Big Money Crypto

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Get Big Money Crypto Now.

by Alex King, CEO, Cestrian Capital Research, Inc.

Here at Cestrian Capital Research, Inc, we have a simple view on how to invest and trade successfully. All our work is focused on understanding what it is that the largest, price-setting asset managers are doing with their capital. We use quantitative, technical, and fundamental methods to spot the breadcrumb trails that Big Money leaves across the market as it rotates capital from opportunity to opportunity in order to create gains out of thin air. We’ve been doing this in stocks and ETFs for many years now, with great success according to our reviews.

But now, Big Money is focused very hard on crypto - specifically on the top three blockchains and coins, being:

- Bitcoin

- Ether

- Solana

And Big Money is now using the exact same methods in crypto it has used in stocks for a century or more.

- Accumulation: build a stake quietly whilst price trends sideways at the lows, and all the news is bad.

- Markup: sit back and do nothing when the news turns positive, enjoying the rising price but not yet taking profits.

- Distribution: after a run-up, sell the stake quietly whilst price trends sideways at the highs.

- Markdown: do nothing as price falls back to Earth, with no buyers of any size to be seen. (And for the more aggressive - generate gains on short positions to then re-invest those gains in long positions at the lows).

This is rotation, and it’s how Big Money became Big Money and stays big money. Why might Bitcoin be falling when Ether is rising? Because Big Money is in the distribution phase in Bitcoin, but the Markup phase in Ether. Why might Solana be rangebound at the lows at this time? Because Big Money is in the accumulation phase in Solana.

Big Money is new to crypto. Only with the advent of BlackRock crypto ETFs and the adoption of the Ethereum blockchain as the basis of asset tokenization has the opportunity set become big enough for the largest asset managers to join the party.

And that’s great news. Why? Because they cannot carry out their business without leaving breadcrumb trails. Here at Cestrian, our charts, our algos, and our fundamental analysis are all designed to read the breadcrumb trail and then follow it successfully. Identifying price zones in which to buy, price zones in which to hold, price zones in which to sell.

Big Money Crypto does exactly what it says it will. We help you follow what Big Money is doing so you can try to follow their lead. (It’s never a good idea to get out in front of Big Money. It can crush you. You want to be just a little bit behind, not too far, not too close).

We offer three tiers of service:

- Free. Just sign up as a free member here at Cestrian, and you’ll receive selected free content by email most days - some crypto, some stocks, some other stuff. You can read our free stuff on our website anytime here.

- Paid Newsletter. The Big Money Crypto Bulletin is published whenever we have an actionable or strategic angle on a stock, a coin, an industry development, whatever. We produce content that matters, when it matters - we won’t deluge you with yet more spam.

- Real-Time Crypto & Stock Trading Algorithms. Whether you choose the Free or the Paid Newsletter option, you can sign up for our trading algorithms - from renowned provider YX Insights - which cover Bitcoin, Ether, Solana, Coinbase and Robinhood. You can see the backtesting data on these algos below.

Of course, if you want our very best work and to be in on our wonderful investor and trader community chat, as well as receving trade disclosure alerts whenever Cestrian staff personal accounts place trades in covered instruments (before the trades are placed!), sign up for our Inner Circle service.

Our “Become A Member” page will walk you through signing up for whichever of these membership levels you choose. But if you have any problems or you’d like to know more about our services, reach out anytime using the contact form below.

Big Money Crypto - Pricing

We believe this service to be excellent value. This is not your normal crypto cheerleading or namecalling. We take an ice-cold approach to analysis.

This is crypto, the Big Money Way.

Big Money Crypto Premium Newsletter - $1499/yr or $149/mo if you’re an Independent Investor; $2999/yr or $299/mo if you’re an Investment Professional.

Crypto Algorithmic Signals - $2999/yr or $299/mo for Independent Investors; $5999/yr or $599/mo if you’re an Investment Professional.

YX Insights - Algo Backtesting Data

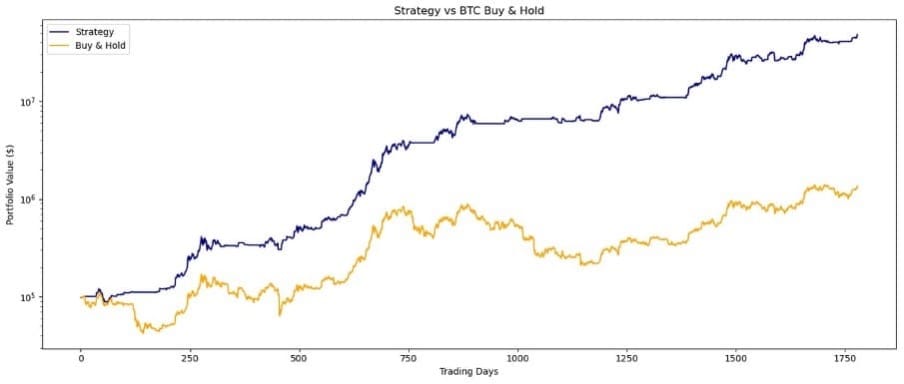

BTC

- Strategy Sharpe Ratio: 2.05

- Strategy Maximum Drawdown: -27.71%

- BTC Buy & Hold Sharpe Ratio: 0.90

- BTC Buy & Hold Maximum Drawdown: -76.66%

Note the y-axis below is in log scale.

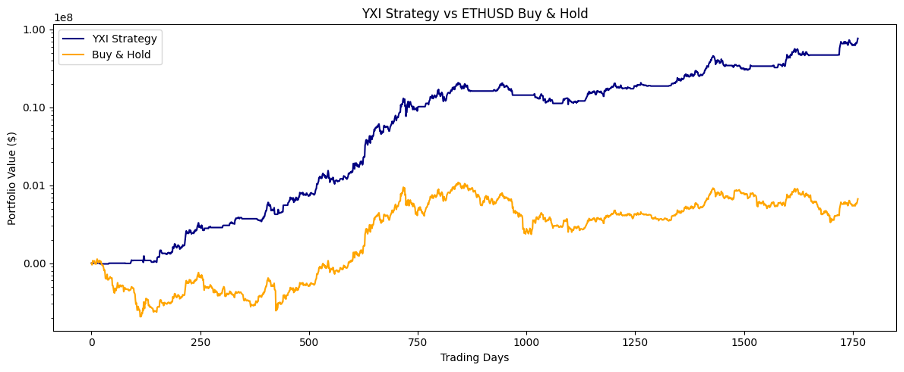

ETH

- Strategy Sharpe Ratio: 1.77

- Strategy Maximum Drawdown: -47.48%

- ETHUSD Buy & Hold Sharpe Ratio: 0.75

- ETHUSD Buy & Hold Maximum Drawdown: -81.81%

Note the y-axis below is in log scale.

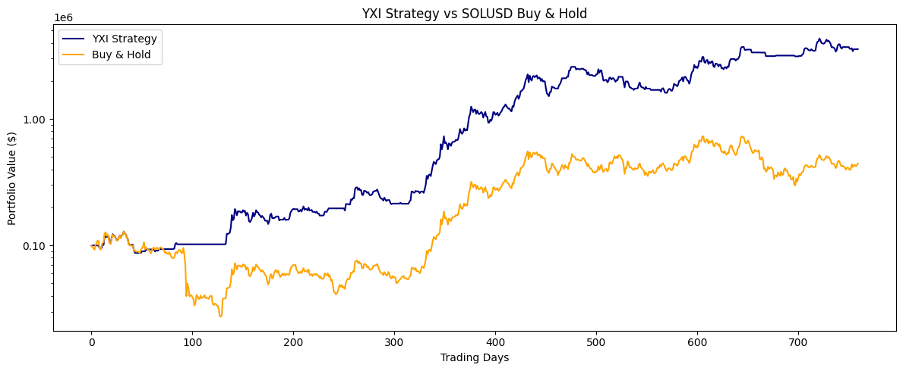

SOL

- Strategy Sharpe Ratio: 2.02

- Strategy Maximum Drawdown: -37.58%

- SOLUSD Buy & Hold Sharpe Ratio: 1.00

- SOLUSD Buy & Hold Maximum Drawdown: -78.80%

Note the y-axis below is in log scale.

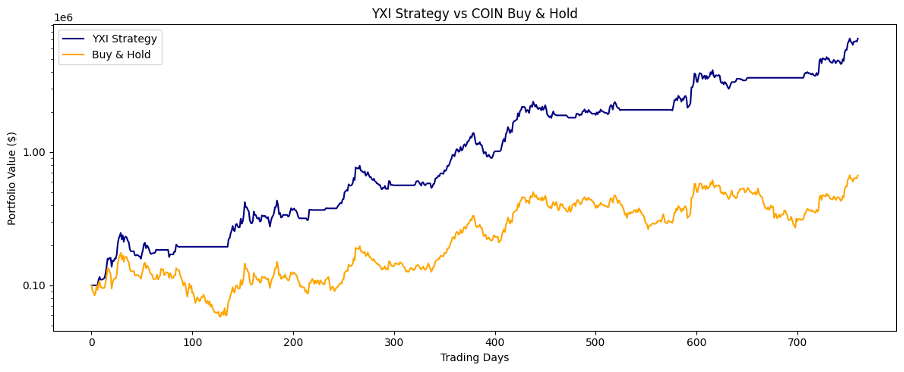

COIN

- Strategy Sharpe Ratio: 2.25

- Strategy Maximum Drawdown: -35.95%

- COIN Buy & Hold Sharpe Ratio: 1.14

- COIN Buy & Hold Maximum Drawdown: -66.81%

Note the y-axis below is in log scale.

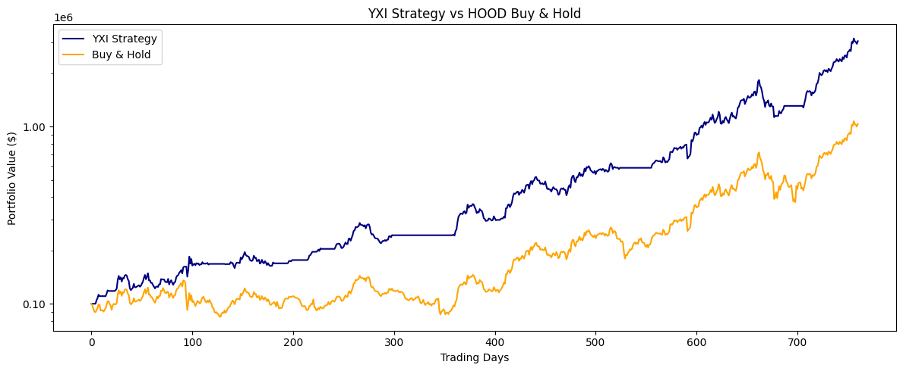

HOOD

- Strategy Sharpe Ratio: 2.43

- Strategy Maximum Drawdown: -38.34%

- HOOD Buy & Hold Sharpe Ratio: 1.55

- HOOD Buy & Hold Maximum Drawdown: -47.66%

Note the y-axis below is in log scale.

Cestrian Capital Research, Inc - 22 July 2025.