Fortinet (FTNT) Q4 FY12/25 Earnings Review

Steady as a Rock

By Hermit Warrior a.k.a Richard Iacuelli

Welcome to the sleek, easier to read format for our earnings reviews which we'll be using for selected names. The aim is to make the important points 'pop out', with an easier read - and we're dragging ourselves firmly into the AI-augmented (not replacement) age with a new 'AI Insights' section. All feedback - good, bad, or just meh - is always welcome!

House View

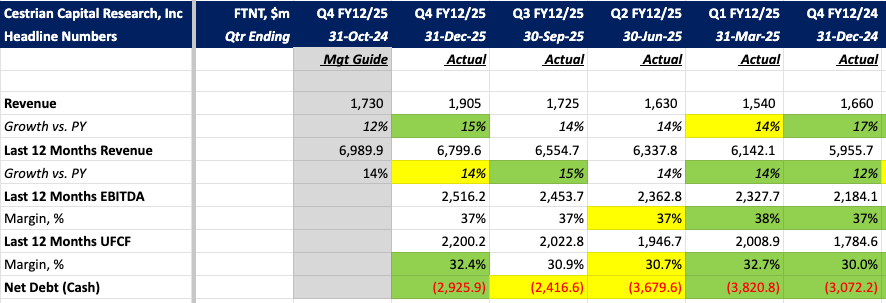

Yet another solid report from Fortinet ($FTNT) for their Q4 earnings print. There's nothing exciting or flashy here and that, I think, is by design. For Fortinet's founder and management team, it's the results that speak for themselves, amid statistics pointing to leading positions in market share, technology and intellectual property (IP), as well as customer experience - all underpinned by disciplined investments in building out underlying technologies and capabilities, often well ahead of competitors, and without much fanfare.

Revenue growth ticked up and margins remained strong, betraying no sign that these are being sacrificed for growth. The Q1 guide for 12% revenue growth will likely be exceeded, potentially matching the more recent 14% growth run-rate (if not the 15% of this quarter).

Here are the headlines.

Analyst Insights -

Growth:

- Q3 revenue growth of 15% came in well above the 12% guide, and up from the 14% yoy growth seen in the previous three quarters, although the guide itself was lower than the 'standard' 13% they had posted in those previous quarters.