The Final "Market On Open” Of 2025. No Paywall Today.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

2026 Will Not Be Like 2023-2025

by Alex King, CEO, Cestrian Capital Research, Inc

If you thought 2025 was hard work - and it was - then I think 2026 is going to be harder still. You already know the is-it-a-bubble-or-isn’t-it yada yada so I won’t rehash that. And you already know the “should I invest in emerging markets” thing so I won’t go there, not least because in my lifetime the siren song of emerging markets has always ended with a reminder of why they remain emergent and not hegemonic. No, the thing that fascinates me about 2026 is: how will policy play out in the market? Because these are the factors at play:

Cold War 2.0 with China is warming up - not in a missiles kind of way but in a strategic manner. Metals, semiconductors, tariff and non-tariff barriers, global influence and reach, these are the weapons of choice in this burgeoning fight for supremacy. The prize isn’t 2026, it’s the next 50-100 years of economic dominance. I am no China whisperer so I cannot speak for the China side, but I know for sure that the US means to maintain its leadership of the world economy, and to do so through technology and military strength as it has done since 1945.

The supply lines for this particular kind of war will carry: money. Lots of it. I expect to see the US adopt a high degree of stimulus in 2026, both monetary (low rates and plentiful liquidity) and fiscal (government spending in key industries).

If you take the boundary conditions for the potential outcomes, this is going to result in either (i) a very powerful bull market in US equities (because liquidity and earnings), US government bonds (because low rates and liquidity and falling inflation), commodities (because metals, see above) and crypto (because liquidity). Or (ii) a near-term “sugar high” and then a punch in the face if this stimulus results in an inflationary spike the way that the Covid stimulus did.

Anyone who tells you they know the answer is deluding you and/or themselves.

The economic policies being implemented in pursuit of maintaining US supremacy are not like the post-war era; and they are being applied against a backdrop of a very strong deflationary force, being AI. This is a new setup with no comparables that I know of. We can look to the Industrial Revolution to see the impact on the labor force of mass-scale automation, but that period tells us nothing about the interplay of modern fiscal and monetary policy vs. securities markets.

Here at Cestrian we will be expanding our capabilities through 2026 using agentic AI at much lower cost than it would take to do this with humans alone. And if that’s true for a “sorry, who?” business like ours then I am pretty sure it’s true for Acme Megacorps A thru Z too. So I don’t think it’s safe to assume massive stimulus = inflation = rates up = bonds, crypto and equities dead. I think we just have to see how it all rolls out.

What is not going to roll out in my view is an easy-up market in the equity indices. I think it’s time to sharpen up and get better. 2025’s volatility was a gift if you did this well and if it hurt you, just consider it tuition fees for 2026; suck it up, study harder, pay more attention, work harder and do better next year. (I’m not myself a Boomer, but sometimes those Boomer values do pay off).

I feel we are well set up for 2026 here at Cestrian. We have humans, algos, agents all focused on the question of Which Number Go Up. We have top quality analysis of equities, bonds, commodities, crypto, via common stocks, ETFs, options and futures. And most of all we have a fantastic team of analysts - all of whom arrived here via unconventional paths, one of the reasons our work is so different to the pack - and an extremely impressive member community in our Inner Circle service, from whom I learn something every single day.

2026? Bring it!

Last Day To Get Half Price Gold, Silver, Platinum, Copper And Whatnot

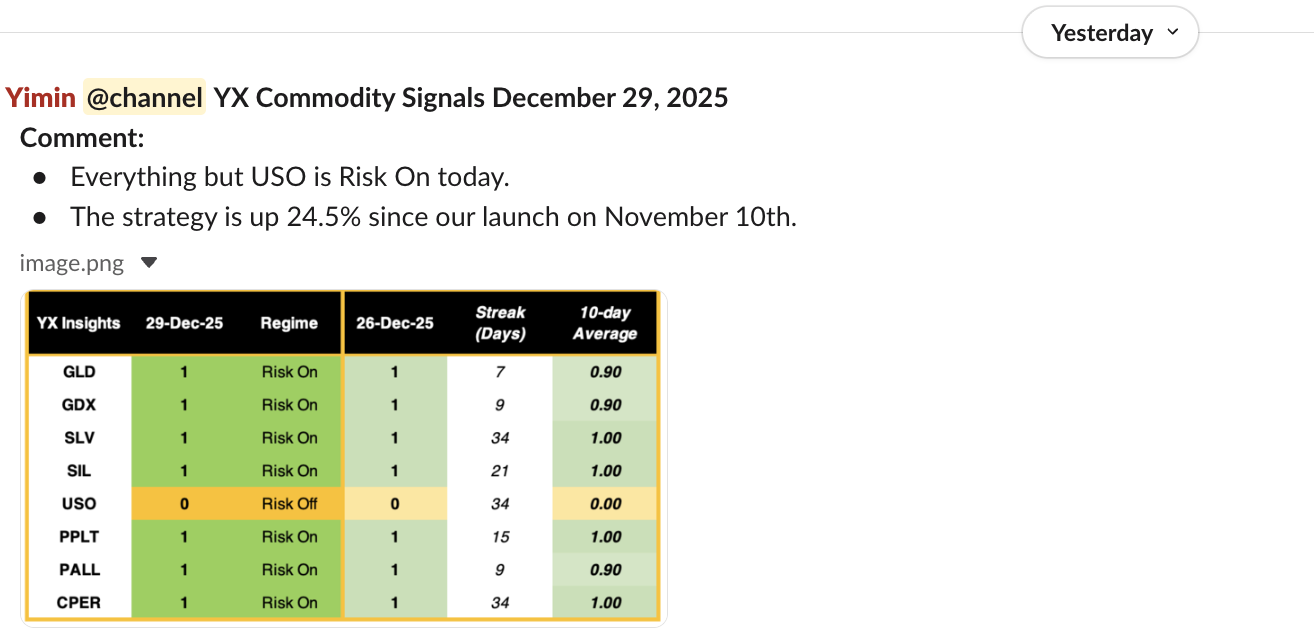

Here’s how our YX Commodities Algo Signals service has been doing lately. This is Monday’s pre-market-open alert posted for members at that time.

Yup, you read that right. The machine was up 24.5% in about six weeks across a diversified basket of metals.

Now, nothing in this world is certain, and the algo could commit acts of self-harm tomorrow, I don’t know. But this family of YX Algos has been humming for a year or more now. It started by navigating Bitcoin through 2024-25, calling “risk on” and “risk off” at the right times. It has continued into 2024 with success in commodities and more.

The YX Commodity Algo service doubles in price on 1 January. That’s tomorrow. So if you think you might like to join up, take a look to see if this is something that will help you, and join today to bag that 50% discounted launch price. You’ll keep your 50% discount for as long as you remain a subscriber. More details here.

Now, below our latest daily review of equities, bonds, sectors, crypto, oil, gold, volality and more. Usually you can get this only by subscribing to our Inner Circle service; today, to mark year end, this is a public post open to all.

Happy New Year folks!

US 10-Year Yield

The Tepper Trade continues.

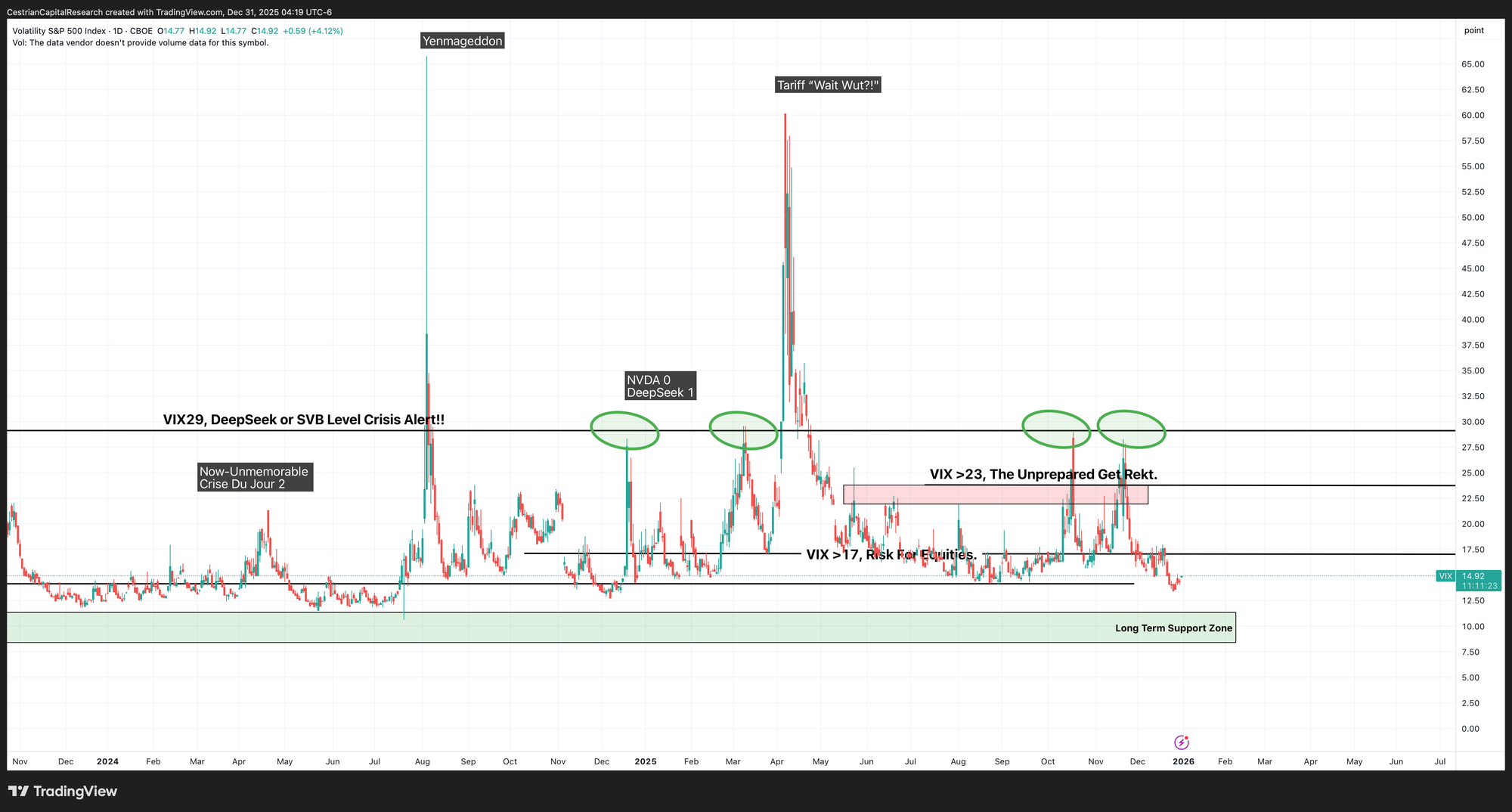

Equity Volatility

All quiet on the volatility front. (This could be just because nobody is in the office to buy SPX puts in any volume, I don’t know).

Disclosure: No position in any Vix-based securities.

Longer-Term Treasury Bonds (TLT / TMF)

No change.

Challenging the 200-day SMA from below. Bullish if up and over it.

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am unhedged long $TLT and $DLTA (an EU UCITS TLT proxy).

Gold

A further drop within that Wave 4 - it hit the Wave 1 high perfectly! - and now into a Wave 5 up I think. I reduced the W5 target a little to reflect the lower W4 low.

Disclosure: I am positioned in gold according to our Commodities Algo Service and our SignalFlow AI Growth Service.

Bitcoin

Here’s the bigger picture.

Disclosure: I am long $IBIT.

Ether

Target $8000, which is a little below the 1.618 Wave 3 extension high.

Disclosure - Long $ETHA and others in the Ether complex.

Oil (USO / WTI / UCO)

Oil “should” continue to sell off; the chart is setting up bullish in the short term in my view though.

2x Levered Long (UCO) / Short (SCO)

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UCO holding over the 8-day SMA and the 21-day EMA.

Disclosure: I am positioned in oil per our Commodities Algo Service.

S&P500 / SPY / UPRO

TO REPEAT: Apparently all of Wall Street is now bullish SPY for 2026. I am not sure whether to be heartened or afraid!! This chart continues to look bullish medium term to me. I stand by the Bully O’ Bull target.

3x Levered Long / Short ETF - UPRO, SPXU

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

UPRO holding over the 8-day still (just about!). Overall these S&P charts lean bullish but you should read them in the context of this video.

Disclosure: I am long $SPY and long $IUSA ie. unhedged long the S&P.

Nasdaq-100 / QQQ / TQQQ

Again - this is my go-to chart for the overall market right now. If any of it is unclear please ask.

Levered Nasdaq - TQQQ Long / SQQQ Short

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am hedged approx 2.3:1 $TQQQ:$SQQQ ie. net long the Nasdaq.

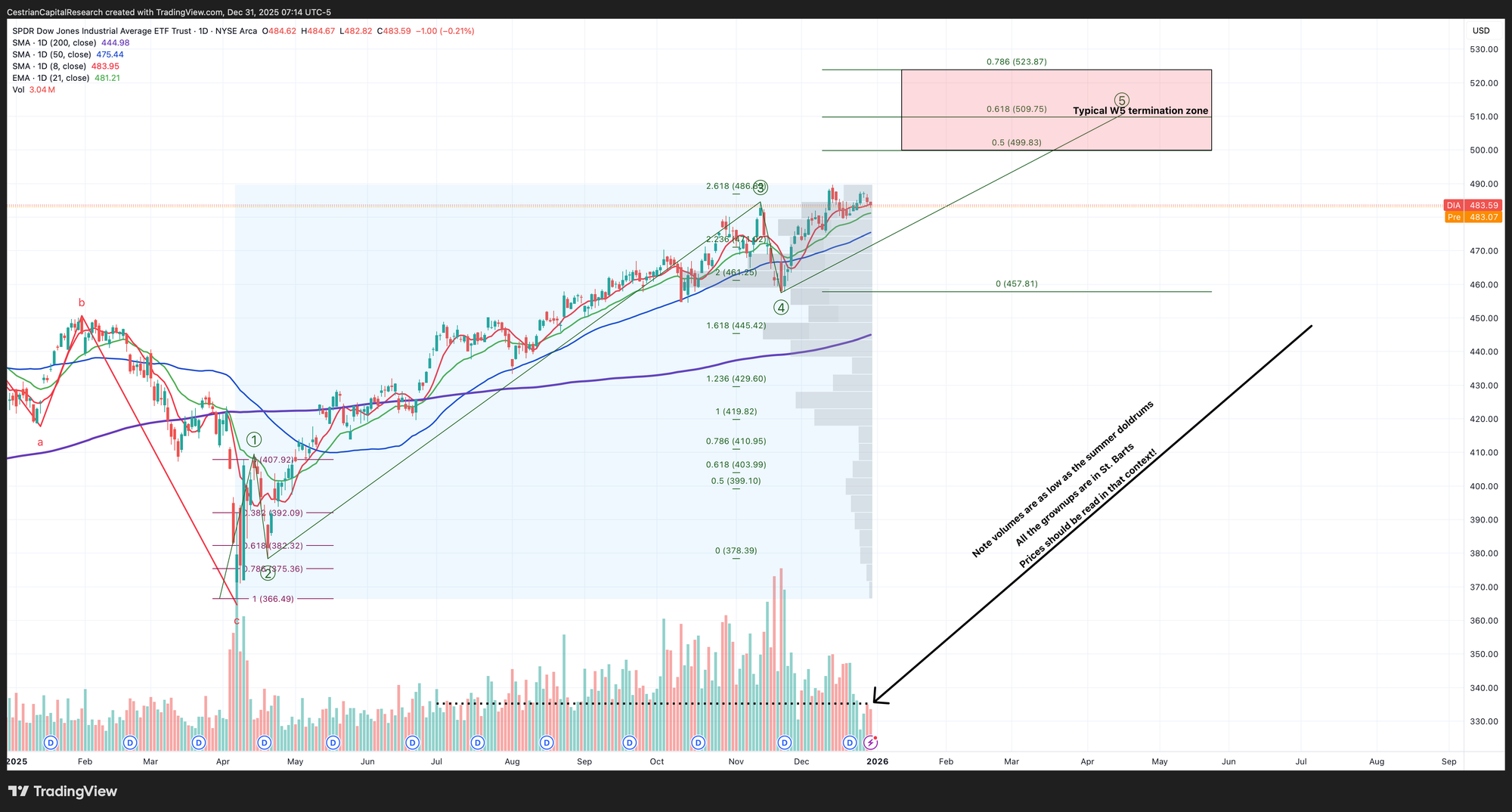

Dow Jones / DIA / UDOW

If you look at that QQQ chart above, the longer-term one, here’s a way to work out whether we’re in a Wave 5 or a Wave 3 right now. It matters - because if now is a Wave 5 then what comes next will be a brutal bear market. But if it’s a Wave 3 then we’ll see a bearish correction before new highs in a year or two. Not a call to get wrong.

The Dow will help us - like this:

Lost the 8-day. Two daily closes below the 21-day EMA (green line) would be a concern. Note the volume or lack of it though.

3x Levered Dow - UDOW Long / SDOW Short

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in the Dow.

Sector ETFs

Bullish over $144, bearish below.

Disclosure: I am positioned in XLK per our SignalFlow AI Growth Service.

3x Levered Long/Short Tech - TECL/TECS

Note - TECL and its inverse TECS tend to be illiquid outside RTH with relatively wide bid/ask spreads.

Note - Leveraged ETFs. Read the fund documentation if you are considering using this instrument.

Disclosure: No position in TECL or TECS

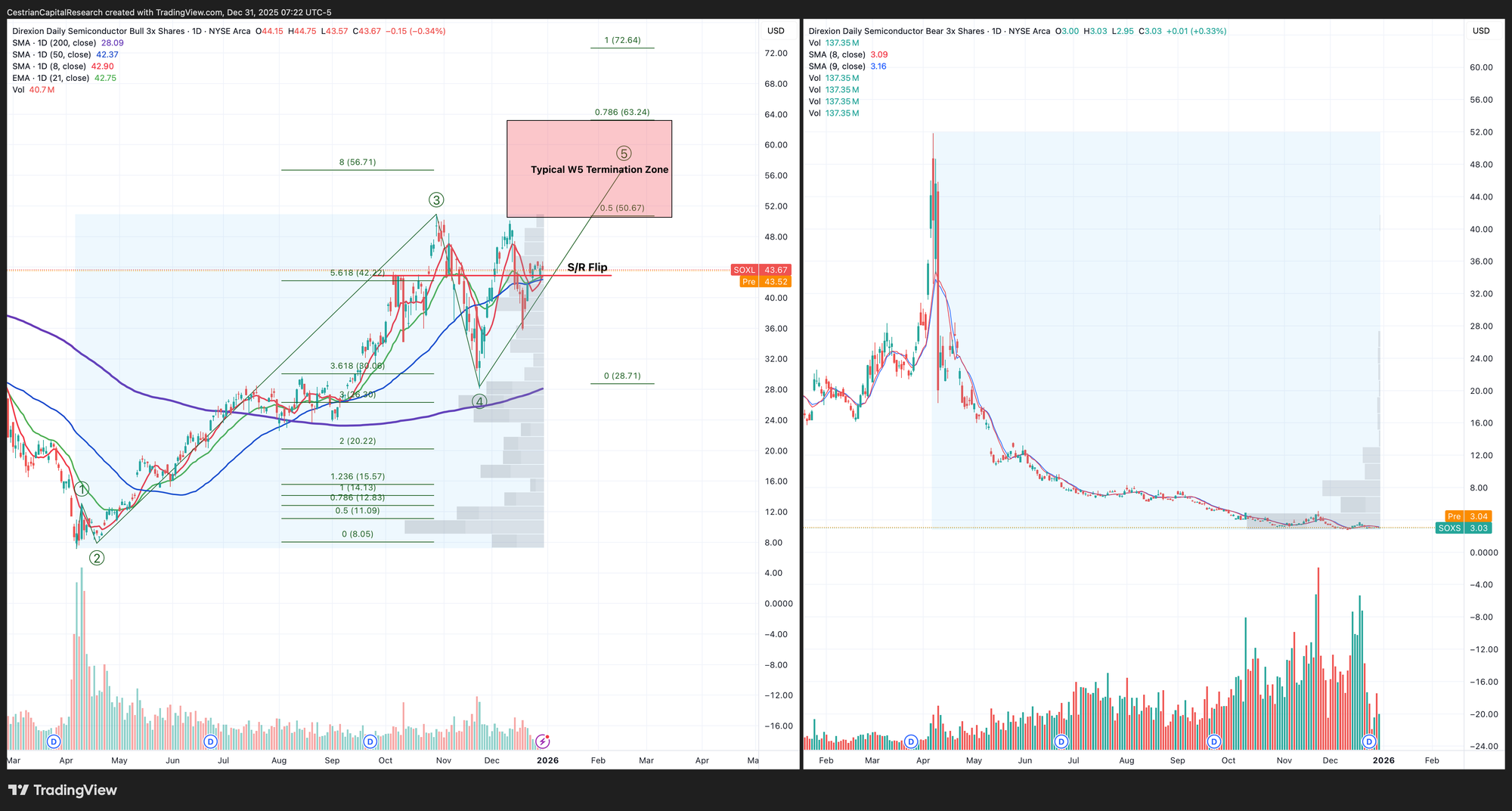

SOXX (Semiconductor)

Holding up nicely, which bodes well for the equity indices as semiconductor tends to lead them.

3x Levered Long / Short Semiconductor - SOXL / SOXS

Note - Leveraged ETF. Read the fund documentation if you are considering using this instrument.

Disclosure: I am hedged approx 3.5:1 $SOXL:$SOXS

Alex King, Cestrian Capital Research, Inc - 31 December 2025.