Getting Into The Swing Of It

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

One More Pillar Of Value

by Alex King, CEO, Cestrian Capital Research, Inc

If you’ve been on the fence about joining our Inner Circle service, you have one more reason to commit.

Today we launched Inner Circle Swing Trades, brought to you by the same team that have been publishing swing trade ideas for Cestrian for the last three years. Rather successfully, I might add.

The ideas are extremely easy to use, and come with built-in risk management suggestions. Here’s one today.

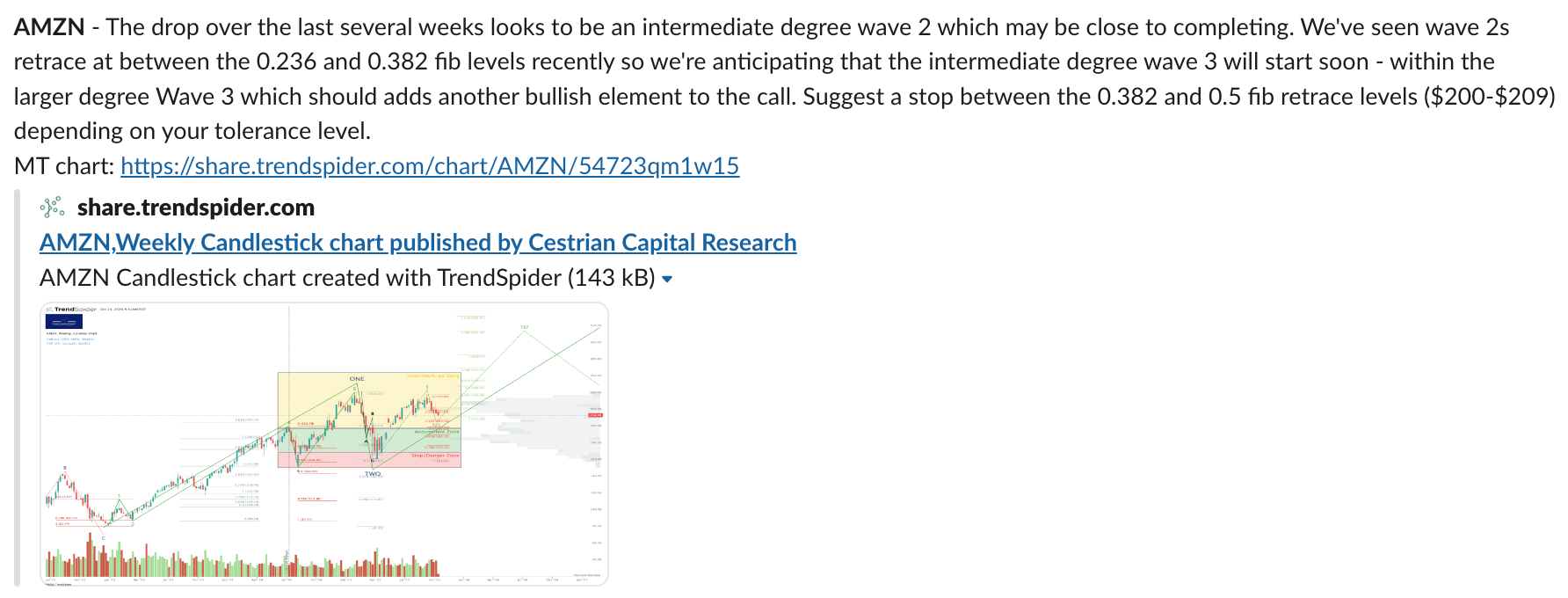

We thought that AMZN holding over the 200-day moving average, despite fairly heavy selling in recent weeks, was likely bullish.

If we’re right, AMZN could move up from here (closed at $216) to somewhere in the $242-286 range; and if we’re wrong, a stop in the $200-209 range can keep you safe. Upside, $26-$70/share; downside, $7-16/share depending on how tight you like your stops.

We’ll post these ideas as they come along; the quality bar is high and we’re looking for compelling risk/reward ratios of upside to downside. All the ideas will be in big liquid stocks, no small cap heroes, so regardless of the size you trade, you’re unlikely to move the market against you. Similarly they will all be common stock ideas, not options.

If you’re an Inner Circle member already, head to the new IC Swing Trade Ideas channel in Slack, here.

If not? Join us.

Cestrian Capital Research, Inc - 14 October 2025.