Veeva Systems (VEEV) – Q3 FY1/2026 Earnings Review

Summary

- Veeva delivered a decent fiscal Q3 2026, with results exceeding guidance and broad-based strength across its business.

- Profitability remained high (TTM Gross Margin 76%) and cash position grew further ($6.6 billion).

- Shares fell post-earnings on Top-20 Vault CRM migration concerns.

- Read on for a detailed financial and technical analysis, as well as rating.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Continued Operational Strength, but CRM Share Concerns Are Rising

by Abhishek Singh

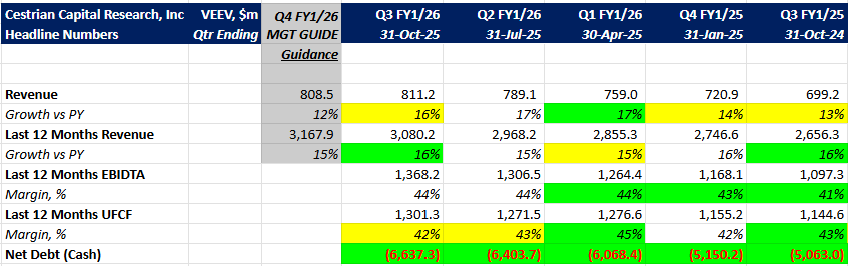

Veeva Systems delivered decent fiscal Q3 2026, see headline numbers below. The quarter saw continued progress in key initiatives: Vault CRM adoption accelerated with more top pharma go-lives, Veeva’s industry-specific AI reached initial delivery milestones, and newer product areas (like Safety, Quality, and Data Cloud) showed solid traction.

The stock has been on a downturn since last earnings release, possibly because Veeva disclosed that it expects only ~14 of the Top 20 pharma/biotech companies to migrate to Vault CRM, with ~6 choosing Salesforce, thus raising concerns around long-term CRM share and revenue durability.