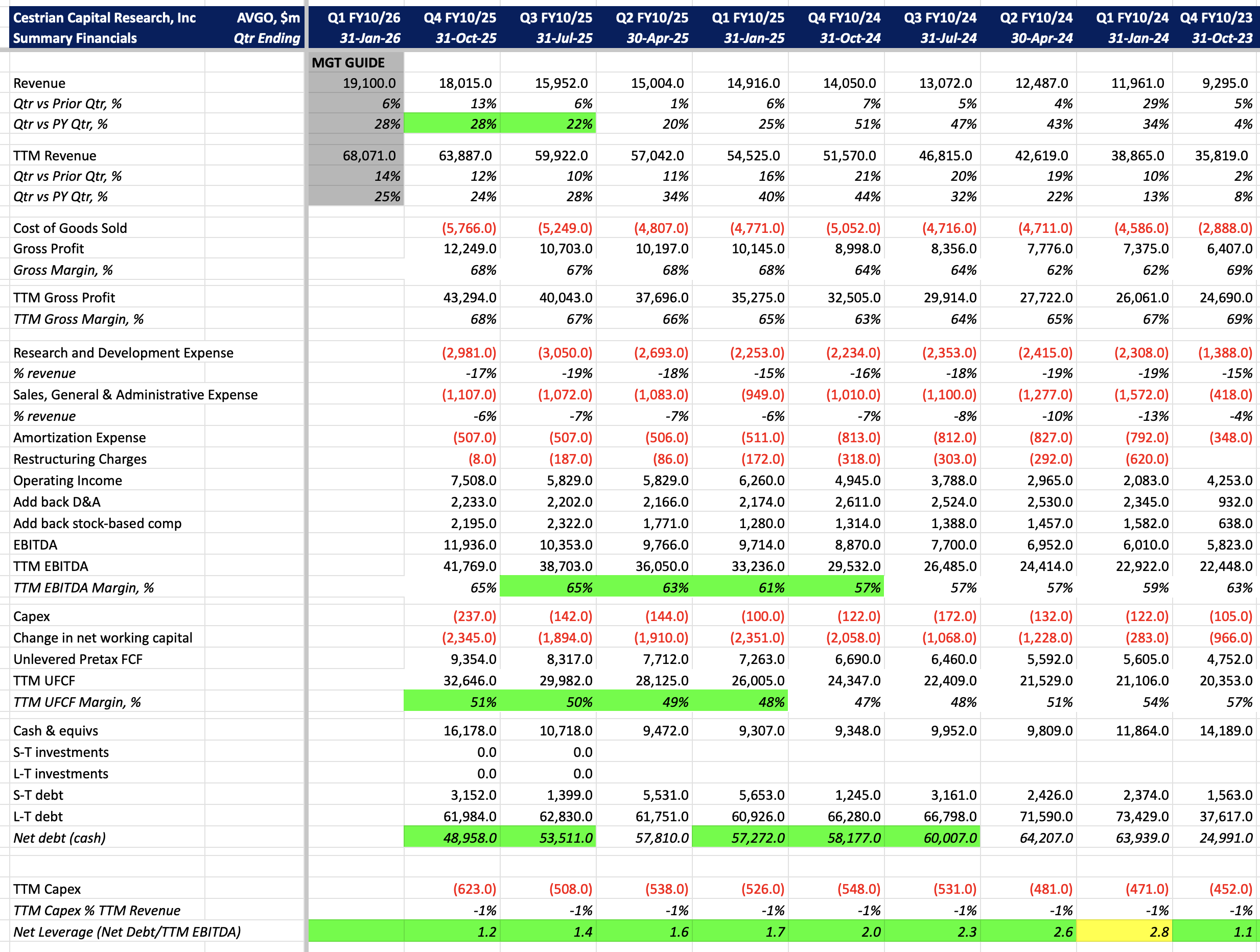

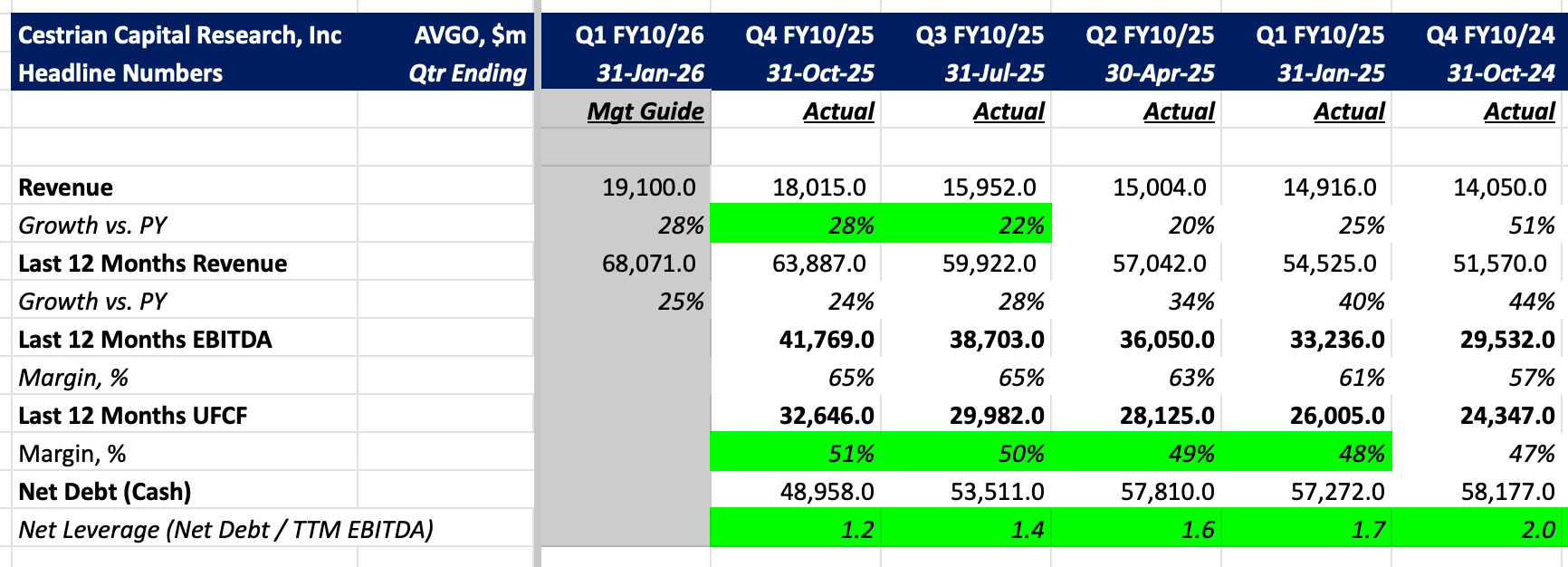

Net leverage is down from 2.0x TTM EBITDA as recently as 31 October last year to 1.2x TTM EBITDA today. Leveraged buyout firms dream of deleverage that fast. Revenue growth accelerated for the last two quarters, and cashflow margins have been climbing for four successive quarters.

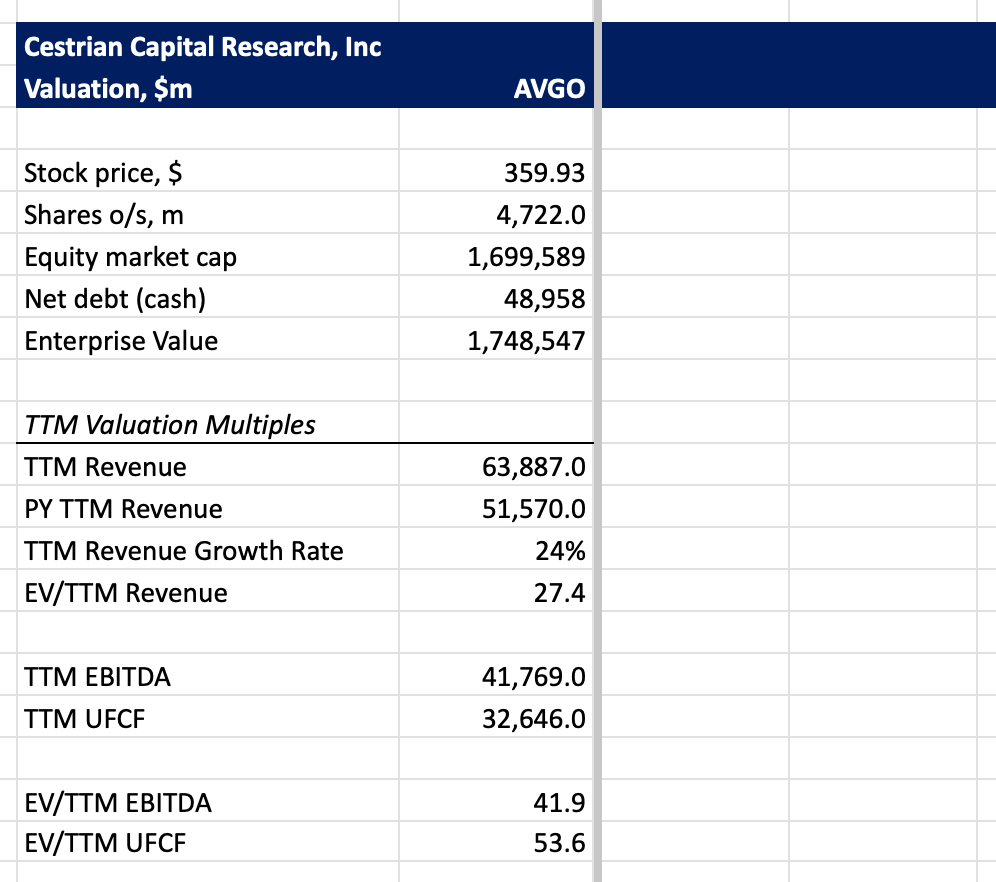

Valuation? Similar cashflow multiples to NVDA, but AVGO is gaining share in AI and its revenue growth rate is climbing; NVDA can only lose share, and its revenue growth is declining. So I think that even though AVGO isn’t the King, yet, its valuation can be defended vs. NVDA.

Rating: Hold.

Cestrian Capital Research, Inc - 14 Dec 2025

Appendix - Full Financials