Zscaler Q1 FY7/26 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Still in the Running, at Least for Now.

By Hermit Warrior, a.k.a Richard Iacuelli

Welcome to the new sleeker, easier to read format for our earnings reviews which we'll be using for selected names. The aim is to make the important points 'pop out', with an easier read - and we're dragging ourselves firmly into the AI-augmented (not replacement) age with a new 'AI Insights' section. All feedback - good, bad, or just meh - is always welcome!

House View

A strong Q1, with revenue growth and margins exceeding expectations, did not satisfy the market this time, with investors turning slowing growth projections for Q2 - and perhaps high valuation metrics - into reasons to sell the stock post-earnings, although chart technicals may have provided added momentum to the drop (we delve into this later on). While Zscaler ($ZS) remains best in class within its mainstay Zero Trust security model, it's difficult not to see the growing trend of end-customers buying into the 'platformization' trend pioneered by Palo Alto Networks ($PANW) as a potential threat to Zscaler's growth ambitions - especially within the crucial large enterprise segment - at least in the longer term.

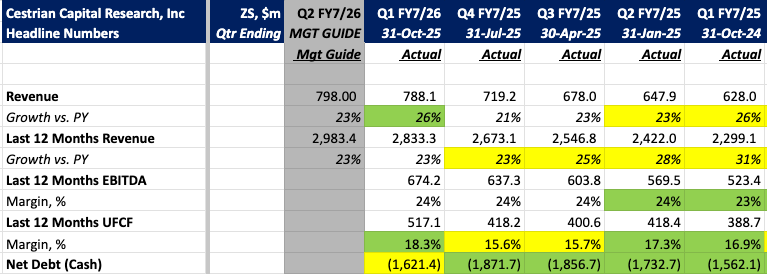

Here are the headlines.

Analyst Insights -

Growth:

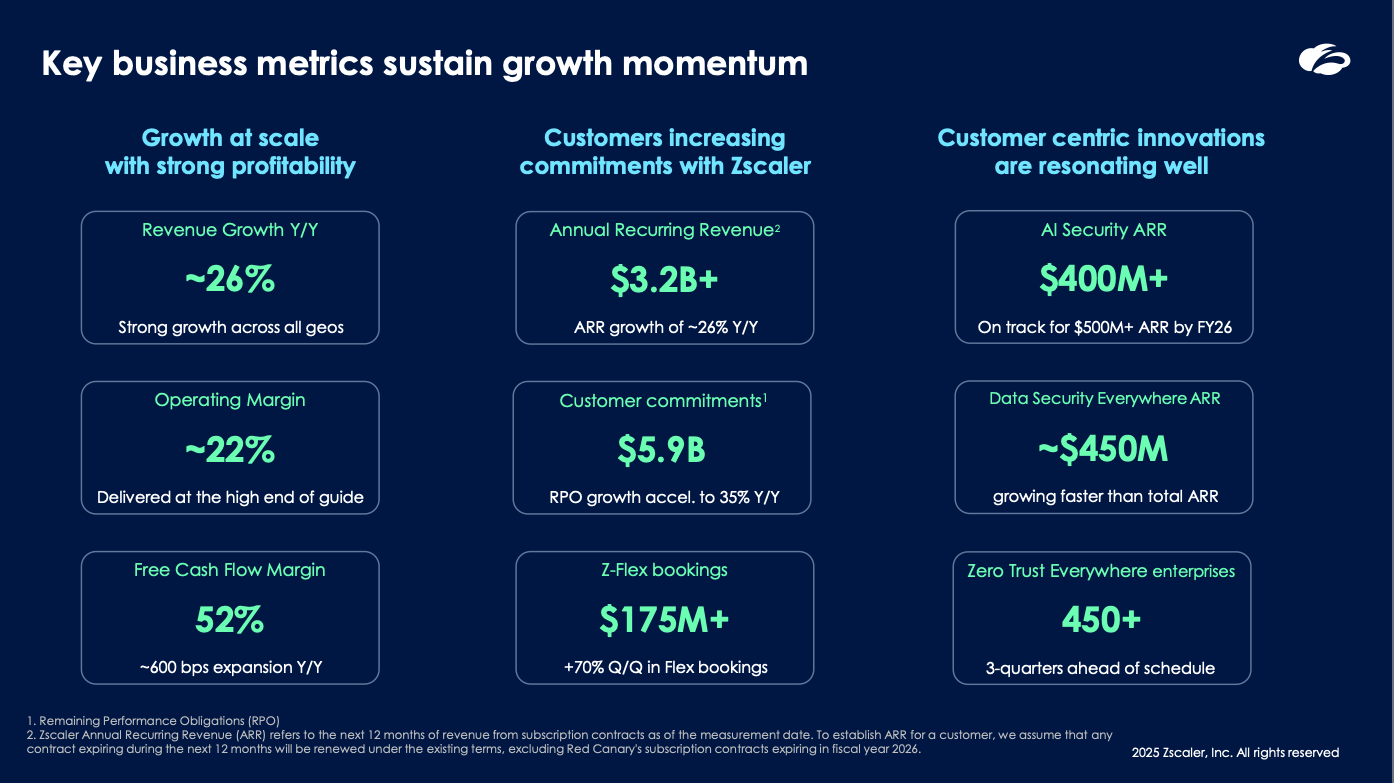

- Q1 revenue growth of 26% year on year handily beat the guide of 23% (as expected) - and was up from 21% in Q4 - but most importantly, marked the first time revenue growth actually accelerated in over 3 years (the last time being in Q3'22).

- The Q2 guide of 23% revenue growth likely disappointed, and helped break a recent run of post-earnings stock-price pops, as it implies a flattening as opposed to further acceleration - reinforced by the FY2026 growth target also set at 23%.

- Remaining Performance Obligations (RPO) increased a still-robust 34.5% yoy, the highest since Q4'23, and could potentially help grind out an extra percentage point or two of extra revenue growth in Q2.

- Annual Recurring Revenue (ARR) grew 26%, in line with revenues, to reach $3.2B, and they highlighted how this makes them one of only 5 peers still delivering 25%+ growth - at least this quarter.

- An aspirational goal of $10B in ARR was mentioned in the earnings call prepared remarks, although no timeline was given.

This takes us to a potentially important insight, highlighted by the platformization point made in our House View paragraph above: