Market On Close, Tuesday 16 December

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Read our full disclaimer, here.

Is It Really The Trough Of Disillusionment Already?

by Alex King, CEO, Cestrian Capital Research, Inc

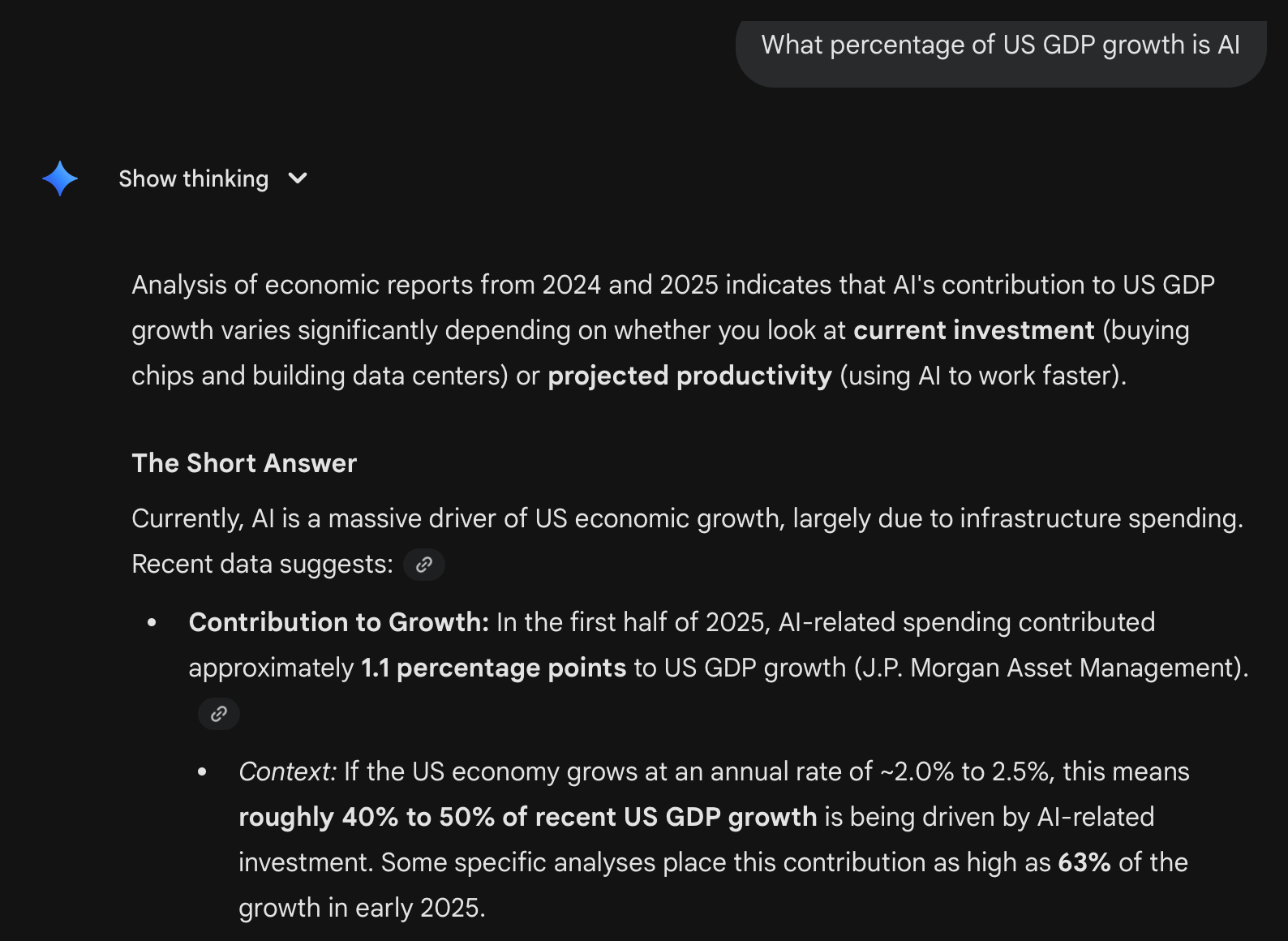

Are we in an AI bubble? If we are, when will it burst?

This is a much harder question to answer than most people believe. By “bubble” most people mean a run-up of prices driven by nothing more substantial than speculation on ever-rising prices. The ‘greater fool’ theory - I can buy now from someone dumber than me, and sell later to some muppet even dumber than both me and the sorry character I bought it from. This I think is an easy and factually accurate characteristic of most all crypto markets, including Bitcoin (I think Ether may be different or at least different for a time, or maybe I’m the patsy in that game, time will tell). But is it a correct characterization of AI stocks?

What is going on in AI is mind-blowingly different from what has gone on before in the evolution of computing. I speak as a relatively old person who has been a professional technology investor for the best part of three decades. Most periods in technology see gradual, evolutionary change. More features onto smaller chips; more data packed into the same network capacity; more storage into ever-smaller packaging; more things that can be done on your laptop today that would have required an enterprise server a decade ago; that kind of thing. There are relatively few tectonic shifts in the industry. Let’s consider a handful of them - which really hit the mark? The invention of the transistor in 1948, and the Shockley junction-transistor in 1951; the invention of the integrated circuit in 1958 (Kilby on germanium) and 1959 (Noyce on silicon); Ethernet, between 1973-1980 (Metcalfe); fiber-optic communications (Kao and Corning, 1966-1970); and so on. The public Internet in the 1990s. And then I think we have to say the GPU by Nvidia in 1999. Notably these are almost all hardware innovations or, in the case of the public Internet, an interoperability innovation based around open standards.

The thing that is unique about the invention of the large-language-model (LLM) software environment is that the computational logic is now abstracted from the code as originally created. There are antecedents for this in earlier machine-learning systems (see The Man Who Solved Markets re. the monolithic, proprietary systems developed by the hedge fund Renaissance Technologies, for instance) but LLMs are the first at-scale computing environment where the internal operations of the computer, the logic as to why conclusion A or B was reached, is often unclear to the humans that created the system. There are many definitions of consciousness or general intelligence in philosophical, psychological and computer science literature - I don’t propose to claim LLMs are there yet but I do say that software systems that can invent new molecules not found in nature but which can be created in the lab, systems that can predict patterns of human behavior in a manner superior to humans themselves, - this is on the way to that lofty goal. This is not like a new-generation user interface or a faster WiFi protocol. And it’s early - very early - in the evolution of these systems. The pace of innovation is remarkable - see this short video evidencing how competition between the key LLM players is delivering rapid gains for the leaders.

Nvidia is trading at around 50x trailing-twelve-months cashflow; so too is Broadcom. These companies are giants and yet continue to grow revenues at very high rates and do so at cashflow margins in excess of 40-50%, with balance sheets that are as safe as …. well as safe as megacap tech balance sheets are, which is to say very safe. Does that make AI a bubble? If you own Nvidia, is your planned exit to an unsuspecting mark? Or can you hold the stock for some years to come in anticipation of long-run value creation? What about shakier propositions like Coreweave or Nebius?

The answer of course is, you have to watch each stock chart and use price and volume to help you judge. But what you really should not do is just assume that we must be in a bubble because AI stocks are up a lot or, worse, that AI stocks are going to fall because they ran up a lot. Why? This is why.

AI is the new military-industrial complex. It is the growth driver in the world’s largest and most important economy. More than that, it is the crux of a global power play between the US and China (the only two countries to ‘own’ LLM models at sufficient scale). The US may lose that play, of course, but (i) I don’t think it will, because so far every time open economies compete with command or semi-command economies, the central-planning model loses, and (ii), if it loses it is going to spend a lot of money for a long time in the losing. And again, I do not think the US will lose. When did the US last lose technology leadership?

If you haven’t read it yet, read the Gemini Mission paper, published by the White House last month, now. Whether you are an ardent supporter, a fierce critic, or a disinterested observer of the current Administration, read it.

AI today is as the Manhattan Project was in the 1940s and the Apollo Program was in the 1960s. It’s not like Webvan or Blue Mountain Arts. It’s not like Farmville or Jenga or ringtones or Crazy Frog. Will there be 90% losers? Absolutely. Will the category keep winning? Absolutely.

Ignore narrative. Follow the money, follow price, follow volume. We show you how to do this all day long in our Inner Circle service.

14 Days Left Of Half-Price Commodity Algo Signals

Anyone with the foresight to join our Commodity Algo Signals service when it launched last month has had the opportunity to enjoy a tremendous run in silver prices whilst also avoiding the chop-and-drop in oil, all using highly liquid ETFs and simple once-per-day trade signals generated by our machine learning algos.

On 1 Jan, launch pricing comes to an end. Right now independent investors pay just $1999/yr or $249/mo to join - that doubles on 1 Jan. To join up whilst you can still grab this low launch price, go here.

US 10-Year Yield

The direction of travel for the 10yr depends simply on whether the bond market believes we are in an inflationary environment (tariffs + stimulus) or deflationary (automation deflating the labor market). For now I think yields are going to come down.

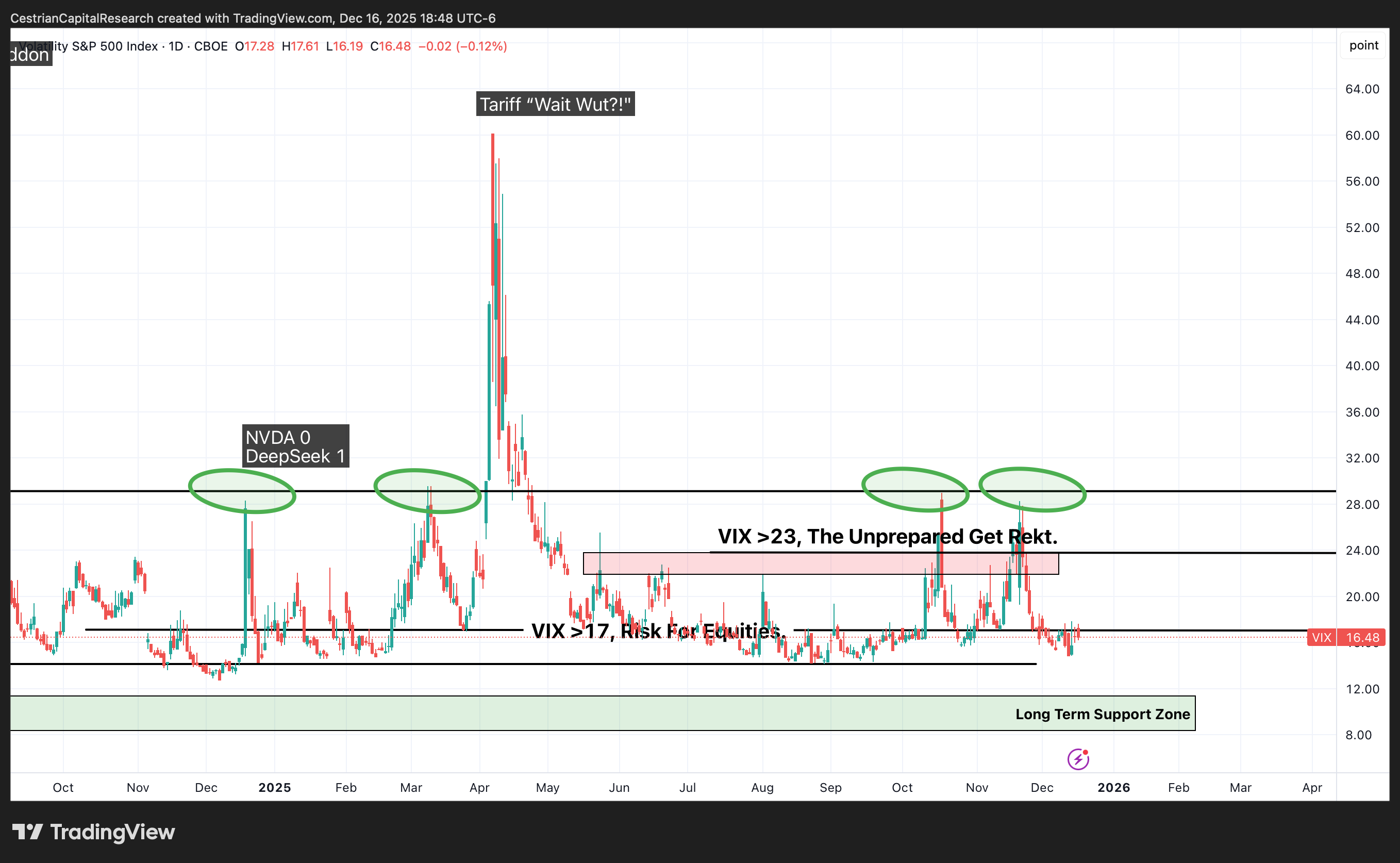

Equity Volatility

Remains subdued.

Disclosure: No position in any Vix-based securities.

Now let’s talk about the S&P500, the Nasdaq, the Dow, bonds, gold, oil, crypto, and key sectors.