Tokenomics Bulletin

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

It’s Just Getting Started.

by Alex King, CEO, Cestrian Capital Research, Inc

Our work in tokenomics, for want of a better term, is written with two groups of people in mind.

- Crypto-natives looking for a grounded take on the impact tokenization is going to have on the incumbent financial plumbing, and ways to capitalize on that, and:

- Crypto-skeptics whose publicly-stated belief that this whole thing is just them pesky kids again … but in their hearts they know change is a-comin’ and they want to learn how to make money from the new new thing without having to go “full degenerate” mode (to which they are allergic).

If you missed it, you should start with our post from yesterday, Everything Is Token.

You can read that here.

Today I just want to run through a quick update on some of the key names we’ll be writing about.

Let’s get to work.

Ether-USD.

Ether trades reasonably well to standard Elliott Wave and Fibonacci level patterns. On this basis I think a bullish target for Ether would be min. $5700 with a chance of $6600 and a very-bullish-indeed upside of $8600.

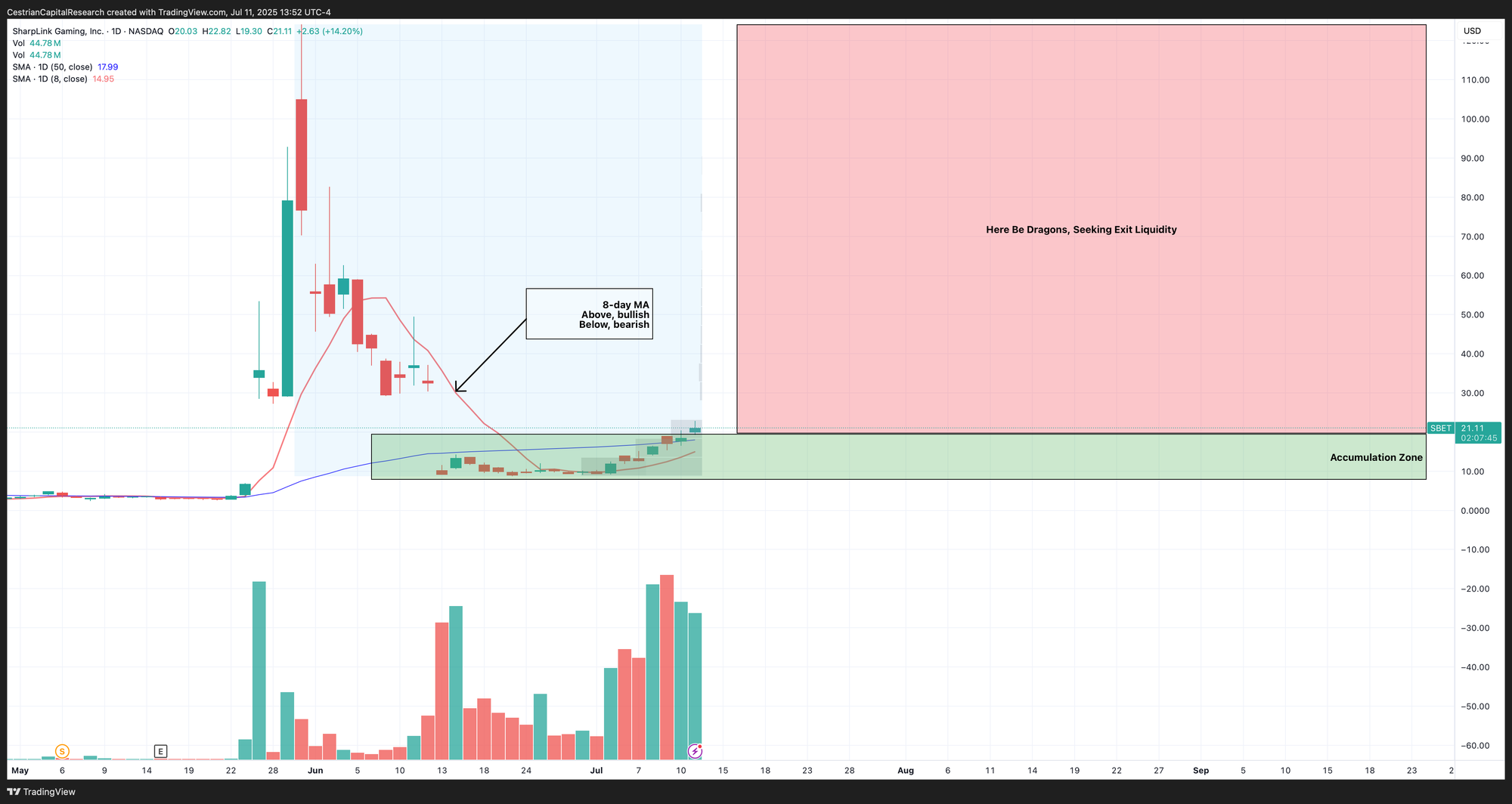

SharpLink Gaming Inc ($SBET)

SBET, now in all essence a pure Ether Treasury Company (strategy: raise money to buy Ether, announce the buy, Ether price hopefully goes up, rinse and repeat. Sorcerer’s Apprentice to the Merlin of MicroStrategy, Mr. Saylor), has a potentially bright future. It is a capital markets operator, no more no less, and if the team has sufficient capital markets skills, they will do well. (And if they lack Mr. Saylor’s genius, they won’t).

The stock chart of names like this is all about avoiding being roadkill. You do not want to provide exit liquidity to a large investor who is laughing all the way to the yacht that you and your compadres just bought them. Watch the volume profile - the volume being traded in each price zone. High volume at low prices = likely accumulation by bigs. Low volume on the way up = late money buying. High volume at high prices = bigs promoting and distributing their holdings. Low volume on the way down - late sellers and hopeful dip-buyers (both likely regretting their life decisions).

SBET has relatively high recent volume in the $8-20/share range.

If you are going to play these names, you have to know your strategy beforehand. Swing trading can succeed; accumulation and long-term hold can succeed. But be sure you know which you are doing. Volume will tell you what is happening here, much more than the stock price.

BitMine Immersion Technologies ($BMNR)

Bulls’ hero Tom Lee of Fundstrat joined the board as Chairman last week. The announcement was 1 July but as can be seen from the stock chart, price told you that something was going to happen, before it was announced. (Situation normal for stocks. $SPY does the same thing so one can hardly call out these small caps for such things.)

I am hesitant to use Elliott Wave analysis for these sorts of names, because at the moment there isn’t the kind of institutional liquidity needed to really support the notion of using the EW / Fibonacci method. But I would say that it probably isn’t a coincidence that the pullback after the Tom Lee moon-move has settled at around the .786 retracement of that move up.

I would expect a kind of step-function in BMNR price, fueled by announcements about its balance sheet (raising money to acquire Ether), its “Ethereum Treasury Operations” (buying Ether - remember crypto is supply limited by design so that is both a value-driver and an execution constraint for companies like this one).

Last Word

It’s early days for Ether. Stay tuned as we add additional companies in Ether’s orbit to this newsletter. Any questions, reach out in comments to this note or hit us up on X, here.

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long poisitions in, inter alia, $ETHE, $SBET, $BMNR.